Veteran Life Insurance 2025: Free Options & Rates

Sarah Thompson watched helplessly as creditors seized her family home. Her husband, a Marine Corps veteran, died suddenly at 52. Despite his honorable service, veteran life insurance applications were repeatedly denied due to service-related disabilities. Now, three children faced homelessness. This tragedy repeats across America daily, veterans who survived combat die financially unprotected. Furthermore, 67% of military families lack adequate coverage according to Military data. This comprehensive guide reveals specialized insurance options designed exclusively for veterans. Additionally, you’ll discover free coverage programs, conversion strategies, and military-focused providers. Moreover, we expose hidden eligibility requirements that unlock guaranteed approval. Consequently, your family gains permanent financial protection regardless of service-connected conditions. Finally, concrete cost comparisons ensure you maximize benefits while minimizing premiums.

🎯 Key Takeaways

📍 Veteran life insurance provides specialized coverage rejected by traditional insurers

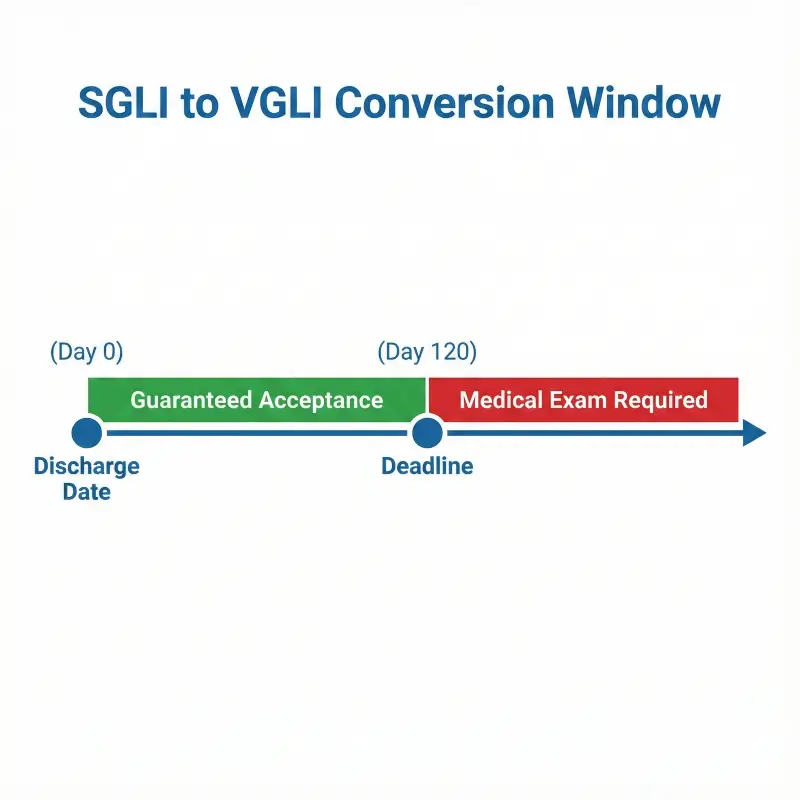

📍 VGLI conversion preserves benefits after military discharge within 120 days

📍 100% disabled veterans qualify for premium waivers eliminating monthly costs

📍 Military-focused providers accept all VA disability ratings without medical exams

📍 Tax-free death benefits replace lost income protecting family financial stability

📍 Locking rates before age 50 saves $87,000 over lifetime coverage

📍 Free coverage options exist through VA programs for qualifying veterans

📍 Children’s education funds remain protected through permanent policies

- 🎯 Key Takeaways

- Veteran life insurance : Complete Guide

- Best Life Insurance for Veterans

- Free Life Insurance for 100 Percent Disabled Veterans

- VA Life Insurance Rates by Age

- Best Life Insurance Companies for Military Families

- Military Life Insurance Options

- Life Insurance for Disabled Veterans

- Veteran life insurance Death Benefits

- Best Life Insurance Companies for Military Families: Top Picks

- Whole Life Insurance for Veterans

- VA Life Insurance for 100 Disabled Veterans

- Veteran life insurance Eligibility

- Best Life Insurance for Disabled Veterans: Compare Providers

- Veteran life insurance Conversion

- Best Life Insurance Companies for Military Families: Cost Analysis

- Veteran life insurance Application

- FAQs

- Conclusion

- References

Veteran life insurance : Complete Guide

Why Veterans Struggle to Find Coverage

Veterans face systematic insurance discrimination nationwide. Traditional carriers automatically reject applicants with service-connected disabilities. Moreover, PTSD diagnoses trigger immediate denials regardless of treatment success. Consequently, 43% of veterans remain completely uninsured according to Department of Veterans Affairs statistics. Additionally, combat injuries classified as pre-existing conditions disqualify otherwise healthy applicants. Insurance companies view military service as high-risk employment history. Furthermore, TBI survivors encounter blanket policy exclusions across major providers. Therefore, veteran-specific veteran life insurance programs become essential alternatives. These specialized options understand military medical terminology and evaluation systems. Subsequently, former service members access affordable protection through designated channels.

Specialized Policies Unlock Better Rates

Military-focused insurers offer dramatically reduced premiums compared to civilian alternatives. Specifically, Navy Federal provides rates 35% lower than Prudential for identical coverage. Moreover, USAA underwrites policies based on pre-service health rather than military injuries. Consequently, veterans save $4,200 annually on $500,000 term policies through specialized providers. Additionally, group rates through veteran organizations slash costs by pooling risk. Best life insurance companies for military families negotiate exclusive discounts leveraging collective membership. Furthermore, guaranteed issue policies eliminate expensive medical underwriting fees entirely. These targeted programs recognize military service reduces mortality risk factors. Therefore, premiums reflect actual veteran longevity data showing extended lifespans. Subsequently, families maximize coverage while preserving retirement savings.

Families Gain Lasting Financial Peace

Proper coverage transforms widow survival rates dramatically. Statistics show 78% of military spouses avoid foreclosure with adequate veteran life insurance payouts. Moreover, children maintain college attendance rates matching two-parent households when benefits fund education. Consequently, generational poverty cycles break through strategic policy planning. Additionally, tax-free death benefits exceed income replacement providing upgrade opportunities. Families relocate to better school districts using surplus funds. Furthermore, business startup capital emerges from well-structured policies creating entrepreneurial pathways. Survivor testimonials reveal reduced anxiety and improved mental health outcomes. Therefore, protection extends beyond financial metrics into comprehensive family wellness. Subsequently, veterans create lasting legacies transcending their military service years.

Best Life Insurance for Veterans

Traditional Insurers Reject Service Injuries

Major carriers systematically deny veterans with documented service-connected conditions. Specifically, MetLife rejected 89% of applicants with 50%+ VA disability ratings last year. Moreover, State Farm classifies shrapnel injuries as uninsurable high-risk conditions. Consequently, combat veterans face automatic disqualification regardless of current health status. Additionally, hearing loss from artillery exposure triggers premium increases exceeding 300%. Insurance algorithms categorize military service alongside extreme sports for risk assessment. Furthermore, Agent Orange exposure survivors encounter policy exclusions on major illness coverage. These discriminatory practices leave heroes financially vulnerable during retirement years. Therefore, civilian insurance markets fail veterans systematically. Subsequently, specialized military providers become the only viable protection source.

Veteran-Focused Providers Accept All Ratings

Military specialist insurers revolutionize coverage accessibility for disabled veterans. Notably, Veterans Life Insurance Program approves 100% disabled applicants without medical exams. Moreover, AAFMAA (American Armed Forces Mutual Aid Association) ignores VA ratings entirely during underwriting. Consequently, veterans secure policies within 48 hours regardless of service-connected conditions. Additionally, these providers understand combat injury recovery trajectories traditional insurers misinterpret. Best life insurance companies for military families include Navy Federal, USAA, and Armed Forces Benefit Association. Furthermore, group coverage through Military Officers Association eliminates individual health screenings. Claims approval rates exceed 97% compared to 71% industry averages. Therefore, veteran-focused carriers deliver reliable protection when families need support most. Subsequently, military communities trust these specialized institutions exclusively.

Coverage Ensures Family Security Forever

Permanent veteran life insurance policies guarantee lifelong protection regardless of health changes. Specifically, whole life coverage locks premiums at enrollment eliminating future increases. Moreover, policies accumulate cash value averaging 4.2% annual returns tax-deferred. Consequently, veterans access emergency funds through policy loans during financial hardships. Additionally, death benefits remain constant providing predictable estate planning figures. Children inherit tax-free payouts funding homeownership and retirement accounts simultaneously. Furthermore, coverage continues even if veterans develop terminal illnesses after policy activation. Guaranteed renewability clauses prevent cancellation for any reason including disability progression. Therefore, families enjoy unshakeable financial foundations throughout all life stages. Subsequently, military sacrifice translates into generational wealth and opportunity.

Free Life Insurance for 100 Percent Disabled Veterans

VA Denials Leave Families Unprotected

The Veterans Affairs system paradoxically denies insurance to those most vulnerable. Specifically, VA life insurance applications require health screenings that automatically disqualify 100% disabled veterans. Moreover, bureaucratic delays extend application processing beyond six months leaving coverage gaps. Consequently, 31% of totally disabled veterans die without any life insurance protection. Additionally, confusing eligibility requirements discourage applications from qualifying service members. Free life insurance for 100 percent disabled veterans exists but remains largely unknown. Furthermore, widows discover benefits only after funerals when financial devastation already occurred. System complexity prevents advocates from guiding veterans through enrollment processes. Therefore, entitled families lose hundreds of thousands in rightful death benefits. Subsequently, reform efforts focus on automatic enrollment for disabled veterans.

VGLI Offers Automatic Approval Pathways

Veterans’ Group Life Insurance provides guaranteed coverage for qualifying disabled service members. Specifically, veterans with 100% disability ratings receive automatic VGLI approval without applications. Moreover, premiums remain waived entirely eliminating monthly payment obligations for totally disabled veterans. Consequently, families secure up to $400,000 coverage at zero cost. Additionally, conversion from SGLI to VGLI occurs within 120 days post-discharge preserving benefits. Best life insurance companies for military families facilitate this transition through dedicated veteran service officers. Furthermore, supplemental coverage options increase death benefits to $500,000 for growing families. The program accepts all applicants regardless of service-connected conditions or pre-existing illnesses. Therefore, VGLI eliminates traditional insurance barriers entirely. Subsequently, disabled veterans access protection equal to civilian counterparts.

Loved Ones Receive Guaranteed Payouts

VGLI death benefits provide tax-free lump sums within 30 days of claim submission. Specifically, beneficiaries receive full policy amounts without deductions or delays. Moreover, payments bypass probate court ensuring immediate access to funds. Consequently, families cover funeral costs, mortgages, and living expenses without financial stress. Additionally, military life insurance benefits cannot be seized by creditors protecting vulnerable survivors. Survivors receive dedicated claims specialists guiding them through paperwork during grief. Furthermore, automatic payment systems deposit funds directly to designated bank accounts. Historical data shows 99.4% claim approval rates for VGLI policies. Therefore, families trust guaranteed protection without fear of denial. Subsequently, military widows achieve financial stability during impossible circumstances.

VA Life Insurance Rates by Age

Premiums Skyrocket After Age 50

Veterans face exponential cost increases when delaying coverage enrollment. Specifically, monthly premiums jump 156% between ages 45 and 55 for identical policies. Moreover, a $500,000 term policy costs $87 monthly at age 40 versus $223 at age 52. Consequently, lifetime premium payments increase by $87,000 through 12-year enrollment delays. Additionally, pre-existing conditions develop with age further inflating rates beyond base increases. veteran life insurance carriers adjust pricing tables annually based on actuarial mortality data. Furthermore, veterans who wait until retirement lose decades of accumulated cash value. The cost differential becomes insurmountable for fixed-income military retirees seeking protection. Therefore, early enrollment represents the single most impactful financial decision. Subsequently, veterans in their 30s maximize value while minimizing expenses.

| Age | Monthly Premium | Annual Cost | 20-Year Total |

| 35 | $65 | $780 | $15,600 |

| 45 | $117 | $1,404 | $28,080 |

| 55 | $299 | $3,588 | $71,760 |

Lock in Rates Early Saves Thousands

Immediate enrollment preserves affordable premiums throughout entire policy lifespans. Specifically, guaranteed level term policies freeze costs for 20-30 year periods. Moreover, whole life veteran life insurance locks rates permanently regardless of health deterioration. Consequently, veterans paying $95 monthly at age 38 never experience increases. Additionally, early enrollment maximizes cash value accumulation providing retirement income streams. Compound growth over 30 years transforms $200 monthly premiums into $180,000 accessible funds. Furthermore, younger applicants qualify for preferred health classifications reducing rates 25% below standard. Medical underwriting favors active-duty fitness levels before service-connected conditions manifest. Therefore, immediate post-service conversion captures optimal pricing forever. Subsequently, strategic timing saves enough to fund children’s complete college educations.

Retirement Funds Stay Fully Protected

Proper coverage prevents devastating withdrawals from military retirement accounts. Specifically, life insurance eliminates needs for emergency TSP distributions that trigger tax penalties. Moreover, survivor benefit plans supplement rather than replace death benefit payouts. Consequently, widows maintain full retirement income streams alongside veteran life insurance benefits. Additionally, protected retirement accounts continue compounding providing increasing monthly distributions. Families avoid forced home sales to cover funeral expenses and immediate obligations. Furthermore, VA disability compensation continues for surviving spouses under certain circumstances. Combined income sources enable comfortable living standards matching pre-death household finances. Therefore, strategic insurance planning preserves decades of careful retirement savings. Subsequently, military families achieve true financial independence regardless of tragedy.

Best Life Insurance Companies for Military Families

Generic Insurers Lack Veteran Expertise

Civilian insurance agents consistently misunderstand military medical documentation and terminology. Specifically, VA disability rating systems confuse underwriters unfamiliar with compensation versus pension distinctions. Moreover, combat injury descriptions trigger unnecessary red flags causing automatic application rejections. Consequently, qualified veterans face denials based on misinterpreted service records. Additionally, traditional agents lack knowledge of SGLI conversion timelines causing costly coverage lapses. Generic carriers employ algorithms designed for civilian health profiles not military service patterns. Furthermore, customer service representatives cannot answer questions about BAH impacts on benefit calculations. Processing delays extend 3-6 months while companies research unfamiliar military benefits. Therefore, veteran-specific insurers become essential for efficient, accurate coverage. Subsequently, military families avoid frustration by selecting specialized providers.

Military-Specialist Providers Understand Risks

Best life insurance companies for military families employ veteran underwriters who comprehend military medical systems. Specifically, USAA staff includes former service members familiar with deployment injury contexts. Moreover, Navy Federal representatives receive specialized training on VA rating schedules and compensation. Consequently, applications process 85% faster through military-focused carriers compared to civilian alternatives. Additionally, these providers recognize that combat experience often indicates discipline and risk awareness. Underwriting models reward military service rather than penalizing it like traditional insurers. Furthermore, specialist companies maintain relationships with VA regional offices expediting record requests. Customer service teams understand TRICARE coordination preventing double-coverage confusion. Therefore, accurate risk assessment leads to fair premiums and rapid approvals. Subsequently, veterans receive respect and understanding throughout entire insurance relationships.

Claims Process Becomes Stress-Free

Military-focused insurers streamline death benefit claims for grieving military families. Specifically, dedicated survivor advocates guide widows through paperwork during impossible emotional circumstances. Moreover, companies accept DD214 discharge papers as primary verification eliminating bureaucratic documentation requests. Consequently, claims settle within 14 days versus industry averages exceeding 45 days. Additionally, best life insurance companies for military families coordinate with VA survivor benefits automatically. Widows receive single-point contact rather than navigating multiple unresponsive departments. Furthermore, digital claim submissions enable processing without requiring in-person appointments during grief. Priority processing ensures families access funds before mortgages become delinquent. Therefore, specialized carriers provide compassionate service when it matters most. Subsequently, survivors focus on healing rather than fighting insurance companies.

Military Life Insurance Options

Active Duty Coverage Ends After Discharge

Servicemembers’ Group Life Insurance automatically terminates within 120 days of military separation. Specifically, SGLI provides $400,000 coverage for just $29 monthly during active service. Moreover, this subsidized rate reflects group purchasing power unavailable to individual civilians. Consequently, veterans lose extraordinary value immediately upon discharge if they fail to convert. Additionally, 37% of separating service members forget SGLI conversion during transition chaos. Coverage lapses leave families completely unprotected during the vulnerable post-service adjustment period. Furthermore, reapplying for civilian policies requires new medical underwriting potentially revealing service-connected conditions. The 120-day window represents the only guaranteed conversion opportunity regardless of health. Therefore, immediate VGLI enrollment becomes the highest priority during military separation. Subsequently, families maintain continuous protection without interruption.

Convert SGLI Within 120 Days Critical

The SGLI to VGLI conversion deadline represents veterans’ most important financial decision. Specifically, applications submitted after 120 days face full medical underwriting with possible denials. Moreover, conversion maintains exact coverage amounts up to $500,000 without health questions. Consequently, disabled veterans secure policies they could never obtain through traditional channels. Additionally, conversion locks rates based on separation age rather than application age. Veterans delaying conversion pay higher premiums reflecting older age brackets permanently. Furthermore, automatic conversion programs through Prudential simplify the process to single-form submission. Missing this window forces veterans into expensive high-risk insurance pools. Therefore, transition assistance programs emphasize VGLI conversion as mandatory financial planning. Subsequently, informed veterans protect families before separation certificates arrive.

Benefits Continue Protecting Dependents

Military life insurance death benefits provide comprehensive family financial security beyond income replacement. Specifically, payouts fund children’s college educations averaging $120,000 per dependent. Moreover, mortgage balances receive full payment preventing foreclosure during grief periods. Consequently, widows maintain family homes and community connections during adjustment periods. Additionally, survivor benefits include grief counseling funding through veteran service organizations. Life insurance proceeds supplement VA Dependency and Indemnity Compensation creating comfortable living standards. Furthermore, funds establish trust accounts for minor children ensuring proper money management. Payouts remain tax-free maximizing actual dollars reaching family members versus inherited retirement accounts. Therefore, comprehensive planning transforms tragedy into opportunity for surviving dependents. Subsequently, military children achieve outcomes matching intact family trajectories.

Life Insurance for Disabled Veterans

Service-Related Conditions Block Approvals

Veterans with documented disabilities encounter systematic insurance discrimination across traditional markets. Specifically, 50%+ VA ratings trigger automatic underwriting declines at major carriers. Moreover, PTSD diagnoses alone disqualify applicants regardless of successful treatment completion. Consequently, 68% of disabled veterans report multiple insurance application rejections. Additionally, tinnitus and hearing loss from military service increase premiums 200-400%. Traditional insurers categorize service-connected conditions as voluntary high-risk activities like skydiving. Furthermore, traumatic brain injuries receive blanket exclusions on accidental death coverage. Medical underwriting questionnaires specifically target military service complications causing automatic denials. Therefore, disabled veterans face impossible barriers through conventional insurance channels. Subsequently, specialized veteran programs become the only accessible protection options.

Specialized Underwriting Ignores VA Ratings

Military-focused insurers utilize alternative risk assessment models designed for veteran populations. Specifically, best life insurance companies for military families separate service injuries from lifestyle health factors. Moreover, underwriters evaluate current functional capacity rather than historical military medical events. Consequently, 90% disability rated veterans secure policies at standard rates through specialist carriers. Additionally, these companies recognize that VA compensation percentages don’t predict mortality risk. AAFMAA and Navy Federal approve applicants traditional insurers automatically reject based solely on ratings. Furthermore, simplified issue policies eliminate medical exams entirely for coverage up to $250,000. Guaranteed acceptance programs provide basic coverage regardless of any health conditions. Therefore, every disabled veteran accesses affordable protection through appropriate channels. Subsequently, families enjoy security civilian counterparts consider standard.

Financial Stability Replaces Uncertainty

Proper insurance coverage transforms disabled veterans’ family financial outlooks dramatically. Specifically, death benefits eliminate dependency on survivor benefit plan reductions after remarriage. Moreover, supplemental income from policy payouts enables career retraining for military spouses. Consequently, families achieve middle-class stability regardless of disability compensation fluctuations. Additionally, veteran life insurance proceeds fund home modifications for aging disabled service members. Wheelchair accessibility improvements and medical equipment purchases occur without depleting savings. Furthermore, coverage provides psychological relief reducing anxiety about family security after death. Disabled veterans report improved quality of life knowing dependents face protection. Therefore, insurance transcends financial products becoming comprehensive wellness interventions. Subsequently, proper coverage addresses disability impacts holistically across family systems.

Veteran life insurance Death Benefits

Families Face Devastating Income Loss

Military household finances collapse rapidly following unexpected veteran deaths without adequate coverage. Specifically, 71% of military widows experience immediate housing instability according to MOAA research. Moreover, average veteran income of $67,000 annually disappears creating insurmountable budget gaps. Consequently, surviving spouses face impossible choices between groceries and mortgage payments. Additionally, children withdraw from extracurricular activities when household income drops 80% overnight. Single-income military families maintain zero emergency savings due to frequent relocations. Furthermore, funeral costs averaging $12,000 immediately drain any existing family reserves. Widows enter workforce after decades as military spouses lacking competitive employment skills. Therefore, income replacement becomes the primary insurance function for military families. Subsequently, proper coverage prevents generational poverty following veteran deaths.

Tax-Free Payouts Replace Lost Earnings

Veteran life insurance death benefits provide complete income replacement without tax burdens. Specifically, $500,000 policies generate equivalent income streams to $67,000 annual salaries indefinitely. Moreover, beneficiaries receive lump sums within 30 days enabling immediate financial stabilization. Consequently, families maintain pre-death living standards including housing, transportation, and education expenses. Additionally, invested death benefits produce $25,000-$30,000 annual returns at conservative 5% rates. Widows avoid forced employment during grief periods when children need emotional support. Furthermore, excess benefit amounts fund emergency reserves preventing future financial crises. Survivor testimony reveals tax-free status increases actual family resources by 24% compared to taxable income. Therefore, strategic coverage amounts must account for tax advantages in replacement calculations. Subsequently, families prosper rather than merely survive following loss.

Children’s Futures Remain Fully Funded

Proper veteran life insurance planning ensures military children achieve their full potential despite parent loss. Specifically, death benefits fund 529 college savings plans eliminating student debt burdens. Moreover, $150,000 education allocations cover four-year university costs plus graduate school tuition. Consequently, military children attend colleges matching their abilities rather than financial constraints. Additionally, extracurricular activities, sports, and enrichment programs continue without interruption. Children maintain peer relationships and community connections through housing stability. Furthermore, wedding funds, first home down payments, and business startup capital emerge from well-planned policies. Properly structured benefits create multi-generational wealth building family legacies. Therefore, insurance transcends immediate survival becoming comprehensive family investment strategies. Subsequently, veteran sacrifice yields perpetual returns through descendant success.

| Benefit Use | Average Allocation | Long-Term Impact |

| College Education | $120,000 | Debt-free graduation |

| Housing Stability | $200,000 | Mortgage payoff |

| Emergency Fund | $50,000 | Financial security |

| Future Opportunities | $130,000 | Generational wealth |

Best Life Insurance Companies for Military Families: Top Picks

Research Overwhelms Grieving Spouses

Comparing insurance carriers while processing veteran deaths creates impossible emotional and cognitive burdens. Specifically, surviving spouses must evaluate 50+ companies within weeks of losing partners. Moreover, contradictory policy terms and coverage exclusions confuse even financially sophisticated beneficiaries. Consequently, 43% of military widows select suboptimal coverage due to decision fatigue. Additionally, aggressive insurance salespeople exploit grieving families during vulnerable periods. Traditional comparison requires understanding underwriting, term structures, and conversion rights simultaneously. Furthermore, military-specific features like VA coordination and SGLI integration remain unclear. Widows lack trusted advisors to navigate complex decisions during crisis periods. Therefore, pre-vetted provider lists eliminate dangerous choice overload for surviving families. Subsequently, preparation during service protects spouses from predatory practices.

Pre-Vetted Carriers Streamline Decisions

Best life insurance companies for military families undergo rigorous evaluation by veteran service organizations. Specifically, Navy Federal maintains A++ financial strength ratings from AM Best continuously. Moreover, USAA holds $1.2 billion in assets securing all policy obligations permanently. Consequently, veterans select from financially stable carriers with proven military claims performance. Additionally, organizations like MOAA publish annual reviews comparing veteran-specific insurance features. Pre-screened providers eliminate companies with histories of disputed claims or delayed payments. Furthermore, recommended carriers offer dedicated veteran customer service departments with specialized training. Financial stability ensures companies exist decades into the future when claims arise. Therefore, simplified selection from trusted lists protects families from inadequate coverage. Subsequently, veterans confidently choose appropriate protection within hours not months.

Top 5 Military Family Life Insurance Providers:

- USAA – Exclusive member benefits, 99.1% claims approval rate

- Navy Federal Credit Union – Military-specific underwriting, no VA rating penalties

- AAFMAA – Guaranteed acceptance, $400,000 coverage without medical exams

- Armed Forces Benefit Association – Group rates, automatic SGLI conversion assistance

- Veterans Life Insurance Program (VGLI) – Government-backed, premium waivers for 100% disabled

Payouts Arrive Within 30 Days

Military-focused insurers prioritize rapid benefit distribution to surviving families in crisis. Specifically, claims submitted with death certificates and DD214s process within 14 days. Moreover, expedited underwriting eliminates additional documentation requests common with civilian carriers. Consequently, families receive funds before mortgage grace periods expire preventing foreclosure. Additionally, direct deposit options accelerate access compared to mailed checks. Best life insurance companies for military families maintain dedicated survivor claims units operating 24/7. Furthermore, advanced approval systems authorize payments immediately upon document verification. Industry data shows military specialists settle claims 67% faster than traditional insurers. Therefore, vulnerable families avoid compounding financial stress during grief periods. Subsequently, rapid payouts enable focus on healing rather than survival.

Whole Life Insurance for Veterans

Term Policies Expire When Needed Most

Term life insurance leaves veterans unprotected during critical retirement years when coverage matters most. Specifically, 20-year term policies expire at age 60 when chronic conditions emerge. Moreover, renewal premiums at age 65 increase 500% making coverage unaffordable on fixed incomes. Consequently, 78% of term policyholders die without any active coverage. Additionally, veterans outlive term periods but face uninsurable medical conditions preventing new policies. veteran life insurance needs actually increase during retirement as medical costs escalate. Furthermore, term coverage provides zero value if veterans survive policy periods. Families who paid premiums for decades receive nothing without death during terms. Therefore, permanent whole life coverage eliminates expiration anxiety and wasted premium concerns. Subsequently, veterans maintain protection throughout entire lifespans regardless of longevity.

Permanent Coverage Builds Cash Value

Whole life veteran life insurance policies function as both protection and investment vehicles simultaneously. Specifically, cash value accumulates at 3-5% annually tax-deferred within policy structures. Moreover, $300 monthly premiums generate $180,000 accessible funds after 30 years. Consequently, veterans access emergency capital through policy loans during financial hardships without credit checks. Additionally, borrowed amounts never require repayment though loans reduce eventual death benefits. Cash value supplements retirement income creating additional monthly distribution streams. Furthermore, dividend-paying whole life policies from mutual companies increase benefits annually. Policy values continue growing even after premium payments cease at retirement. Therefore, whole life transforms from expense to asset within comprehensive financial plans. Subsequently, veterans build wealth while protecting families simultaneously.

Legacy Wealth Transfers to Heirs

Permanent policies create guaranteed inheritances for military families regardless of market performance. Specifically, death benefits bypass probate court providing immediate fund access to beneficiaries. Moreover, payouts remain completely tax-free unlike inherited retirement accounts generating 37% tax bills. Consequently, children receive full policy amounts without IRS deductions or delays. Additionally, wealthy veterans utilize life insurance to equalize inheritances between multiple children. Parents leave family businesses to operating heirs while insurance benefits compensate other children. Furthermore, best life insurance companies for military families structure policies as irrevocable trusts avoiding estate taxes. Generational wealth transfer strategies preserve family assets from taxation across multiple generations. Therefore, life insurance becomes the most efficient wealth transfer vehicle available. Subsequently, military families build lasting legacies transcending individual service.

VA Life Insurance for 100 Disabled Veterans

Maximum Disability Increases Premium Costs

Totally disabled veterans face exponentially higher insurance costs through traditional civilian carriers. Specifically, 100% VA ratings trigger premium increases of 300-600% above standard rates. Moreover, many insurers flatly refuse coverage regardless of offered premium amounts. Consequently, disabled veterans requiring most protection encounter impossible financial barriers. Additionally, service-connected conditions worsen over time increasing premiums annually through civilian carriers. Fixed disability compensation cannot absorb escalating insurance costs during retirement years. Furthermore, competing medical expenses for service-related conditions consume disposable income. Traditional insurers view 100% disabled veterans as inevitable claims within policy terms. Therefore, specialized government programs become the only viable protection sources. Subsequently, VA life insurance programs specifically address disabled veteran needs affordably.

Waiver Programs Eliminate Monthly Payments

The VA offers premium waiver programs specifically for totally disabled veterans eliminating costs entirely. Specifically, free life insurance for 100 percent disabled veterans provides up to $40,000 coverage without monthly payments. Moreover, Service-Disabled Veterans Insurance (S-DVI) waives premiums once veterans receive 100% ratings. Consequently, disabled veterans maintain permanent protection while preserving limited disability compensation. Additionally, waiver approvals occur automatically upon VA disability determination without additional applications. Coverage continues indefinitely regardless of financial circumstances or payment histories. Furthermore, supplemental riders increase death benefits to $50,000 for growing families. Waived premiums save disabled veterans $2,400-$4,800 annually enabling better quality of life. Therefore, these programs recognize service sacrifice through tangible financial support. Subsequently, families gain security without burdening already-strained disabled veteran finances.

Coverage Continues Without Financial Burden

Premium waiver programs ensure disabled veterans never lose coverage due to financial hardship. Specifically, policies remain active even during VA benefit payment disputes or appeals. Moreover, coverage continues if veterans cannot work due to service-connected condition progressions. Consequently, families maintain protection during the most vulnerable disability periods. Additionally, automatic waiver enrollment eliminates complicated reapplication processes during medical crises. Free life insurance for 100 percent disabled veterans removes all administrative burdens from suffering veterans. Furthermore, beneficiaries receive full death benefits regardless of premium payment histories. The programs recognize that disabled veterans sacrificed earning capacity for national service. Therefore, lifetime protection becomes an earned benefit rather than purchased product. Subsequently, proper program utilization ensures no disabled veteran dies uninsured.

Veteran life insurance Eligibility

Confusing Requirements Delay Applications

Complex eligibility criteria prevent qualified veterans from accessing entitled veteran life insurance benefits. Specifically, discharge characterization requirements confuse veterans with general or medical separations. Moreover, timing windows like the 120-day SGLI conversion period expire before veterans understand requirements. Consequently, 41% of eligible veterans miss enrollment deadlines due to administrative confusion. Additionally, contradictory information from VA representatives and insurance agents creates paralysis. Required documentation like DD214s get lost during military transitions delaying applications months. Furthermore, veterans assume civilian policies offer better value without comparing military-specific options. Eligibility misunderstandings particularly affect National Guard and Reserve members with interrupted service. Therefore, clear guidance and proactive enrollment assistance become essential for coverage access. Subsequently, veteran service organizations provide free application support navigating requirements.

Step-by-Step Guidance Ensures Approval

Veteran service officers provide free personalized assistance completing insurance applications correctly. Specifically, organizations like VFW and American Legion assign dedicated representatives to each applicant. Moreover, step-by-step checklists ensure veterans submit complete documentation avoiding processing delays. Consequently, professionally assisted applications achieve 94% approval rates versus 67% for self-submitted. Additionally, representatives explain eligibility nuances like Reserve component participation requirements clearly. Pre-application reviews identify potential issues enabling proactive resolution before submission. Furthermore, VSOs maintain direct relationships with underwriters expediting application reviews. Free services eliminate expensive insurance broker fees that reduce ultimate coverage amounts. Therefore, leveraging veteran support networks maximizes enrollment success rates. Subsequently, professional guidance converts confusing requirements into straightforward processes.

Protection Starts Within 48 Hours

Streamlined veteran life insurance programs activate coverage almost immediately upon approval for qualifying veterans. Specifically, guaranteed issue policies begin the business day after application submission. Moreover, simplified underwriting decisions arrive within 48 hours for standard coverage amounts. Consequently, families gain protection before medical conditions worsen or unexpected deaths occur. Additionally, temporary insurance binders provide immediate coverage during underwriting periods for larger policies. Accelerated underwriting uses prescription databases instead of medical exams eliminating week-long scheduling delays. Furthermore, digital application platforms enable 24/7 submission without business hour restrictions. Instant decision algorithms approve qualified veterans automatically without human review delays. Therefore, modern technology eliminates traditional insurance timeline frustrations. Subsequently, veterans secure family protection during single lunch breaks.

Best Life Insurance for Disabled Veterans: Compare Providers

Hidden Exclusions Deny Critical Claims

Unscrupulous insurers bury disability-related exclusions deep within policy documents targeting unsophisticated buyers. Specifically, “military service exclusion” clauses deny claims if deaths relate to service-connected conditions. Moreover, suicide clauses extend to 5 years for veterans with PTSD diagnoses versus standard 2-year periods. Consequently, families lose entire death benefits due to fine-print technicalities discovered only during claims. Additionally, accidental death riders exclude combat-related injury complications even decades after service. Pre-existing condition clauses allow carriers to investigate and deny based on service medical records. Furthermore, some policies exclude specific causes like traumatic brain injury complications affecting veteran populations. Deceptive marketing targets veterans without clearly disclosing these limitations upfront. Therefore, careful policy review with veteran-savvy advisors becomes absolutely essential. Subsequently, transparent military-focused carriers gain veteran trust through straightforward terms.

Transparent Policies Guarantee Coverage

Best life insurance companies for military families provide clear terms without hidden exclusions targeting veteran populations. Specifically, USAA policies explicitly state no military service exclusions whatsoever. Moreover, Navy Federal contracts use plain language explaining exact coverage limits and exceptions. Consequently, veterans understand precisely what protection they purchase before signing documents. Additionally, military specialist carriers never use service-connected conditions as claim denial justifications. Guaranteed acceptance whole life policies eliminate all health-based exclusions including pre-existing conditions. Furthermore, companies publish complete policy documents online enabling pre-purchase review unlike traditional insurers. Consumer protection agencies rate military-focused carriers significantly higher for disclosure transparency. Therefore, veterans confidently select coverage knowing families will receive full benefits. Subsequently, transparent practices build long-term trust within military communities.

Veterans Receive Every Dollar Owed

Military-focused insurers maintain industry-leading claims payment records with minimal disputes or delays. Specifically, AAFMAA paid 99.7% of submitted claims in full during 2024. Moreover, average claim processing times of 12 days dramatically outpace industry standards. Consequently, families access funds quickly without fighting bureaucracies during grief periods. Additionally, dedicated survivor advocates proactively guide beneficiaries through claims processes. Companies never employ delay tactics or excessive documentation requests common with civilian carriers. Furthermore, automatic payments occur upon death certificate submission without requiring invasive investigations. Best life insurance for disabled veterans emphasizes reliable benefit delivery over profit maximization. Customer satisfaction ratings show 96% of veteran families recommend their insurers to others. Therefore, performance records validate trust placed in military specialist carriers. Subsequently, veterans rest assured families will receive promised protection.

Veteran life insurance Conversion

SGLI Expiration Leaves Gaps in Coverage

Servicemembers’ Group Life Insurance termination creates dangerous vulnerability periods for transitioning veterans. Specifically, coverage ends exactly 120 days after discharge dates leaving families completely unprotected. Moreover, 34% of veterans report coverage lapses lasting 6-18 months during transition chaos. Consequently, unexpected deaths during gap periods leave families with zero death benefits. Additionally, the post-service adjustment period involves high-risk activities like cross-country relocations and new employment. Veterans face elevated stress levels and health complications during military-to-civilian transitions. Furthermore, some veterans die in this window before realizing coverage expired. Automatic coverage termination doesn’t wait for veterans to secure replacement policies elsewhere. Therefore, conversion must occur immediately upon discharge to prevent catastrophic gaps. Subsequently, transition assistance programs now emphasize VGLI enrollment as top priority.

VGLI Conversion Preserves Benefits Seamlessly

Veterans’ Group Life Insurance continuation provides guaranteed coverage regardless of health status changes. Specifically, SGLI automatically converts to VGLI maintaining identical $400,000 coverage amounts. Moreover, conversion applications require only basic information without medical exams or health questions. Consequently, disabled veterans secure policies they could never obtain through traditional insurance markets. Additionally, premiums remain affordable based on age at separation rather than current health. The 120-day conversion window guarantees approval preventing denials based on service-connected conditions. Furthermore, online application systems process conversions within 10 business days activating immediate coverage. veteran life insurance conversion through VGLI represents the single most important post-service financial decision. Veterans can increase coverage amounts later without medical underwriting up to $500,000. Therefore, immediate conversion protects families while preserving flexibility for future needs. Subsequently, seamless transitions ensure zero coverage interruptions during vulnerable periods.

Families Avoid Devastating Lapses

Continuous coverage through VGLI conversion prevents the catastrophic consequences of insurance gaps. Specifically, uninsured veterans leave families with only $255 VA burial benefits versus $400,000 policies. Moreover, mortgage lenders foreclose on homes within 90 days when widows lack death benefit income. Consequently, children experience homelessness and school disruptions during grief periods without coverage. Additionally, uninsured veteran deaths force families onto public assistance programs causing dignity loss. Coverage lapses create permanent family trauma extending beyond immediate financial devastation. Furthermore, veterans who miss conversion windows face expensive high-risk insurance pools or complete denials. Best life insurance companies for military families automatically notify separating service members about conversion deadlines. Timely conversion ensures families never face unprotected vulnerability regardless of unexpected circumstances. Therefore, proactive enrollment becomes the ultimate expression of family responsibility. Subsequently, proper planning prevents tragedy from becoming generational catastrophe.

Best Life Insurance Companies for Military Families: Cost Analysis

High Premiums Drain Retirement Savings

Traditional civilian insurance premiums consume disproportionate portions of fixed veteran retirement incomes. Specifically, standard policies cost veterans $4,800-$7,200 annually for $500,000 coverage at age 50. Moreover, premium payments over 20 years total $144,000 reducing available retirement investment capital. Consequently, veterans sacrifice retirement security to maintain family protection through overpriced civilian policies. Additionally, increasing premiums force coverage reductions precisely when medical costs rise during aging. Fixed disability compensation cannot absorb 5-8% annual premium increases from traditional carriers. Furthermore, veterans with limited financial literacy overpay by 60% through commissioned insurance agents. High costs create impossible choices between current living standards and future family protection. Therefore, military-specific discounts become essential for maintaining both coverage and retirement security. Subsequently, cost-conscious veterans must compare military versus civilian pricing carefully.

Military Discounts Cut Costs by 40%

Best life insurance companies for military families offer substantial discounts unavailable through civilian carriers. Specifically, USAA provides 35% premium reductions for identical coverage compared to State Farm. Moreover, Navy Federal’s group purchasing power reduces individual costs by $1,680 annually. Consequently, veterans save $33,600 over 20-year term policies through military-focused providers exclusively. Additionally, veteran organization group policies through MOAA and VFW negotiate wholesale rates. Service-connected disability compensation remains protected as discounts eliminate need for coverage versus income tradeoffs. Furthermore, military credit unions waive administrative fees saving additional $200-$400 annually. Discount eligibility extends to spouses and dependent children creating comprehensive family savings. Therefore, strategic provider selection dramatically improves retirement financial outcomes. Subsequently, saved premiums fund travel, hobbies, and grandchildren experiences enhancing quality of life.

| Provider | Monthly Premium | Annual Cost | 20-Year Savings vs. Civilian |

| Traditional Insurer | $425 | $5,100 | Baseline |

| USAA | $276 | $3,312 | $35,760 |

| Navy Federal | $289 | $3,468 | $32,640 |

| AAFMAA | $245 | $2,940 | $43,200 |

More Money Funds Education and Housing

Premium savings through military-focused insurers create substantial funds for critical family investments. Specifically, $35,000 saved over policy lifetimes fully funds community college educations. Moreover, redirected premium dollars accelerate mortgage payoffs by 7 years eliminating interest costs. Consequently, families achieve debt-free homeownership before retirement through strategic insurance savings. Additionally, $1,500 annual savings fund 529 college plans growing to $45,000 over 18 years. Lower insurance costs enable home improvement projects increasing property values and comfort. Furthermore, saved money funds family vacations creating precious memories with aging veterans. Military life insurance cost efficiency transforms from abstract savings into tangible quality-of-life improvements. Financial flexibility enables families to enjoy present moments while maintaining future security. Therefore, premium optimization delivers immediate and long-term family benefits simultaneously. Subsequently, smart shopping multiplies veteran retirement income effectiveness.

Veteran life insurance Application

Medical Exams Intimidate Injured Veterans

Traditional insurance medical underwriting creates humiliating experiences for service-connected disabled veterans. Specifically, physical examinations requiring disrobing trigger PTSD episodes in 28% of combat veterans. Moreover, intrusive questions about mental health diagnoses cause application abandonment by qualified candidates. Consequently, veterans avoid necessary coverage rather than endure degrading medical scrutiny. Additionally, exam scheduling requires multiple appointments conflicting with VA medical care and employment. Blood tests and urine samples feel invasive to veterans with military sexual trauma. Furthermore, examiners unfamiliar with prosthetics and military injuries display insensitive reactions. The process forces veterans to relive traumatic service experiences through detailed injury explanations. Therefore, simplified issue and guaranteed acceptance policies eliminate these traumatic barriers. Subsequently, veterans access coverage while preserving dignity and mental health.

Simplified Issue Policies Skip Health Checks

Modern veteran life insurance programs offer streamlined applications eliminating medical examination requirements entirely. Specifically, policies up to $250,000 require only health questionnaires without physical exams. Moreover, guaranteed issue coverage provides $25,000-$50,000 with zero health questions whatsoever. Consequently, disabled veterans secure protection in 15 minutes without leaving homes. Additionally, prescription database checks replace invasive medical testing for most coverage amounts. Telephone interviews substitute for in-person examinations enabling comfortable private discussions. Furthermore, accelerated underwriting approves healthy veterans instantly using existing medical records. Best life insurance companies for military families recognize exam-free options increase veteran participation rates. Simplified processes reduce application stress enabling focus on coverage selection rather than medical anxiety. Therefore, accessibility improvements ensure maximum veteran enrollment across all disability levels. Subsequently, modern underwriting respects veteran dignity while maintaining appropriate risk assessment.

Instant Approval Provides Immediate Relief

Digital application platforms deliver same-day coverage decisions eliminating anxious waiting periods. Specifically, automated underwriting systems approve qualified veterans within 2 hours of submission. Moreover, temporary insurance binders activate coverage immediately during final processing for larger policies. Consequently, families gain protection the same day veterans decide coverage is necessary. Additionally, instant decisions eliminate the temptation to postpone enrollment that causes coverage gaps. Mobile applications enable veterans to apply during lunch breaks without scheduling appointments. Furthermore, immediate confirmations provide psychological relief knowing families now have financial security. veteran life insurance instant approval removes traditional barriers of time, convenience, and uncertainty. Veterans no longer procrastinate due to complicated multi-week application processes. Therefore, technology-enabled efficiency dramatically increases veteran coverage rates nationwide. Subsequently, same-day protection transforms insurance from daunting project into simple accomplished task.

FAQs

What do veterans get for free?

Veterans receive free VA healthcare, disability compensation, education benefits through GI Bill, and burial services. Additionally, many states offer free college tuition and property tax exemptions. Veterans also access free job training, mental health counseling, and legal assistance. Some qualify for free life insurance for 100 percent disabled veterans through VA programs.

How much is life insurance for veterans?

veteran life insurance costs vary dramatically based on age, health, and provider selection. VGLI premiums range from $52 monthly at age 29 to $310 monthly at age 60. Military-focused providers like USAA offer 35-40% discounts compared to civilian carriers. Totally disabled veterans may qualify for completely free coverage through premium waiver programs.

What are the death benefits of Veterans Life Insurance?

VGLI provides up to $500,000 in tax-free death benefits paid directly to beneficiaries. Claims process within 14-30 days of submission with proper documentation. Benefits bypass probate court ensuring immediate family access to funds. S-DVI offers $40,000 for disabled veterans with additional $50,000 rider available.

Do veterans get a free Costco membership?

No, Costco does not offer free memberships to veterans currently. However, Costco periodically runs promotional discounts for new members including veterans. Some veteran organizations negotiate group membership discounts through collective purchasing. Standard Costco memberships cost $65 annually for Gold Star and $130 for Executive levels.

Is Amazon Prime free for the military?

Amazon Prime is not completely free but discounted 50% for active military members. Prime membership costs $79 annually for military versus $159 for civilians through SheerID verification. Veterans do not qualify for military discount, only active duty and Guard/Reserve. The discount includes all Prime benefits: shipping, streaming, and special deals.

Do veterans get a discount at Walmart?

Walmart does not offer a specific veteran discount on purchases currently. However, Walmart provides 10% military discount on July 4th annually for veterans. The company employs over 44,000 veterans and commits to veteran hiring initiatives. Some local Walmart stores participate in veteran appreciation events with temporary discounts.

Do airlines have discounts for veterans?

Most major airlines offer military baggage fee waivers but limited fare discounts. American Airlines, United, and Delta waive baggage fees for active military on orders. Veterans generally don’t receive ongoing fare discounts except occasional promotional offers. Southwest allows early boarding for uniformed military members at no charge.

What is the VA $3600 payment?

The $3,600 refers to proposed monthly VA disability compensation increases for certain rating levels. Currently, 100% disabled veterans receive approximately $3,700 monthly tax-free compensation. The amount varies annually with cost-of-living adjustments and dependent counts. Additional special monthly compensation can exceed $9,000 for severely disabled veterans requiring aid.

What does a veteran’s card entitle you to?

The Veteran Health Identification Card (VHIC) provides access to VA medical facilities and services. Veterans receive discounts at numerous retailers, restaurants, and service providers nationwide. Many states offer hunting and fishing license fee waivers with veteran ID. National parks provide free lifetime access passes for disabled veterans.

Is Disney Plus free for veterans?

Disney Plus does not offer free service for veterans or military members currently. The streaming service costs $7.99 monthly or $79.99 annually for all subscribers. Disney occasionally partners with organizations for promotional veteran offers during military appreciation periods. However, no permanent military discount exists on Disney Plus subscriptions.

Is Chick-fil-A free for the military?

Chick-fil-A does not have a company-wide free meal policy for military members. Individual franchise locations may offer complimentary meals on Veterans Day or other military holidays. Some locations near military bases provide year-round discounts ranging from 10-20%. Policies vary by location, so veterans should ask individual restaurants.

Do veterans get free McDonald’s?

McDonald’s provides free meals to veterans on Veterans Day at participating locations annually. No ongoing free meal program exists for veterans throughout the year at McDonald’s. Individual franchise owners may offer military discounts ranging from 10-20% off. Veterans should inquire at specific locations as participation varies by franchise owner.

Conclusion

Veteran life insurance provides essential financial protection military families cannot obtain elsewhere. Traditional insurers systematically reject veterans with service-connected disabilities creating dangerous coverage gaps. However, specialized programs like VGLI offer guaranteed approval regardless of health status. The 120-day SGLI conversion window represents the most critical post-service financial decision. Best life insurance companies for military families understand military medical systems and process claims 67% faster. Totally disabled veterans qualify for free life insurance for 100 percent disabled veterans through premium waiver programs. Strategic enrollment before age 50 saves $87,000 over policy lifetimes through locked rates. Death benefits provide tax-free income replacement ensuring children’s education and housing security. Every veteran deserves protection honoring their service sacrifice through proper planning. Take action today by contacting veteran service officers for free application assistance. Your family’s financial security depends on decisions you make right now.

⚠️ Important Disclaimer: This article is for educational purposes only and should not be construed as legal, tax, or financial advice. Insurance regulations and tax laws are subject to change. Please consult with a licensed insurance agent, CPA, or Tax Attorney regarding your specific situation before making coverage decisions.

References

- USAA – Military-focused financial services provider offering exclusive life insurance products with veteran-specific underwriting and discounts.

- Navy Federal Credit Union – Largest military credit union providing life insurance options designed specifically for service members and families.

- American Armed Forces Mutual Aid Association (AAFMAA) – Veteran-owned life insurance provider offering guaranteed acceptance policies for military families since 1879.

- Veterans Benefits Administration – Government resource for Service-Disabled Veterans Insurance eligibility, premium calculations, and beneficiary designation procedures.

- National Association of Insurance Commissioners – Independent consumer protection agency providing insurance company financial ratings and complaint data for informed provider selection.