Towing Company Insurance: 2025 Costs & On-Hook Guide

The towing industry operates in a uniquely hazardous environment. A single mishap, dropping a $90,000 luxury sedan during transport, damaging a customer’s transmission during hookup, or causing a multi-vehicle pileup while towing a disabled truck, can generate claims exceeding half a million dollars. Unlike standard commercial vehicle operations, towing businesses face dual liability: both for their driving operations and for the vehicles they’re transporting or storing.

This comprehensive guide demystifies towing company insurance, breaking down the specialized coverages that protect your business from catastrophic financial exposure. Whether you operate a single light-duty wrecker or manage a fleet of heavy-duty recovery vehicles, understanding On-Hook coverage, Garagekeepers Legal Liability, and federal compliance requirements is non-negotiable for sustainable operations.

🎯 Key Takeaways

📍 Average annual premiums range from $8,000-$15,000 per truck for light-duty operations, scaling to $25,000+ for heavy-duty recovery with hazmat endorsements.

📍 On-Hook Coverage is mandatory and distinct from standard liability, it protects vehicles being towed, not just your truck.

📍 Federal Motor Carrier Safety Administration (FMCSA) requires MCS-90 endorsements and minimum $750,000 liability for interstate towing.

📍 Garagekeepers Legal Liability covers customer vehicles stored at your impound lot, a separate exposure from towing operations.

📍 Driver qualification files and safety programs can reduce premiums by 15-30% through loss control credits.

📍 State-specific requirements vary dramatically, some states mandate bond filings while others require garage liability minimums.

- 🎯 Key Takeaways

- Understanding Towing Insurance Coverage

- Cost Analysis: How Much Does Towing Business Insurance Cost?

- Federal & State Filing Requirements

- Comparing Commercial Vehicle Risks Across Industries

- How to Get the Best Rates on Towing Insurance Companies Policies

- Towing Insurance FAQs

- Conclusion: Building a Sustainable Risk Management Strategy

- References

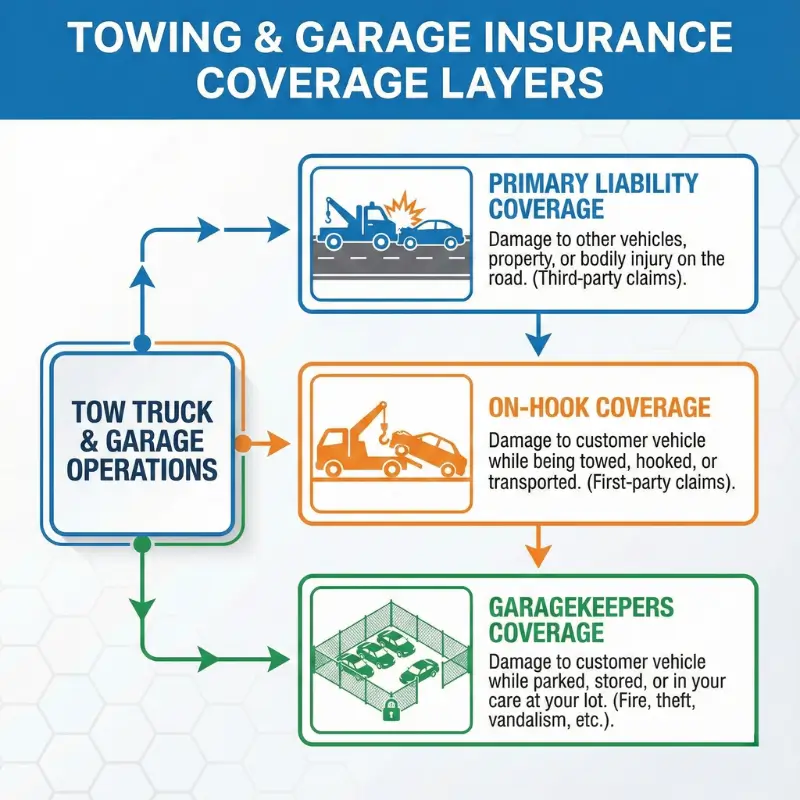

Understanding Towing Insurance Coverage

Primary Liability: The Foundation of Towing Business Insurance

Commercial auto liability forms the bedrock of any towing insurance policy. This coverage responds when your tow truck causes bodily injury or property damage to third parties during driving operations. The federal minimum for interstate towing operations is $750,000 combined single limit (CSL), though most carriers recommend $1 million to adequately protect against severe accident scenarios.

Primary liability covers situations like:

- Your driver rear-ends another vehicle while responding to a roadside call

- Your wrecker causes a multi-vehicle accident on the highway

- A pedestrian is injured in your impound lot by your moving truck

However, and this is where many towing operators encounter dangerous coverage gaps, primary liability does not cover the vehicle you’re towing. That requires specialized On-Hook coverage.

💡 Expert Tip: Many towing operators mistakenly believe their $1 million liability policy covers everything. Primary liability only protects against damage your truck causes while driving. Damage to the vehicle being towed falls under On-Hook coverage, which must be purchased separately.

On-Hook Coverage: Protecting Your Cargo

On-Hook coverage (also called “Motor Truck Cargo” in some policies) is the most critical, and most misunderstood, component of commercial towing insurance. This specialized coverage protects customer vehicles while they’re attached to your tow truck or being transported.

What On-Hook Coverage Protects:

- Vehicle slides off your flatbed during transport and sustains $40,000 in damage

- Hydraulic failure causes you to drop a luxury vehicle during loading

- The towed vehicle’s transmission is damaged due to improper hookup procedures

- Cargo shifts during emergency braking, causing damage to the customer’s car

Coverage Limits and Deductibles: Most policies offer On-Hook limits between $50,000 and $250,000 per occurrence, with deductibles ranging from $1,000 to $5,000. For light-duty operations towing passenger vehicles, $100,000 limits typically suffice. Heavy-duty operators recovering semi-trucks or commercial equipment should carry $250,000+ limits.

| Coverage Component | On-Hook Liability | Garagekeepers Legal Liability |

| What’s Covered | Vehicles being towed/transported | Vehicles stored at your facility |

| When It Applies | During hookup, transport, unhooking | While parked in your impound lot |

| Typical Limit | $50,000-$250,000 per vehicle | $500,000-$2,000,000 aggregate |

| Common Deductible | $2,500-$5,000 | $1,000-$2,500 |

| Exclusions | Mechanical breakdowns, wear/tear | Customer’s own negligence, theft by customer |

Garagekeepers Legal Liability: Storage Protection

Garagekeepers Legal Liability protects customer vehicles while they’re stored at your impound facility, body shop, or tow yard, essentially when they’re no longer attached to your truck. This coverage is legally required in most states for businesses that store customer property.

Three Coverage Forms:

Legal Liability Only: Covers damage only when you’re legally liable (your negligence caused the damage). This is the most affordable option but provides the narrowest protection.

Direct Primary: Covers customer vehicles regardless of fault, but only for specified perils like fire, theft, or vandalism. This is the most comprehensive and expensive option.

Direct Excess: Combines both approaches, covers you when liable, then provides excess coverage above the customer’s own insurance for other perils.

Common Garagekeepers Claims:

- Fire spreads through your impound lot, destroying 30 stored vehicles

- Vandals break into your facility and damage customer cars

- Your employee accidentally backs into a parked customer vehicle

- Storm damage (hail, falling trees) impacts stored vehicles

For a typical towing operation with 20-50 vehicles on the lot at any given time, $1 million aggregate Garagekeepers coverage is standard. High-volume urban operations may need $2-5 million.

💡 Expert Tip: Many towing operators opt for “Legal Liability Only” Garagekeepers to save on premiums, then face denied claims when their customer’s vehicle is damaged by a third party. If you’re storing high-value vehicles or operating in an area prone to theft or vandalism, Direct Primary coverage is worth the premium increase.

Physical Damage Coverage for Your Fleet

While liability and On-Hook protect others’ property, Physical Damage coverage protects your tow trucks. This typically includes:

Collision: Damage to your wrecker from accidents (overturns, impacts, rollovers)

Comprehensive: Non-collision losses like theft, vandalism, fire, weather damage, hitting an animal

For a $120,000 heavy-duty rotator wrecker, expect to pay $3,500-$6,000 annually for full Physical Damage coverage with a $2,500 deductible. The unique challenge with tow trucks is their high replacement cost, specialized equipment like hydraulic underlift systems, wheel lifts, and recovery booms significantly increases vehicle values compared to standard commercial trucks.

Unlike commercial food truck insurance which focuses on kitchen equipment and food spoilage liability, towing requires specialized coverage for mechanical lifting equipment. A standard commercial truck policy won’t adequately address the unique exposures of boom operation or vehicle recovery scenarios.

Additional Essential Coverages

General Liability: Covers slip-and-falls at your office, customer injuries in your waiting area, or advertising injury claims. While your commercial auto policy covers vehicle-related injuries, GL picks up premises liability. Minimum recommended limit: $1 million per occurrence.

Workers’ compensation insurance: if you have employees, this insurance policy is mandatory in most states, so you should think about it seriously.Towing is classified as high-risk due to roadside hazards, heavy lifting, and traffic exposure. Expect rates of $15-$25 per $100 of payroll.

Uninsured/Underinsured Motorist Coverage: Protects your business when an at-fault driver lacks adequate insurance. Given that tow trucks often respond to accidents involving uninsured motorists, this coverage is particularly valuable.

Medical Payments: Covers medical expenses for passengers in your tow truck, regardless of fault. Limits of $5,000-$10,000 are typical.

Cost Analysis: How Much Does Towing Business Insurance Cost?

Average Premium Ranges by Operation Type

Towing business insurance cost varies dramatically based on truck class, radius of operation, cargo values, and driver qualifications. Here’s what you can expect:

| Operation Type | Annual Premium Range | Coverage Included |

| Light-Duty (Class 1-3) Single Truck | $8,000-$15,000 | $1M Liability, $100K On-Hook, Basic GL |

| Medium-Duty (Class 4-6) 2-3 Trucks | $18,000-$35,000 | $1M Liability, $150K On-Hook, Garagekeepers |

| Heavy-Duty Recovery (Class 7-8) | $25,000-$45,000 per truck | $2M Liability, $250K On-Hook, Hazmat endorsement |

| Full-Service Fleet (10+ trucks) | $150,000-$400,000 | Comprehensive package with all endorsements |

These ranges assume experienced drivers (5+ years), clean MVRs (Motor Vehicle Records), and no recent claims. New towing operators or those with adverse loss history may face 50-100% premium surcharges.

Primary Rating Factors That Drive Your Premium

Driver Experience and Safety Records: The single largest rating factor is your drivers’ qualifications. Carriers analyze:

- Years of towing experience (3+ years preferred)

- Moving violations in past 3 years (any major violations = surcharge)

- Accident history (at-fault accidents can increase rates 30-50%)

- License suspensions or DUI/DWI (may result in coverage denial)

A 25-year-old driver with 2 years of experience will cost 40-60% more to insure than a 45-year-old with 15 years of clean driving history.

Geographic Location: Where you operate significantly impacts rates. Urban operations in high-traffic areas like Los Angeles or New York face premiums 25-40% higher than rural operators. This mirrors patterns seen in personal lines, just as cheap car insurance in Virginia might be more affordable than coverage in major metropolitan areas, rural towing operations benefit from lower claim frequency.

States with elevated accident rates, severe weather patterns (hail in Texas, snow/ice in Michigan), or high theft rates also see increased premiums.

Radius of Operation:

- Local (0-50 miles): Lowest rates, as you’re operating in familiar territory

- Intermediate (51-200 miles): Moderate increase, typically 15-25% above local rates

- Long-haul (200+ miles): Highest rates, may require interstate authority and higher federal minimums

Annual Mileage: A truck running 30,000 miles annually will cost less to insure than one logging 80,000 miles. More road exposure equals higher accident probability.

Vehicle Value and Equipment: A $45,000 used flatbed with basic equipment costs far less to insure than a $175,000 heavy-duty rotator with computerized hydraulics. Similar to how commercial dump truck insurance premiums scale with truck value and payload capacity, towing insurance adjusts for equipment sophistication and replacement cost.

💡 Expert Tip: Installing telematics devices (GPS tracking, dash cameras, speed monitoring) can reduce your premiums by 10-20% through most carriers’ safety programs. These devices also provide critical evidence in disputed liability claims, protecting your business from fraudulent damage allegations.

Hidden Cost Factors Most Operators Overlook

Claims History (Loss Ratio): Insurance underwriters calculate your “loss ratio”, total claims paid divided by total premiums collected. If you’ve paid $40,000 in premiums over 3 years but filed $60,000 in claims, you have a 150% loss ratio. Anything above 70-80% triggers significant rate increases at renewal.

Storage Facility Risk: If you maintain an impound lot, underwriters assess:

- Perimeter security (fencing, gates, lighting)

- Fire protection (hydrants, sprinkler systems)

- Vehicle density (too many cars in confined space increases total exposure)

- Location (high-crime neighborhoods pay more)

Contracts and Certifications: Towing operators with municipal contracts, AAA certifications, or insurance company partnerships often access preferred rates because these contracts indicate established business stability and training standards.

Deductible Selection: Choosing a $5,000 deductible versus $1,000 can reduce premiums by 15-25%. However, ensure you maintain adequate cash reserves to cover multiple deductibles if you experience several claims in one year.

Seasonal and Short-Term Coverage Considerations

Some towing operations experience seasonal fluctuations, snow removal contracts in winter, motorcycle towing surges in summer. If you need to temporarily add capacity:

Temporary commercial vehicle insurance or one week truck insurance options exist for short-term truck additions, though they’re more expensive on a per-day basis than annual policies. If you’re leasing a wrecker for a 2-month municipal contract, expect to pay 15-20% of the annual premium for that coverage period.

For operators financing equipment through lenders like Santander auto insurance, maintaining continuous coverage is mandatory, policy lapses can trigger loan acceleration clauses or forced-placed coverage at 2-3x normal rates.

Federal & State Filing Requirements

Federal Motor Carrier Safety Administration (FMCSA) Compliance

Any towing operation conducting interstate commerce, even if you only occasionally cross state lines, must comply with FMCSA regulations. This means navigating a complex web of federal filings that can result in operating authority suspension if mismanaged.

USDOT Number Registration: Every commercial towing operation must obtain a US Department of Transportation (USDOT) number if they:

- Ensure that the vehicle does not carry a load exceeding the permitted weight (greater than or equal to 10,001 pounds)

- Transport vehicles across state lines for compensation

- Transport hazardous materials requiring placarding

Apply through the FMCSA’s Unified Registration System (URS). The USDOT number must be displayed on both sides of your commercial vehicles.

Motor Carrier (MC) Number: If you engage in for-hire interstate transportation, you also need an MC number (operating authority). This distinguishes you as a property carrier authorized to transport goods (including towed vehicles) across state lines for compensation.

MCS-90 Endorsement: This is the federal financial responsibility endorsement that must be attached to your insurance policy. The MCS-90 guarantees that your insurer will pay up to the federal minimum ($750,000 for non-hazmat property carriers) even if your policy excludes coverage for a particular incident. The endorsement protects the public, not your business.

BMC-91X Form (Proof of Insurance Filing): Your insurance carrier must file Form BMC-91X with the FMCSA to prove you maintain the required minimum insurance. This filing electronically updates your FMCSA operating authority to show “Active” insurance status. Without this filing, your authority is suspended within 45 days, making it illegal to operate interstate.

💡 Expert Tip: Many towing operators purchase insurance but never verify their carrier filed the BMC-91X. Always check your FMCSA profile at safer.fmcsa.dot.gov to confirm your insurance is showing as “Active.” Operating with suspended authority due to missing filings can result in $16,000+ federal penalties per violation.

MCS-150 Biennial Update Requirement

Every two years, you must update your company’s information through the MCS-150 form, including:

- Changes in mileage

- Vehicle fleet size

- Types of cargo transported

- Operational changes

Failure to file results in automatic authority deactivation. The FMCSA sends reminder notices, but it’s your responsibility to comply. Mark your calendar for your update month (visible on your USDOT profile).

State-Specific Requirements and Variations

While federal regulations establish baselines, states layer additional requirements that vary significantly:

Bond and Permit Requirements: Many states require towing operators to post surety bonds ranging from $5,000 to $50,000 as consumer protection. California, for instance, requires Vehicle Tow and Storage Liens bonds. These aren’t insurance policies but financial guarantees you’ll operate ethically.

State Minimum Liability Levels: Some states mandate higher minimums than federal requirements. Always carry the higher of federal or state minimums to avoid compliance gaps.

Garage Liability Mandates: States like Texas and Florida require minimum Garagekeepers coverage for any business storing customer vehicles. Limits vary from $50,000 to $500,000 depending on facility size.

Regional Examples:

In areas where insurance costs vary widely, similar to how park city car insurance rates reflect local claim costs and demographics, towing operators must adapt coverage to regional hazards. Virginia, for instance, requires specific language in towing contracts and mandates hourly storage rates, which impacts your Garagekeepers exposure assessment.

Non-Trucking Liability (NTL) Considerations

If you operate under a motor carrier’s authority but occasionally use your tow truck for personal errands or bobtail back to your facility without a towed vehicle, you need Non-Trucking Liability coverage. This fills coverage gaps when you’re operating outside of your for-hire capacity.

Many operators overlook this, assuming their commercial policy covers all driving. However, standard towing policies exclude coverage when you’re not operating “in the business of towing.” A $500-$1,200 annual NTL policy prevents devastating coverage denials.

Comparing Commercial Vehicle Risks Across Industries

Towing vs. Other Commercial Transportation Risks

Towing vs. Dump Truck Operations: While both involve heavy vehicles and require substantial liability coverage, commercial dump truck insurance primarily focuses on cargo spillage, overloading, and construction zone accidents. Dump trucks transport owned cargo (gravel, demolition debris), so cargo liability is straightforward.

Towing, by contrast, involves transporting customer property, creating bailment liability, you’re legally responsible for property entrusted to your care. This fundamental difference is why On-Hook coverage exists as a distinct product. A dump truck operator doesn’t need equivalent protection because they’re not responsible for the $80,000 vehicle they’re hauling.

Unique Towing Exposures:

- Roadside Work Zone Hazards: Tow truck drivers work in active traffic lanes, increasing struck-by-vehicle risks exponentially compared to delivery drivers who park in designated areas.

- Customer Property Liability: Beyond the vehicle itself, towed cars often contain personal property, laptops, jewelry, firearms. Disputes over missing items require careful documentation and can trigger theft allegations.

- Subrogation Warfare: When you tow an accident-damaged vehicle, multiple insurance companies often pursue subrogation against your On-Hook coverage, claiming your hookup procedures worsened existing damage. This creates prolonged legal battles unique to towing.

Short-Term and Flexible Coverage Needs

Scaling Operations Up or Down:

Seasonal demand fluctuations challenge towing businesses. Winter storm contracts may require doubling your fleet temporarily, while summer months see reduced call volume in northern climates. Traditional annual policies don’t accommodate this flexibility efficiently.

Options include:

Temporary Additions: Adding a leased or borrowed wrecker to your existing policy for 30-90 days. Expect pro-rated premiums plus administrative fees.

Power Unit Only Policies: If you’re borrowing a truck but operating under your authority, you can obtain coverage that follows your drivers rather than specific vehicles.

Short-Term Certificates: For one-time special events (county fair contracts, marathon support), some carriers offer temporary commercial vehicle insurance for 1-7 days, though premiums are disproportionately expensive compared to annual coverage.

If you’re renting or borrowing equipment for a weekend recovery operation, one week truck insurance might cost $800-$1,500 depending on truck value and operation type, compare this to $11,000 annually ($212/week equivalent) for year-round coverage to understand the premium loading.

How to Get the Best Rates on Towing Insurance Companies Policies

The Strategic Advantage of Specialized Brokers

Purchasing insurance for towing companies through a generalist agent who primarily sells personal auto and homeowners policies is a recipe for inadequate coverage and inflated premiums. Towing is a specialty risk requiring carriers who understand the industry’s unique exposures.

Working with Tow Truck Insurance Brokers:

Specialized tow truck insurance brokers or those focusing on brokers towing niches maintain relationships with the 15-20 carriers nationwide that actively write towing business. These brokers understand:

- Which carriers accept heavy-duty recovery operations

- How to structure On-Hook and Garagekeepers for optimal protection

- Federal filing processes and FMCSA compliance

- State-specific nuances that impact coverage adequacy

A specialized broker can typically present 4-6 competitive quotes versus a generalist agent who might access only 1-2 carriers willing to write towing.

Questions to Ask Potential Brokers:

- “What percentage of your book is commercial trucking and towing?”

- “Which carriers do you represent that specialize in towing operations?”

- “How do you handle BMC-91X federal filings?”

- “Can you provide references from other towing operators?”

💡 Expert Tip: Avoid brokers who quote you over the phone without thoroughly reviewing your operation. Reputable brokers will request driver MVRs, vehicle specifications, loss history, and operational details before providing quotes. Quick quotes typically mean inadequate coverage or inflated premiums to compensate for unknown risks.

Bundling Strategies and Multi-Policy Discounts

Package Policies: Most carriers offer 10-20% discounts when you bundle:

- Commercial auto (primary liability + physical damage)

- On-Hook coverage

- Garagekeepers Legal Liability

- General Liability

- Workers’ Compensation (if the carrier writes WC)

This bundling also simplifies administration, one renewal date, one carrier contact for all claims, streamlined certificate requests.

Business and Personal Lines Bundling: Some carriers offer additional discounts (5-10%) if you place your personal auto, homeowners, and umbrella policies with them alongside your commercial coverage. While it seems minor, on a $30,000 annual commercial premium, that’s $1,500-$3,000 in savings.

Safety Programs and Loss Control Measures

Telematics and Driver Monitoring: Carriers increasingly offer significant discounts (15-25%) for installing telematics systems that monitor:

- Hard braking and rapid acceleration

- Speeding and excessive idling

- Hours of service compliance (for interstate operators)

- Dash camera footage for exoneration claims

Platforms like Samsara, Geotab, or Verizon Connect integrate with insurance programs, providing real-time driver coaching and incident documentation.

Formal Safety Management Systems: Implementing written safety policies demonstrates risk management commitment:

- Pre-trip vehicle inspection protocols

- Driver training and certification programs

- Incident investigation procedures

- Drug and alcohol testing policies (DOT-compliant for CDL drivers)

Carriers may audit these programs and offer 5-15% discounts for comprehensive safety cultures.

Driver Qualification Files: Maintaining complete DQ files for every driver, including MVR reviews, road tests, medical certificates, isn’t just federal compliance; it’s a negotiating tool. Demonstrating meticulous driver vetting can persuade underwriters to waive surcharges for newer operations.

Strategic Deductible Management

Balancing Retention and Premium: Every $1,000 increase in deductible typically reduces premiums by 3-5%. However, consider your claim frequency:

- Low-frequency operations (1-2 small claims every 3-4 years): Maximize deductibles to $5,000+ and pocket the premium savings.

- Higher-frequency operations (multiple minor claims annually): Moderate deductibles of $2,500 prevent cash flow strain from frequent out-of-pocket payments.

Per-Occurrence vs. Aggregate Deductibles: Some carriers offer aggregate deductible structures where your total annual deductible obligation is capped. For example, a $2,500 per-occurrence deductible with a $10,000 annual aggregate means after you’ve paid $10,000 in deductibles for the year, subsequent claims have no deductible. This benefits high-claim-frequency operations.

Payment Plans and Cash Flow Optimization

Monthly vs. Annual Payment: Paying annually typically saves 5-8% in financing fees. However, for new operators or those managing tight cash flow, monthly EFT (Electronic Funds Transfer) plans preserve working capital.

Audit Policies: Some coverages like Workers’ Compensation use audit-based premiums, you pay an estimated premium, then the carrier audits actual payroll at year-end and adjusts. Understanding this prevents cash flow surprises during audit season.

Towing Insurance FAQs

What is towing insurance?

Towing insurance refers to the specialized commercial coverage package protecting towing businesses from liabilities unique to vehicle recovery and storage operations. Unlike standard commercial auto insurance, towing business insurance includes On-Hook coverage (protecting vehicles being towed), Garagekeepers Legal Liability (covering stored customer vehicles), and enhanced liability limits meeting federal FMCSA requirements. It combines commercial auto liability, cargo protection, premises liability, and often Physical Damage coverage for the tow trucks themselves, creating comprehensive protection against the industry’s distinctive exposures from roadside hookup through impound storage.

Does Progressive cover towing?

Progressive Commercial offers towing coverage as part of their commercial auto insurance products, though availability varies by state and operation type. They provide standard commercial auto liability, Physical Damage coverage for tow trucks, and can add On-Hook and Garagekeepers endorsements. However, Progressive may not write heavy-duty recovery operations or businesses with adverse loss history. For the most comprehensive options, towing operators should compare Progressive against specialty carriers like Great American, Philadelphia Insurance, or CoverWallet that focus specifically on towing risks. Always verify your quote includes both On-Hook coverage and Garagekeepers, as these aren’t automatically included in standard commercial auto policies.

How much is tow truck insurance?

Tow truck insurance costs vary widely based on operation scale and risk profile. Light-duty operators (Class 1-3 wreckers) with one truck typically pay $8,000-$15,000 annually for full coverage including $1 million liability, $100,000 On-Hook, and Physical Damage. Medium-duty operations (2-3 trucks) average $18,000-$35,000 yearly, while heavy-duty recovery operations can exceed $25,000-$45,000 per truck due to increased cargo values and liability exposure. Driver experience, loss history, geographic location, and radius of operation significantly impact final premiums. New operators or those with recent claims may face 50-100% surcharges, while established businesses with clean safety records access preferred rates.

How much is towing insurance per month?

Monthly towing insurance premiums typically range from $650-$1,250 for single light-duty trucks when paid through installment plans, though this includes 5-8% financing fees compared to annual pay plans. Medium-duty operations average $1,500-$2,900 monthly for 2-3 trucks, while heavy-duty recovery operations can exceed $2,000-$3,750 per truck monthly. These figures assume comprehensive coverage including liability, On-Hook, Physical Damage, and Garagekeepers. Monthly payment plans provide cash flow flexibility but cost more over the policy term, a $12,000 annual premium becomes $12,720 when financed monthly ($1,060 per month). Established operators with strong credit often access better financing terms reducing this premium loading.

How to get towing contracts with insurance companies?

Securing towing contracts with insurance companies requires meeting specific qualification standards and proactive business development. First, obtain proper licensing (USDOT number if interstate), maintain minimum $1 million liability coverage, and secure Garagekeepers insurance for storage operations. Join industry associations like the Towing and Recovery Association of America (TRAA) which insurance companies use to vet qualified operators. Contact insurance company fleet management departments directly, requesting inclusion in their approved vendor networks, major carriers like State Farm, Geico, and Progressive maintain preferred provider lists. Expect credential verification including insurance certificates, driver qualification reviews, and facility inspections. Provide 24/7 availability, competitive rates, and professional service to maintain these lucrative contracts. Many operators also network through tow truck insurance brokers who maintain insurance company relationships and can facilitate introductions to fleet managers.

Do insurance companies cover towing fees?

Whether insurance companies cover towing fees depends on the policy type and circumstances. In auto insurance policies, towing is typically covered under Roadside Assistance or Emergency Road Service endorsements, these pay $50-$100 per disablement toward towing costs, though you can usually add higher limits. Comprehensive coverage may also pay for towing if your vehicle is damaged by a covered peril like theft recovery or collision. However, these coverages are optional, not all policies include them. When someone causes an accident affecting your vehicle, their liability coverage should pay your towing costs as part of property damage liability. For towing businesses, On-Hook coverage protects vehicles you’re towing, while the customer’s insurance (or the at-fault party’s insurance) typically pays your towing service fees. Always document towing charges clearly and provide itemized invoices to facilitate insurance reimbursement.

What does towing insurance cover (On-Hook vs Garagekeepers)?

On-Hook coverage and Garagekeepers Legal Liability serve distinct purposes in commercial towing insurance. On-Hook protects customer vehicles while attached to your tow truck or being transported, covering damage from drops during loading, improper hookup causing transmission damage, or cargo shifting during transport. It applies from the moment you hook the vehicle until you disconnect it at the destination. Coverage limits typically range $50,000-$250,000 per vehicle. Garagekeepers, conversely, covers customer vehicles while stored at your impound lot or facility, protecting against fire, theft, vandalism, or accidental damage by your employees while parked. It applies after you’ve unhooked the vehicle through the time the customer retrieves it. Garagekeepers policies come in three forms: Legal Liability Only (you’re at fault), Direct Primary (covers regardless of fault), and Direct Excess (combines both). You need both coverages because the liability transition happens the moment you disconnect, On-Hook ends, Garagekeepers begins.

Who pays for towing a truck after an accident?

Towing payment responsibility after an accident depends on fault determination and insurance coverage structures. If another driver caused the accident, their property damage liability insurance pays for towing your vehicle to a repair facility, this is part of their legal obligation to make you whole. If you caused the accident, your collision coverage (if you carry it) pays for towing minus your deductible. Without collision coverage, you pay out-of-pocket. When fault is disputed or the at-fault party is uninsured, your uninsured motorist property damage coverage or collision coverage may pay initially, then your insurer pursues subrogation against the responsible party. Law enforcement-initiated tows (DUI, expired registration, accident scene clearing) are typically the vehicle owner’s responsibility regardless of fault. For commercial trucks, fleet insurance policies often include towing and labor coverage automatically. Always retain towing receipts and invoices, these become evidence in insurance claims. If disputes arise over excessive towing charges, a car insurance lawyer can help negotiate reasonable settlements or pursue bad faith claims against insurers wrongfully denying coverage.

Conclusion: Building a Sustainable Risk Management Strategy

Operating a towing business without comprehensive insurance coverage is professional recklessness, the financial exposure from a single catastrophic claim can erase years of profits and potentially force business closure. The specialized nature of towing risks, combining commercial vehicle operation, cargo liability, and storage responsibilities, demands equally specialized insurance solutions.

Key Action Steps:

- Never operate without On-Hook coverage, assuming your primary liability covers towed vehicles is the most common and expensive mistake in the industry.

- Work exclusively with specialized brokers, generalist agents lack access to towing-specific carriers and underwriting expertise for proper coverage structuring.

- Maintain rigorous federal compliance, verify your BMC-91X filing shows active insurance status and keep MCS-150 updates current to avoid operating authority suspension.

- Invest in safety infrastructure, telematics, dash cameras, and formal driver training programs aren’t costs; they’re premium reduction tools that pay for themselves through decreased claims and insurance discounts.

- Review coverage annually, as your operation scales, equipment values increase, or you add services (heavy-duty recovery, hazmat), your insurance must evolve proportionally.

The towing industry’s trajectory toward increased professionalization and regulatory scrutiny means adequate insurance transitions from optional protection to mandatory business infrastructure. Whether you’re launching a single-truck operation or managing a regional fleet, understanding the interaction between On-Hook, Garagekeepers, federal filings, and liability structures protects both your assets and your reputation in an industry where one mistake can define, or destroy, a business.

For businesses handling diverse assets beyond vehicles, similar to how used car insurance protections must address vehicle history uncertainties, comprehensive towing coverage addresses the unpredictable nature of roadside recovery and storage operations. Partner with knowledgeable brokers, maintain obsessive documentation habits, and view insurance not as an expense but as the foundation enabling sustainable growth in this high-risk, high-reward industry.

⚠️ Important Disclaimer: This article is for educational purposes only and should not be construed as legal, tax, or financial advice. Insurance regulations and tax laws are subject to change. Please consult with a licensed insurance agent, CPA, or Tax Attorney regarding your specific situation before making coverage decisions.

References

- Federal Motor Carrier Safety Administration (FMCSA) – USDOT registration, operating authority requirements, and MCS-90 endorsement information

- National Association of Insurance Commissioners (NAIC) – Commercial auto insurance state requirements and regulatory frameworks

- Towing and Recovery Association of America (TRAA) – Industry best practices, safety standards, and professional certifications

- Insurance Information Institute (III) -2025 Commercial Vehicle Insurance Fact Book – Premium trend analysis and coverage statistics

- American Trucking Associations Foundation – Commercial vehicle insurance requirements and industry research

- Code of Federal Regulations Title 49 – Transportation regulations including insurance minimum requirements for property carriers

- National Highway Traffic Safety Administration (NHTSA) – Towing safety data and roadside work zone hazard statistics