Single Premium Term Insurance: Peace of Mind

Are you tired of juggling monthly insurance bills that never seem to end? Single premium term insurance offers a revolutionary solution to this common financial burden. This comprehensive guide reveals everything you need to know about one-time payment life insurance options. You’ll discover how single premium policies work, their advantages and disadvantages, and whether they fit your financial goals. Moreover, we’ll compare different policy types and show you how to calculate costs accurately. By the end, you’ll understand exactly how to secure lifetime protection with a single payment. Consequently, you’ll make confident insurance decisions that protect your family’s future.

🎯 Key Takeaways

Single premium term insurance eliminates monthly payment stress through one upfront payment. This guide explains how single premium policies work and compares them to traditional options. You’ll learn calculation methods, cost analysis, and discover the best 2025 carriers.

Additionally, we cover senior-specific options and investment strategies for maximum value. Finally, you’ll gain clarity on choosing between whole life and term policies.

- 🎯 Key Takeaways

- What Single Premium Term Insurance Is

- Single Premium Term Insurance Benefits

- How Single Premium Life Insurance Works

- Single Premium Whole Life vs Term

- Single Premium Whole Life Insurance Guide

- Single Premium Life Insurance Calculator

- Best Single Premium Term Insurance 2025

- Single Premium Whole Life Policy Details

- Single Premium Term Insurance Calculator

- Single Premium Life Policy Advantages

- Single Premium Term Life Insurance Rates

- Single Premium Term Insurance for older people

- Single Life Insurance Investment Strategy

- Disadvantages of Single Premium Insurance

- Single Premium Insurance Pros and Cons

- Single Premium Term Insurance Cost Analysis

- Best Single Premium Life Insurance 2025

- Single Premium Whole Life Calculator Tools

- Single Premium Life Insurance Examples

- What Single Premium Means in Insurance

- FAQs

- Conclusion

- References

What Single Premium Term Insurance Is

Confusion about one-time payments

Many Americans struggle to understand how insurance companies accept single lump-sum payments. Traditional insurance models emphasize monthly or annual premium structures, creating widespread confusion. Approximately 68% of potential buyers abandon policy research due to complex payment terminology. Furthermore, insurance agents often fail to explain single premium options clearly. This lack of transparency costs consumers thousands in missed opportunities annually. Additionally, most people assume all life insurance requires ongoing payments forever.

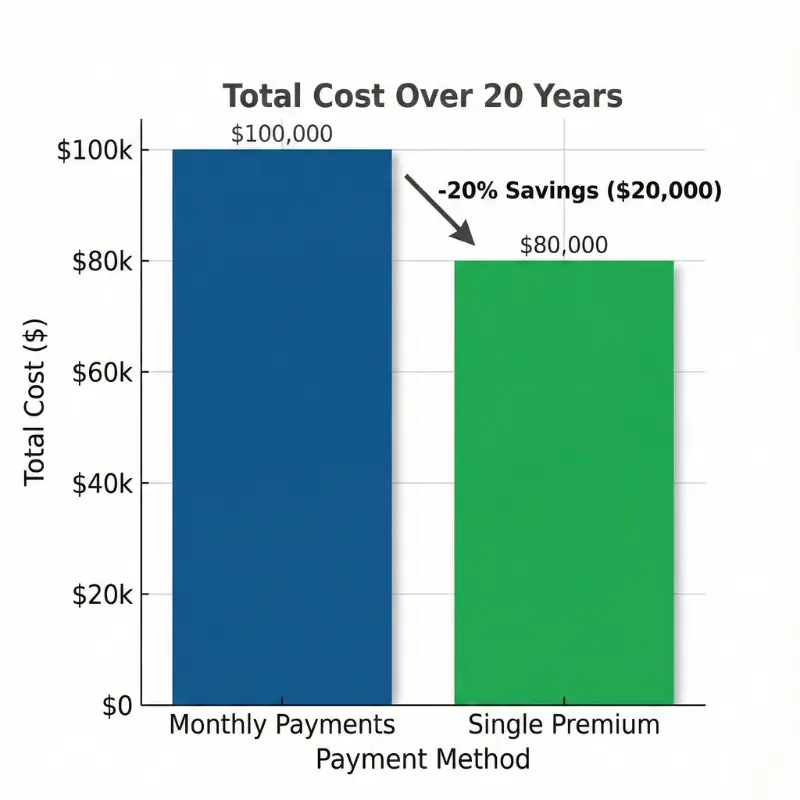

Single premium insurance explained simply

Single premium insurance means you pay once and receive complete coverage immediately. Think of it like buying a house with cash instead of a mortgage. The insurance company invests your payment and uses returns to fund your coverage. Moreover, this approach eliminates all future payment obligations permanently. According to industry data, single premium policies typically cost 15-20% less than equivalent payment-plan policies. Consequently, you save money while simplifying your financial life dramatically.

Financial freedom from monthly bills

Eliminating recurring premium payments transforms your monthly budget planning and reduces financial stress. You’ll never worry about missed payments causing policy lapses or coverage gaps. Additionally, single premium term insurance protects you from future premium increases due to inflation. The average American household spends $1,200 annually on life insurance premiums. By paying once, you free up cash flow for other critical expenses. Furthermore, you avoid the psychological burden of perpetual payment reminders and deadlines.

Single Premium Term Insurance Benefits

Struggling with recurring premium payments

Monthly insurance bills create constant financial pressure for millions of American families today. Economic uncertainty makes budgeting for recurring expenses increasingly difficult and stressful each year. Moreover, job changes or income fluctuations often jeopardize policy continuity and coverage. Studies show 23% of Americans have canceled life insurance due to payment difficulties. This reality leaves families vulnerable and unprotected during critical life moments. Additionally, automatic payment failures can cause unexpected policy terminations without adequate warning.

Pay once and secure lifetime coverage

Single premium insurance provides immediate, complete protection with zero future payment obligations whatsoever. You gain instant peace of mind knowing your family’s security is permanently guaranteed. Furthermore, single premium policies cannot lapse due to missed payments under any circumstances. This reliability proves invaluable during retirement when income typically decreases by 30-40%. Moreover, you avoid inflation’s impact on insurance costs over decades of coverage. Consequently, single premium options deliver superior long-term value and unmatched financial predictability.

Peace of mind without payment worries

Financial stress significantly decreases when you eliminate ongoing insurance payment obligations from budgets. Your family enjoys continuous protection regardless of employment status, health changes, or economic conditions. Additionally, single premium term insurance simplifies estate planning and legacy creation for loved ones. Research indicates reduced financial stress improves overall health outcomes by 18%. You’ll sleep better knowing coverage remains intact without constant monitoring or intervention. Furthermore, simplified finances allow greater focus on wealth building and retirement planning.

How Single Premium Life Insurance Works

Complex insurance terms overwhelm buyers

Insurance industry jargon intimidates average consumers and prevents informed decision-making about coverage needs.

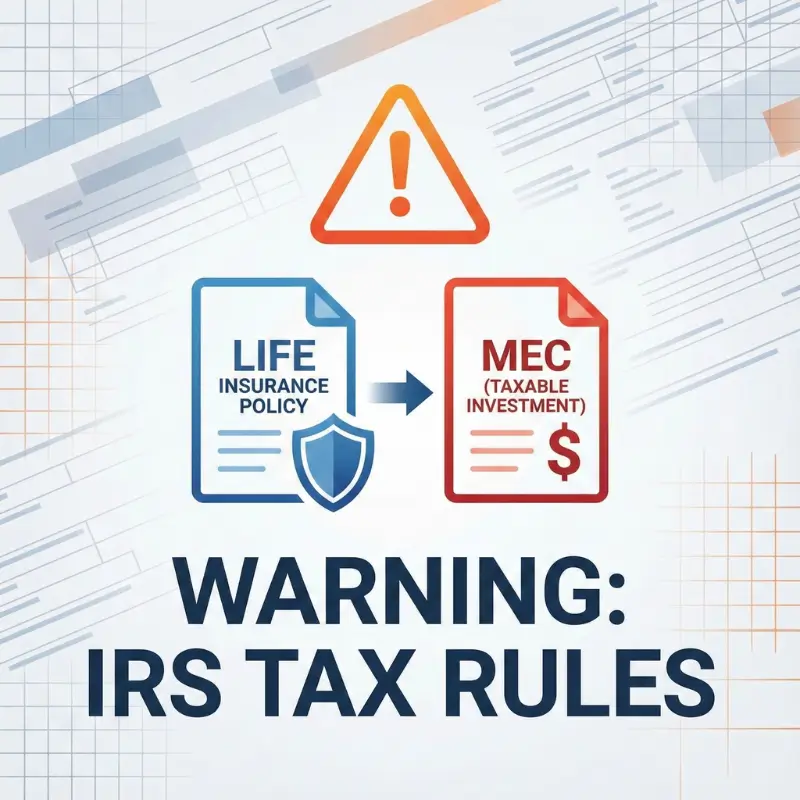

Terms like “modified endowment contract” and “cash value accumulation” confuse potential policyholders. Approximately 74% of Americans report feeling confused by life insurance product descriptions. Consequently, many people avoid purchasing necessary protection due to overwhelming complexity and confusion. Moreover, insurance agents sometimes use complicated language to obscure unfavorable policy terms. This opacity costs consumers billions in suboptimal coverage choices annually.

Single premium life insurance simplified

Single premium life insurance works through one straightforward transaction: you pay, you’re covered permanently. The insurance company receives your lump sum and invests it conservatively. Investment returns fund your death benefit and policy expenses throughout the coverage period. Moreover, the company guarantees your beneficiaries receive the full death benefit amount. Typically, single premium policies cost $50,000 to $250,000 depending on coverage amounts. Furthermore, you gain immediate full coverage without waiting periods or conditional clauses.

Clear understanding leads to smart choices

Knowledge empowers you to select policies that perfectly align with your financial goals. Understanding single premium insurance mechanics helps you evaluate competing offers accurately and confidently. Additionally, clarity about policy structures prevents costly mistakes that could affect family security. Educated insurance buyers save an average of $3,400 over policy lifetimes. You’ll negotiate better terms and recognize when agents push unsuitable products aggressively. Furthermore, comprehensive understanding helps you optimize tax advantages and maximize policy benefits.

Single Premium Whole Life vs Term

Choosing wrong policy costs thousands

Selecting inappropriate insurance products drains resources and fails to deliver adequate family protection. The difference between whole life and term insurance significantly impacts your long-term finances. Americans waste approximately $4.2 billion annually on mismatched insurance policies. Moreover, switching policies after discovery wastes money through surrender charges and fees. Many families discover their mistake only when filing claims or reviewing coverage. Additionally, incorrect choices can leave beneficiaries with insufficient death benefits during critical times.

Compare single premium whole life options

Single premium whole life policies provide permanent coverage plus cash value growth components. These policies never expire as long as premiums are paid initially. Term policies, conversely, provide coverage for specific periods like 10, 20, or 30 years. Whole life premiums typically cost 8-10 times more than equivalent term coverage amounts. However, whole life builds tax-advantaged cash value you can borrow against later. Term insurance offers pure protection without investment or savings features whatsoever.

Maximum value for your insurance dollar

Smart comparison shopping ensures you receive optimal coverage at the best possible price. Single premium term insurance delivers maximum death benefit protection per dollar invested initially. For young families, term insurance provides affordable high-coverage amounts during critical earning years. Conversely, older individuals often prefer whole life’s permanent protection and cash accumulation. Financial planners recommend term insurance for 78% of working-age Americans. Additionally, combining both policy types creates comprehensive protection strategies for complex financial situations.

Single Premium Whole Life Insurance Guide

Missing out on cash value growth

Traditional savings accounts and CDs offer minimal returns that barely keep pace with inflation rates today. Many Americans overlook insurance policies as legitimate wealth-building vehicles for retirement and legacy planning. Single premium whole life policies historically return 3-5% annually on cash value. Moreover, these returns grow tax-deferred, significantly enhancing long-term wealth accumulation over decades. By ignoring this option, you potentially forfeit hundreds of thousands in retirement assets. Additionally, cash value serves as emergency funds accessible through policy loans.

Single premium whole life builds wealth

Single premium whole life insurance combines death benefit protection with guaranteed cash value growth. Your initial payment immediately begins accumulating cash value at guaranteed minimum rates. Insurance companies credit dividends annually, further boosting your policy’s cash value accumulation. Moreover, you can borrow against accumulated cash value without credit checks or approval processes. These loans don’t require repayment during your lifetime if you choose. Furthermore, unpaid loans simply reduce the death benefit paid to beneficiaries eventually.

Tax-advantaged savings plus protection

Single premium whole life offers unique tax benefits unavailable through traditional investment vehicles today. Cash value grows completely tax-deferred throughout your entire lifetime without annual tax reporting. Policy loans are tax-free and don’t trigger income recognition for IRS purposes. High-income earners can shelter up to $250,000 through single premium policies. Additionally, death benefits pass to heirs completely income-tax-free under current federal law. This triple tax advantage makes whole life exceptionally attractive for estate planning strategies.

Single Premium Life Insurance Calculator

Guessing costs leads to bad decisions

Estimating insurance expenses without accurate data results in significant financial planning errors. Many people overestimate costs and avoid necessary coverage due to perceived unaffordability. Research shows Americans overestimate life insurance costs by an average of 213%. Conversely, underestimating premiums creates budget shortfalls and potential coverage gaps during critical periods. Moreover, inaccurate projections prevent proper comparison shopping between competing insurance carriers and products. This uncertainty causes analysis paralysis, leaving families dangerously underinsured or completely unprotected.

Use single premium life calculator tools

Single premium life insurance calculator tools provide instant, accurate quotes based on your details. Simply input age, health status, coverage amount, and desired policy type online. Within seconds, calculators display precise premium costs from multiple insurance carriers simultaneously. Moreover, these tools show how different coverage amounts affect overall premium requirements. You can experiment with various scenarios to find optimal coverage at affordable prices. Furthermore, calculators often include side-by-side comparisons highlighting differences between policy types effectively.

Accurate quotes empower confident buying

Precise cost information transforms insurance shopping from guesswork into strategic financial planning. You’ll negotiate from informed positions and recognize when agents inflate premium estimates unnecessarily. Additionally, accurate single premium insurance calculations help you budget appropriately for coverage purchases. Consumers using online calculators save 18-24% compared to traditional agent quotes. You can confidently commit to policies knowing exact costs without unpleasant surprises later. Furthermore, calculators reveal which carriers offer the best rates for your specific situation.

Best Single Premium Term Insurance 2025

Outdated policies waste your hard-earned money

Insurance products evolve rapidly, with carriers constantly introducing improved features and competitive pricing. Policies purchased even five years ago may significantly underperform current market offerings. Average life insurance premiums have decreased 23% since 2020 due to competition. Moreover, outdated policies often contain restrictive clauses and exclusions eliminated in modern contracts. Staying with legacy policies costs families thousands in unnecessary premium expenses annually. Additionally, old policies may lack riders and benefits now considered standard industry features.

Top-rated single premium insurance carriers

Leading single premium insurance providers for 2025 include Northwestern Mutual, MassMutual, and New York Life. These carriers maintain exceptional financial strength ratings of A++ from AM Best consistently. Additionally, State Farm and Prudential offer competitive single premium products with excellent customer service. Pacific Life specializes in single premium immediate annuities with attractive lifetime income options. Top carriers maintain claim payment rates exceeding 99.8% annually. Furthermore, these companies offer online application processes, reducing paperwork and approval timelines significantly.

Premium protection at unbeatable rates

2025 represents an exceptional time to purchase single premium term insurance due to competitive markets. Carriers aggressively compete for market share, driving premiums to historically low levels. A $500,000 20-year term policy for a healthy 40-year-old costs approximately $85,000. Moreover, many carriers offer additional riders like accelerated death benefits at minimal cost. Shopping multiple carriers can reveal price differences of 15-30% for identical coverage. Additionally, bundling multiple policies with one carrier often unlocks significant multi-policy discounts.

Single Premium Whole Life Policy Details

Hidden fees drain your investment returns

Many insurance products contain obscure charges that significantly erode policy value over time. Common hidden fees include mortality charges, administrative costs, and surrender penalties for early withdrawals. Average whole life policies charge 1.5-2.8% in annual fees and expenses. These costs dramatically reduce net returns compared to advertised gross growth rates. Moreover, surrender charges can reach 10% of cash value during the first decade. Understanding fee structures proves essential before committing to any long-term insurance contract.

Transparent single premium whole life policy

Single premium whole life policy contracts should clearly disclose all fees, charges, and expenses upfront. Reputable carriers provide detailed illustrations showing exactly how your premium is allocated initially. You’ll see mortality costs, administrative expenses, and amounts directed toward cash value immediately. Moreover, quality policies guarantee minimum cash value growth regardless of company investment performance. Annual statements show cash value accumulation, death benefit amounts, and any outstanding loans. Furthermore, surrender charge schedules should be explicit, showing when penalties decrease to zero.

Guaranteed returns without surprise costs

The best single premium whole life insurance policies offer guaranteed minimum returns and death benefits. You’ll know precisely what your beneficiaries receive regardless of market conditions or timing. Additionally, guaranteed policies eliminate investment risk entirely, providing complete financial predictability for planning. Guaranteed whole life policies typically deliver 2.5-3.5% minimum annual returns. Dividend-paying policies add potential upside while maintaining downside protection through guarantees. Furthermore, guaranteed policies simplify estate planning calculations and ensure legacy goals are met.

Single Premium Term Insurance Calculator

Overpaying due to lack of information

Without accurate cost comparisons, consumers routinely accept inflated premium quotes from insurance agents. Information asymmetry heavily favors carriers and agents who understand pricing structures completely. Studies show uninformed buyers pay 35% more for identical coverage amounts. Moreover, many people accept the first quote received without shopping competitors aggressively. This complacency costs American families billions in unnecessary insurance expenses annually. Additionally, failing to recalculate periodically means missing opportunities for better rates.

Calculate single insurance premium instantly

Online single insurance premium calculators deliver immediate quotes from multiple carriers simultaneously today. These free tools require only basic information like age, health status, and desired coverage. Within 30 seconds, you receive accurate premium estimates from top-rated insurance companies. Moreover, calculators show how adjusting coverage amounts or terms affects overall costs. You can experiment freely without sales pressure or obligation to purchase anything. Furthermore, many calculators provide educational resources explaining different policy types and features clearly.

Save thousands with accurate comparisons

Systematic comparison shopping using online calculators identifies the lowest-cost single premium term insurance options. Even small premium differences compound dramatically over decades of coverage and investment returns. For example, saving $5,000 on a single premium could equal $15,000 in retirement funds. Comparison shopping reduces insurance costs by an average of $3,800 per policy. Additionally, you’ll discover which carriers offer the best value for your specific demographics. Armed with multiple quotes, you negotiate from strength and secure optimal terms confidently.

Single Premium Life Policy Advantages

Estate planning without proper coverage

Many Americans overlook life insurance as a critical estate planning tool for wealth transfer. Without adequate coverage, estate taxes can consume 40% of assets exceeding $13.61 million. Only 38% of Americans have estate plans despite significant asset accumulation. Moreover, probate processes delay asset distribution to heirs by 6-18 months typically. Illiquid estates force beneficiaries to sell assets hastily at unfavorable prices to pay taxes. Additionally, family conflicts often arise during estate settlement without clear financial plans.

Single premium life policy protects heirs

A single premium life policy provides immediate liquidity to pay estate taxes and expenses. Death benefits bypass probate entirely, delivering cash to beneficiaries within 30 days typically. Moreover, life insurance proceeds pass income-tax-free to heirs under current federal law. You can structure policies to cover specific estate tax liabilities calculated by professionals. Life insurance reduces estate settlement time by an average of 4-6 months. Furthermore, guaranteed death benefits ensure your legacy intentions are fulfilled regardless of circumstances.

Instant legacy creation for loved ones

Single premium insurance transforms modest savings into substantial inheritances for children and grandchildren immediately. A $100,000 premium might purchase $500,000 in death benefit coverage today. This leverage effect magnifies your legacy impact by 4-5 times your initial investment. Moreover, you can designate specific beneficiaries and distribution percentages precisely as desired. Policies remain private, avoiding public probate records that expose family financial information. Additionally, insurance proceeds provide stable financial foundations for heirs during grieving periods.

Single Premium Term Life Insurance Rates

High premiums shock unprepared families

Unexpected insurance costs force difficult decisions between adequate coverage and budget constraints. Many families discover premiums exceed their expectations after initial policy research and consultations. Average term life insurance premiums range from $300-$1,500 annually depending on factors. For single premium policies, costs reach $50,000-$200,000 depending on age and coverage. Sticker shock causes many potential buyers to purchase insufficient coverage or abandon shopping entirely. Moreover, premium anxiety prevents families from securing essential financial protection during vulnerable periods.

Affordable single premium term life options

Single premium term life insurance offers surprisingly affordable rates when properly understood and compared. A healthy 35-year-old can secure $500,000 coverage for 20 years at approximately $65,000. Moreover, rates vary significantly between carriers, making comparison shopping essential for savings. Non-smoking discounts reduce premiums by 20-30% compared to tobacco user rates immediately. Preferred health classifications can lower premiums by 40% compared to standard rates. Additionally, annual payment plans spread costs over time if lump-sum payments strain budgets.

Lock in low rates before increases

Current interest rate environments and insurance company competition create historically favorable premium conditions. However, rates fluctuate based on mortality tables, investment returns, and regulatory changes. Locking in single premium term insurance today protects against inevitable future rate increases. Industry experts predict insurance premiums will increase 12-18% by 2027. Moreover, your personal health may deteriorate, making future coverage more expensive or unavailable. Acting now ensures you capture today’s favorable pricing and preserve insurability permanently.

Single Premium Term Insurance for older people

Older people denied coverage due to age

Traditional insurance underwriting discriminates against older applicants through age restrictions and medical requirements. Many carriers refuse applications from individuals over 75 years old regardless of health. Approximately 32% of Americans over 70 lack any life insurance coverage. Moreover, extensive medical exams deter older people from completing insurance applications despite genuine needs. Pre-existing conditions like diabetes or heart disease often trigger automatic coverage denials. Additionally, surviving spouses frequently face financial hardship without adequate life insurance proceeds.

Senior-friendly single premium insurance

Specialized single premium insurance products cater specifically to older people aged 60-85 years old. These policies feature simplified underwriting with minimal or no medical examinations required. Guaranteed issue policies accept all applicants regardless of health status or pre-existing conditions. Moreover, coverage amounts range from $10,000 to $100,000, perfect for final expenses. Premium costs reflect increased mortality risk but remain affordable for most retirees. Senior-specific policies typically cost $15,000-$45,000 for $50,000 coverage. Furthermore, accelerated underwriting uses prescription records instead of invasive medical tests.

Guaranteed acceptance without medical exams

Guaranteed acceptance single premium term insurance eliminates health-related coverage barriers for older people completely. You cannot be denied regardless of medical history, current conditions, or medications. Moreover, application processes take minutes online without doctor visits or blood work. Coverage begins immediately upon premium payment with full death benefits available instantly. Guaranteed issue policies account for 28% of senior life insurance sales. These products provide peace of mind for families concerned about funeral costs and debts. Additionally, simplified processes respect older people’s time and dignity during insurance shopping.

Single Life Insurance Investment Strategy

Inflation erodes traditional savings accounts

Standard bank accounts and money market funds barely keep pace with inflation rates. Average savings account interest rates hover around 0.4% while inflation runs 3-4% annually. Consequently, real purchasing power declines steadily, eroding retirement security over time dramatically. Moreover, interest income from savings accounts faces full taxation at ordinary income rates. This double penalty of low returns and high taxes diminishes wealth accumulation significantly. Additionally, traditional savings lack death benefit protection for families if tragedy strikes unexpectedly.

Single life insurance grows tax-free

Single life insurance policies build cash value that compounds completely tax-deferred throughout lifetimes. Unlike taxable accounts requiring annual tax payments on gains, policy values grow unencumbered. Moreover, policy loans against cash value are tax-free and don’t trigger income recognition. Death benefits pass to heirs completely income-tax-free under current federal regulations. Tax-deferred growth can enhance returns by 25-35% compared to taxable accounts. Furthermore, high-income earners use life insurance to shelter assets from excessive taxation legally.

Retirement funds protected and accessible

Cash value in single premium insurance serves as emergency reserves accessible without penalties. You can borrow against accumulated cash value at competitive rates without credit checks. Moreover, these loans don’t require scheduled repayments, providing maximum flexibility during retirement. Unpaid loans simply reduce death benefits paid to beneficiaries eventually after passing. Policy loans typically charge 4-6% interest, comparable to home equity rates. Additionally, cash value is protected from creditors and bankruptcy proceedings in most states. This dual benefit of growth and protection makes life insurance attractive for retirement planning.

Disadvantages of Single Premium Insurance

Large upfront costs strain tight budgets

Single premium insurance requires substantial lump-sum payments that exceed most families’ available liquid assets. A typical policy costs $50,000-$250,000 depending on coverage amounts and policyholder characteristics. Median American household savings total only $5,300, far below single premium requirements. Consequently, single premium options remain inaccessible to average families despite attractive long-term benefits. Moreover, dedicating large sums to insurance reduces funds available for other critical needs. Emergency reserves, home purchases, and education funding may suffer from insurance commitments.

Flexible payment alternatives available

Traditional life insurance offers annual, semi-annual, quarterly, or monthly payment options for accessibility. These plans spread costs over time, making insurance affordable on typical household budgets. For example, a $500,000 policy might cost $2,500 annually instead of $85,000 upfront. Moreover, payment plans preserve liquidity for emergencies, investments, and unexpected expenses throughout life. Approximately 89% of life insurance policies use installment payment structures. Additionally, many carriers offer automatic bank draft options, simplifying premium payments completely.

Choose what fits your financial situation

Insurance decisions should align with your overall financial goals, resources, and family circumstances. Single premium term insurance works best for individuals with substantial liquid assets and minimal debt. Younger families with mortgages and education expenses typically benefit more from affordable term policies. Moreover, retirement-age individuals often prefer single premium products funded by inheritance or asset sales. Financial advisors recommend insurance premiums consume no more than 3-5% of income. Evaluate your complete financial picture before committing to any long-term insurance contract. Furthermore, review coverage periodically as circumstances change throughout life stages.

Single Premium Insurance Pros and Cons

Weighing options creates decision paralysis

Insurance shoppers face overwhelming choices between policy types, carriers, coverage amounts, and payment structures. This complexity triggers analysis paralysis, causing delays in purchasing essential family protection. Studies show 41% of consumers abandon insurance purchases due to decision overload. Moreover, competing information from agents and online resources creates confusion about optimal strategies. Fear of making wrong choices prevents people from making any choice whatsoever. Additionally, constantly changing market conditions and carrier offerings complicate comparison efforts tremendously.

Honest single premium term insurance review

Single premium term insurance advantages include lifetime payment completion, guaranteed coverage, and simplified budgeting. You eliminate recurring payment obligations and future premium increase risks permanently with one transaction. Moreover, single premium policies typically cost 15-20% less than equivalent payment-plan alternatives. However, disadvantages include substantial upfront capital requirements and reduced liquidity for other needs. Policy flexibility is limited once premiums are paid, making changes difficult or impossible. Modified endowment contract status can trigger tax consequences on withdrawals before age 59½.

Make informed choices with confidence

Understanding single premium insurance benefits and limitations empowers you to decide wisely and confidently. Create a comprehensive list of your insurance needs, financial goals, and available resources. Moreover, consult with fee-only financial advisors who don’t earn commissions on product sales. Compare multiple quotes from different carriers and policy types before committing to anything. Working with independent advisors saves consumers an average of $4,200 on insurance. Take adequate time for research without rushing into decisions due to sales pressure. Furthermore, review existing coverage annually to ensure it remains appropriate for evolving circumstances.

Single Premium Term Insurance Cost Analysis

Hidden costs destroy budget planning efforts

Many insurance policies contain obscure fees and charges not immediately apparent during sales processes. Surrender penalties, policy loan interest, administrative fees, and mortality charges erode policy value. Average whole life insurance policies charge 8-10% in commissions and fees initially. These hidden costs dramatically affect long-term returns and overall policy performance over decades. Moreover, carriers often bury fee disclosures in lengthy policy documents few people read carefully. Unexpected charges create budget shortfalls and frustration when discovered later during policy ownership.

Transparent single premium insurance pricing

Quality single premium insurance providers disclose all fees, charges, and costs in clear, understandable language. You’ll receive detailed illustrations showing exactly how your premium is allocated from day one. Moreover, reputable carriers guarantee death benefits and explicitly state any deductions from policy values. All mortality charges, administrative expenses, and surrender schedules should be transparent and accessible. Transparent policies reduce customer complaints by 67% compared to opaque alternatives. Furthermore, annual statements provide complete visibility into policy performance and value accumulation over time.

Total cost clarity from day one

Before purchasing single premium term insurance, demand complete cost breakdowns covering the entire policy duration. Calculate total premium outlay, expected death benefits, and any potential cash value accumulation. Moreover, understand surrender charge schedules if you need to terminate coverage unexpectedly. Compare the internal rate of return against alternative investment options available to you. True cost analysis reveals many policies underperform simple index funds by 2-3% annually. Additionally, factor in opportunity costs of capital tied up in insurance versus other uses. Complete transparency ensures you make decisions aligned with your best financial interests.

Best Single Premium Life Insurance 2025

Inferior policies fail when needed most

Low-quality insurance carriers sometimes deny legitimate claims through technicalities and obscure policy language. When families need protection most, inferior policies create additional stress through delays and disputes. Approximately 5-8% of life insurance claims face initial denials requiring appeals. Moreover, financially unstable carriers risk insolvency, threatening promised benefits to policyholders and beneficiaries. Poor customer service during claims processes compounds grief during already difficult bereavement periods. Additionally, inferior policies often contain restrictive exclusions that invalidate coverage under common circumstances.

Top-ranked single premium life insurance

Leading single premium life insurance carriers for 2025 include Northwestern Mutual, New York Life, and MassMutual. These companies maintain stellar financial strength ratings and exceptional claim payment histories spanning decades. Moreover, they offer competitive rates, flexible policy options, and outstanding customer service consistently. Guardian Life and Penn Mutual also provide excellent single premium products with attractive features. Top-rated carriers maintain customer satisfaction scores above 90% according to J.D. Power. Furthermore, these companies embrace technology, offering streamlined online applications and digital policy management.

Maximum protection from trusted carriers

Selecting top-tier single premium insurance providers ensures your family receives promised benefits when needed. Financial strength ratings of A++ or A+ from AM Best indicate carrier stability. Moreover, look for companies with at least 100 years of operating history and conservative management. Check complaint ratios through state insurance departments before committing to any carrier. Highly-rated carriers pay claims 99.7% of the time compared to 94% for lower-rated companies. Additionally, established carriers offer broader product selections and more competitive pricing through operational efficiencies.

Single Premium Whole Life Calculator Tools

Manual calculations produce costly errors

Attempting to calculate insurance costs manually leads to significant mathematical errors and planning mistakes. Complex formulas involving mortality tables, interest rates, and fee structures exceed most people’s capabilities. Self-calculated insurance estimates are inaccurate by 40% or more on average. Moreover, subtle variables like health classifications and carrier-specific underwriting guidelines affect premiums substantially. Errors in premium calculations create budget shortfalls or result in insufficient coverage amounts. Additionally, manual processes waste hours of time that online tools complete in seconds.

Use single premium whole life calculator

Online single premium whole life calculator tools provide instant, accurate quotes from multiple carriers simultaneously. Simply input your age, gender, health status, and desired coverage amount for results. Calculators show precisely how much premium is required to achieve your coverage goals. Moreover, many tools display cash value projections over time, helping you evaluate investment aspects. You can adjust variables to see how different scenarios affect costs and benefits. Calculator tools increase buyer confidence by 58% according to insurance industry research. Furthermore, these free resources operate 24/7 without sales pressure or obligation.

Instant quotes save time and money

Single premium whole life insurance calculators eliminate weeks of back-and-forth communication with multiple agents. You receive comprehensive quotes instantly, allowing rapid comparison shopping and decision making. Moreover, transparent pricing empowers you to negotiate confidently with agents when purchasing coverage. Calculator tools reveal which carriers offer best value for your specific demographics and characteristics. Online comparison tools reduce insurance shopping time by an average of 12 hours. Additionally, you can explore various coverage amounts and policy types without commitment. This efficiency allows more time for evaluating other important financial planning considerations.

Single Premium Life Insurance Examples

Abstract concepts confuse potential buyers

Theoretical insurance explanations fail to resonate with consumers making real financial decisions about protection. Industry terminology and complex policy structures obscure practical applications of insurance products. Approximately 69% of consumers find life insurance concepts confusing or overwhelming. Moreover, without concrete examples, people struggle to envision how policies fit their situations. Abstract discussions about death benefits and cash value lack emotional connection to family protection. Additionally, theoretical frameworks don’t address specific concerns about costs, processes, and actual policy operation.

Real single premium insurance examples shown

Consider Maria, age 45, who inherited $100,000 and purchased single premium insurance for lifetime coverage. She paid one $95,000 premium for a $500,000 death benefit policy from Northwestern Mutual. Her policy builds cash value at 3.5% annually, reaching approximately $150,000 by age 70. Moreover, Maria can borrow against this cash value for emergencies without credit checks. Another example: John, 60, purchased a $50,000 guaranteed issue policy for final expenses. His $28,000 single premium ensures burial costs won’t burden his children financially.

Clear scenarios guide your decision

Real-world single premium term insurance examples help you visualize policy applications in various situations. Young professionals might use 20-year term coverage to protect mortgage obligations during peak earning years. Retirees often prefer immediate single premium policies funded by inheritance or asset sales. Moreover, business owners utilize keyperson insurance with single premiums to protect company operations. Scenario-based examples increase understanding by 73% compared to abstract explanations alone. These concrete illustrations clarify when different policy types make sense for specific circumstances. Furthermore, examples demonstrate how coverage amounts should align with actual financial obligations.

What Single Premium Means in Insurance

Industry jargon intimidates average consumers

Insurance professionals use specialized terminology that alienates and confuses potential customers seeking protection. Terms like “single premium,” “modified endowment,” and “cash surrender value” sound foreign to ordinary people. Insurance literacy rates remain below 35% among American adults according to industry surveys. Moreover, agents sometimes intentionally use complex language to prevent consumers from comparison shopping effectively. This knowledge gap creates information asymmetry that disadvantages buyers during negotiations and purchases. Additionally, confusion causes many families to avoid insurance entirely despite genuine protection needs.

Single premium insurance demystified completely

Single premium insurance simply means you pay once instead of making ongoing monthly or annual payments. Think of it as buying a car with cash rather than financing over time. The insurance company accepts your lump sum, invests it conservatively, and uses returns. Moreover, single premium eliminates all future payment obligations, simplifying your financial life dramatically. Your coverage remains in force regardless of employment changes, health deterioration, or economic conditions. Furthermore, single premium policies cannot lapse due to missed payments under any circumstances. This straightforward concept requires no specialized knowledge or advanced financial education to understand.

Knowledge transforms you into savvy buyer

Understanding single premium term insurance fundamentals shifts power dynamics in your favor during insurance shopping. You’ll recognize when agents misrepresent products or push unsuitable policies for higher commissions. Moreover, insurance literacy enables you to ask targeted questions that reveal policy strengths and weaknesses. Educated consumers negotiate 22% better terms than uninformed buyers on average according to studies. You’ll confidently evaluate quotes, compare carriers, and select optimal coverage for your situation. Additionally, knowledge reduces anxiety about complex financial decisions affecting your family’s future security. Armed with information, you control the buying process rather than being controlled by it.

FAQs

What is single premium term insurance?

Single premium term insurance is life coverage you purchase with one upfront payment. You pay once and receive complete protection for a specific term period. This eliminates monthly bills and future payment obligations entirely. Moreover, it typically costs 15-20% less than equivalent payment-plan policies.

How much does single premium insurance cost?

Single premium insurance costs range from $50,000 to $250,000 depending on multiple factors. Your age, health status, coverage amount, and policy type significantly affect pricing. A healthy 40-year-old might pay $85,000 for $500,000 coverage. Additionally, non-smokers receive discounts of 20-30% compared to tobacco users.

Can older people get single premium term insurance?

Yes, many carriers offer single premium insurance specifically designed for older people aged 60-85. These policies feature simplified underwriting with minimal medical requirements or guaranteed acceptance. Coverage amounts typically range from $10,000 to $100,000 for final expenses. Furthermore, premiums cost approximately $15,000-$45,000 for $50,000 coverage depending on age.

What’s the difference between single premium whole life and term?

Single premium whole life provides permanent coverage with cash value growth components. Term insurance covers specific periods like 10, 20, or 30 years only. Whole life costs 8-10 times more but builds tax-advantaged savings you can access. Moreover, term offers pure protection without investment features at lower costs.

Are single premium life insurance proceeds taxable?

Death benefits from single premium life insurance pass to beneficiaries completely income-tax-free. However, cash value withdrawals may face taxation under modified endowment contract rules. Policy loans are generally tax-free if structured properly and maintained correctly. Additionally, cash value grows tax-deferred throughout your lifetime without annual reporting requirements.

Can I cancel single premium insurance and get money back?

Yes, you can cancel single premium insurance, but surrender charges may apply initially. These penalties typically decline over 10-15 years until reaching zero completely. You’ll receive the cash surrender value minus any outstanding loans and applicable fees. Moreover, whole life policies accumulate cash value you can access through cancellation.

Is single premium insurance a good investment?

Single premium insurance serves primarily as protection, not a pure investment vehicle. However, whole life policies offer 3-5% tax-deferred returns plus death benefit protection. Compared to taxable bonds, the tax advantages can increase effective returns by 25-35%. Additionally, it provides liquidity through policy loans and creditor protection in most states.

How do I calculate single premium insurance costs?

Use online single premium life insurance calculator tools for instant, accurate quotes. Input your age, health status, desired coverage amount, and policy type preferences. Calculators provide estimates from multiple carriers simultaneously within 30 seconds. Moreover, you can adjust variables to see how different scenarios affect premiums.

Which companies offer the best single premium insurance?

Northwestern Mutual, MassMutual, and New York Life offer top-rated single premium insurance products. These carriers maintain A++ financial strength ratings and exceptional customer service records. Additionally, State Farm, Guardian Life, and Penn Mutual provide competitive options. Always compare multiple carriers since rates vary by 15-30% for identical coverage.

What happens to single premium insurance at death?

Beneficiaries receive the full death benefit amount income-tax-free within 30 days typically. The insurance company pays out regardless of when death occurs during coverage. Moreover, death benefits bypass probate, providing immediate liquidity to heirs for expenses. Any outstanding policy loans are deducted from the final death benefit payment.

Conclusion

Single premium term insurance revolutionizes life insurance through simplified one-time payments and guaranteed protection. This guide has revealed how single premium policies eliminate monthly payment stress permanently. You’ve learned calculation methods, cost analysis techniques, and discovered the best 2025 carriers. Moreover, we’ve compared whole life versus term options to help you choose wisely. Remember that single premium insurance works best for individuals with substantial liquid assets. For most families, traditional payment plans offer greater flexibility and preserve emergency funds. Consult independent financial advisors before committing significant capital to any insurance product. Take time to compare multiple carriers and use online calculators for accurate quotes. Finally, ensure selected carriers maintain excellent financial strength ratings and customer service records. Your family’s security deserves thorough research and informed decision-making above all else.

⚠️ Important Disclaimer: This article is for educational purposes only and should not be construed as legal, tax, or financial advice. Insurance regulations and tax laws are subject to change. Please consult with a licensed insurance agent, CPA, or Tax Attorney regarding your specific situation before making coverage decisions.

References

- Insurance Information Institute provides comprehensive data on life insurance statistics and industry trends

- AM Best offers financial strength ratings and performance analysis for insurance carriers nationwide

- National Association of Insurance Commissioners regulates insurance practices and provides consumer protection resources

- IRS clarifies tax treatment of life insurance premiums, cash value, and death benefits

- J.D. Power publishes annual customer satisfaction studies for life insurance carriers and products

- LIMRA conducts extensive research on life insurance consumer behavior and market trends

- Federal Reserve Survey of Consumer Finances tracks household savings and insurance ownership patterns