Jackson national life insurance Secrets

Are you worried about leaving your family financially vulnerable after you’re gone? Many Americans struggle with choosing the right life insurance provider, fearing they’ll select an unreliable company or overpay for inadequate coverage. jackson national life insurance has served millions of policyholders for decades, yet confusion persists about their offerings, ownership changes, and financial stability. This comprehensive guide will reveal everything you need to know about jackson national life insurance, including policy options, company history, recent corporate changes, customer reviews, and product benefits. You’ll discover how to verify policy legitimacy, access customer service, and determine if this insurer matches your family’s protection needs. Furthermore, you’ll learn about ownership transitions, rating confirmations, and state-specific regulations that affect your coverage decisions today.

🎯 Key Takeaways

📍 Jackson National Life Insurance offers diverse annuity and life insurance products with strong financial ratings

📍 Recent ownership changes strengthened the company’s independence and focused service delivery capabilities

📍 The jackson national life insurance Company maintains A+ ratings from major agencies, confirming financial stability

📍 Customer reviews reveal both satisfaction with product performance and occasional service accessibility challenges

📍 State guarantee associations protect policyholders even if insurers experience financial difficulties

📍 Product offerings include variable annuities, fixed indexed annuities, and various life insurance solutions

📍 Policy lookup tools help recover forgotten coverage and reconnect beneficiaries with valuable benefits

- 🎯 Key Takeaways

- Jackson national life insurance : Overview

- Jackson National Life Insurance Company

- Who Owns Jackson Insurance Company?

- Who Bought Out Jackson National Life?

- Is jackson national life insurance legit?

- Jackson national life insurance reviews

- Jackson National Insurance Product Range

- Jackson Life Insurance Company Services

- Jackson Life Insurance Policy Benefits

- Jackson national life insurance ratings

- Jackson Annuity Investment Options

- Jackson National Life Customer Service

- When Did Jackson National Stop Selling?

- Jackson national life insurance lookup

- What Happened To Jackson National Life?

- Jackson national life insurance New York

- Why Did Prudential Sell Jackson?

- Finding Old Life Insurance Policies

- Life Insurance Company Closure Concerns

- Jackson National Life Insurance Future

- FAQs

- Conclusion

- References

Jackson national life insurance : Overview

Understanding Your Policy Options Today

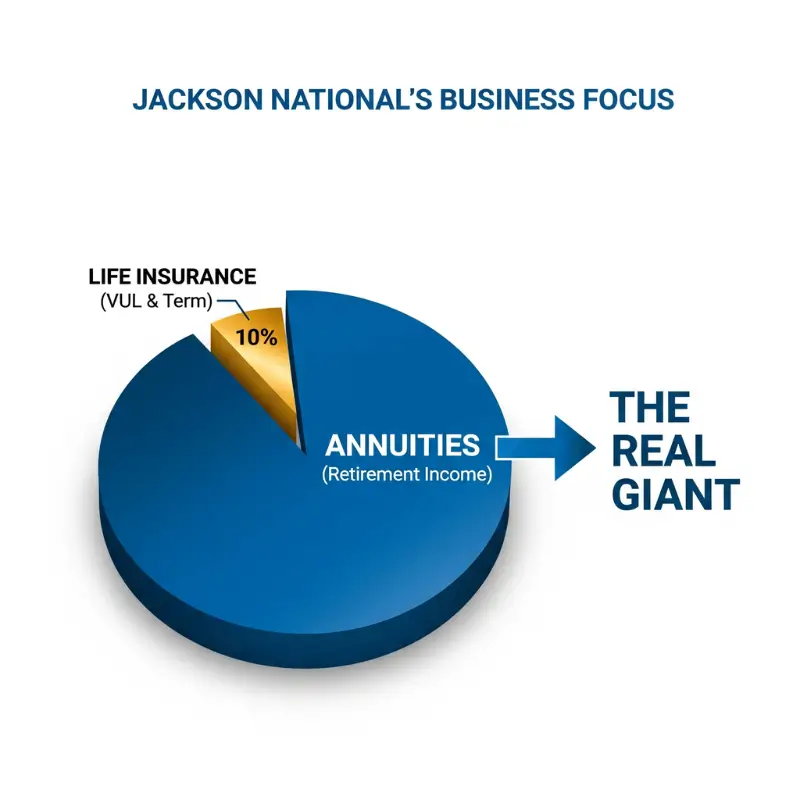

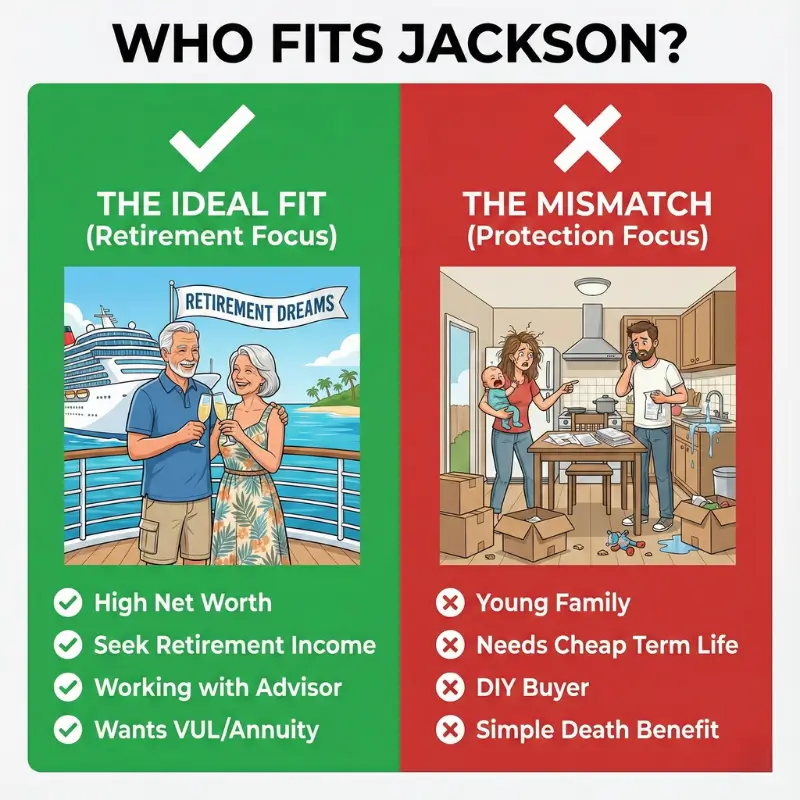

Choosing the right insurance coverage overwhelms many Americans facing countless provider options. Jackson national life insurance specializes in retirement solutions and protection products designed for long-term financial security. The company focuses primarily on annuities rather than traditional term life insurance. Their product lineup includes variable annuities, fixed indexed annuities, and registered index-linked annuities. Additionally, they offer institutional investment products and retirement plan services. Most consumers access Jackson National Life Insurance products through financial advisors and independent agents. The company doesn’t sell directly to consumers online. This distribution model ensures personalized guidance but limits immediate digital purchasing options. Understanding this structure helps set appropriate expectations.

Jackson national life insurance Explained

Jackson National Life Insurance operates as a specialized financial services provider within the insurance industry. Founded in 1961, the company built its reputation through innovative annuity products. Unlike traditional life insurers focusing on death benefits, Jackson national life insurance emphasizes retirement income solutions. Their products combine insurance guarantees with investment opportunities. Variable annuities allow contract owners to allocate funds among various investment options. Fixed indexed annuities provide principal protection with growth potential tied to market indexes. According to LIMRA research, Jackson consistently ranks among the top annuity providers nationwide. The jackson national life insurance Company reported over $327 billion in assets under management. This substantial asset base demonstrates significant market presence and customer trust throughout decades of operation.

Why Millions Trust This Insurer Nationwide

Trust develops through consistent performance, financial strength, and reliable customer service over extended periods. Jackson national life insurance has maintained strong financial ratings from independent agencies for many years. The company serves over 4 million contract owners across the United States. Their longevity in competitive insurance markets demonstrates resilience and adaptability. Many financial advisors recommend Jackson National Life Insurance products for retirement planning strategies. The insurer’s focus on innovation has produced award-winning annuity products. However, trust also stems from regulatory oversight and state guarantee protections. State insurance departments monitor company operations to protect consumer interests. These multilayered safeguards provide policyholders with confidence. Moreover, the company’s commitment to transparency has strengthened its reputation significantly.

Jackson National Life Insurance Company

Exploring the Company’s Rich History

The Jackson National Life Insurance Company began operations in Jackson, Michigan, in 1961. Initially, the company offered traditional life insurance products to local communities. During the 1980s, leadership shifted focus toward variable annuities and retirement products. This strategic pivot positioned the company for tremendous growth. Prudential plc, a UK-based financial services group, acquired Jackson in 1986. Under Prudential ownership, Jackson National Life Insurance Company expanded its market presence dramatically. The company introduced innovative products that appealed to baby boomers approaching retirement. By the 2000s, Jackson had become America’s leading variable annuity provider. According to company historical records, this growth trajectory continued for decades. The insurer adapted to changing market conditions and regulatory environments successfully throughout its evolution.

Jackson National Life Insurance Company Today

Today, the jackson national life insurance Company operates as an independent entity following its 2021 demerger. The company maintains headquarters in Lansing, Michigan, with additional operations nationwide. Current leadership emphasizes digital transformation and enhanced customer experience initiatives. Jackson National Life Insurance Company employs thousands of professionals supporting policyholders and distribution partners. The organization continues focusing primarily on retirement solutions rather than diversifying into other insurance lines. This specialization allows deep expertise in annuity products and retirement planning strategies. Recent years brought significant technological investments improving policy management and customer communication. The company now offers enhanced online portals for contract owners and financial advisors. These digital tools streamline transactions and provide real-time account information efficiently.

How It Became an Industry Leader Now

Leadership emerges from consistent innovation, financial strength, and market responsiveness over extended periods. jackson national life insurance Company achieved top rankings through several strategic advantages. First, their early adoption of variable annuity products captured growing retirement market demand. Second, strong relationships with independent financial advisors expanded distribution reach significantly. Third, competitive product features and pricing attracted both advisors and consumers consistently. According to Morningstar data, Jackson maintained top-five market share positions for many years. The company invested heavily in technology infrastructure supporting efficient operations. Additionally, risk management practices helped navigate market volatility during economic downturns. Their focused strategy avoided diversification into less profitable insurance segments. This disciplined approach maximized resources and expertise within the retirement solutions space.

Who Owns Jackson Insurance Company?

Ownership Changes Creating Policyholder Concerns

Corporate ownership transitions often trigger anxiety among policyholders worried about service continuity and financial stability. Jackson National Life Insurance experienced significant ownership changes that raised questions throughout the industry. For decades, Prudential plc owned Jackson as a subsidiary within its global operations. In 2020, Prudential announced plans to separate from Jackson through a demerger process. This news initially concerned policyholders unfamiliar with corporate restructuring implications. Many wondered whether their policies would remain valid or if benefits might change. Additionally, questions arose about financial strength following the separation from a large parent company. These concerns intensified during the transition period as details emerged gradually. However, regulatory approvals and careful planning addressed most policyholder worries effectively.

Jackson national life insurance ownership clarity

Currently, jackson national life insurance operates as a publicly independent company following the 2021 demerger. The separation from Prudential plc created a standalone entity focused exclusively on retirement solutions. Jackson Financial Inc. now serves as the parent company of jackson national life insurance company. This structure provides dedicated management attention without competing priorities from unrelated business lines. The demerger transferred ownership to existing Prudential plc shareholders through a distribution process. Subsequently, some shareholders sold their stakes while others maintained investment positions. Today, institutional investors and public shareholders collectively own Jackson Financial Inc. This ownership structure ensures accountability through public markets and regulatory oversight. The Securities and Exchange Commission monitors Jackson Financial’s public company disclosures regularly.

Your Policy Remains Protected and Secure

Despite ownership changes, jackson national life insurance policies maintain full legal validity and contractual protections. Insurance contracts constitute binding legal agreements that survive corporate restructuring transactions. State insurance regulations require companies to honor all existing policy obligations regardless of ownership changes. Furthermore, the demerger actually strengthened jackson national life insurance company financial position. The separation allowed focused capital allocation specifically supporting Jackson’s business operations. Independent financial strength ratings confirmed the company’s ability to meet long-term obligations. Major rating agencies like A.M. Best maintained positive outlooks following the transaction. Additionally, state guarantee associations provide backup protection if insurers face financial difficulties. These multilayered safeguards ensure policyholders receive promised benefits even during corporate transitions.

Who Bought Out Jackson National Life?

Merger News Shocking Insurance Markets Recently

In 2020, financial news outlets reported Prudential plc’s intention to separate from its U.S. operations. This announcement surprised many industry observers who expected continued ownership integration. The term “buyout” doesn’t accurately describe what happened to jackson national life insurance. Instead, Prudential executed a demerger creating an independent company through shareholder distribution. This corporate action differed significantly from traditional acquisition scenarios where another company purchases assets. Initially, speculation suggested potential private equity buyers might acquire Jackson from Prudential. However, Prudential chose a different path prioritizing shareholder value through independent operations. The insurance markets reacted with mixed responses to this unexpected strategic direction. Some analysts praised the move while others questioned its timing and rationale given market conditions.

Jackson national life insurance company acquisition

Technically, no external party acquired jackson national life insurance company through a traditional buyout transaction. The 2021 demerger separated Jackson from Prudential plc, creating a standalone publicly traded entity. Jackson Financial Inc. emerged as the new parent company holding jackson national life insurance operations. This structure allowed existing Prudential shareholders to receive Jackson shares proportionally. Subsequently, public markets determined Jackson Financial’s valuation through normal trading activities. The separation process required extensive regulatory approvals from state insurance departments and federal authorities. According to company filings, the transaction involved complex financial and legal arrangements. Nevertheless, the outcome provided jackson national life insurance company with operational independence. This autonomy enables focused strategic decisions without considering unrelated business unit priorities within a conglomerate structure.

Strengthened Financial Stability Benefits You Directly

The demerger structure actually enhanced jackson national life insurance financial strength rather than weakening it. Independent operations allow dedicated capital management supporting specifically annuity and retirement product obligations. Prudential’s departure eliminated potential conflicts between different business unit capital needs. Jackson National Life Insurance Company now controls its own investment strategies and risk management approaches. Rating agencies like Moody’s confirmed strong financial positions following the separation. The company maintains robust statutory capital exceeding regulatory requirements by comfortable margins. This financial strength ensures jackson national life insurance can honor long-term policy commitments reliably. For policyholders, the separation means focused attention on retirement solutions rather than divided priorities. Additionally, transparent public company reporting provides enhanced visibility into financial performance and strategic direction regularly.

Is jackson national life insurance legit?

Scam Fears Troubling Potential Policyholders Daily

Online scams and fraudulent insurance schemes have made consumers understandably cautious about insurance providers. Some people question whether jackson national life insurance operates legitimately given limited direct consumer awareness. Unlike household-name insurers advertising heavily, Jackson primarily serves customers through financial advisor channels. This lower public profile sometimes raises unnecessary suspicion among uninformed consumers. Additionally, complex annuity products can seem confusing, leading some to mistakenly assume fraudulent intent. Social media posts occasionally spread misinformation about legitimate insurers including Jackson National Life Insurance Company. These unfounded concerns damage reputations and create unnecessary anxiety for potential policyholders. However, distinguishing legitimate insurers from scams requires examining regulatory licenses, financial ratings, and operational history carefully.

Jackson national life insurance legitimacy proven

Jackson national life insurance operates as a fully legitimate, state-licensed insurance company with decades of regulatory compliance. The company holds insurance licenses in all 50 states and the District of Columbia. State insurance departments rigorously scrutinize insurers before granting licenses to operate within their jurisdictions. Furthermore, Jackson National Life Insurance Company maintains membership in state guarantee associations protecting policyholders. These associations provide backup coverage if insurers become insolvent, though Jackson remains financially strong. The company files regular financial statements with the National Association of Insurance Commissioners. These public filings demonstrate transparency and accountability to regulators and consumers alike. Additionally, major rating agencies continuously evaluate jackson national life insurance financial strength. These independent assessments confirm the company’s legitimacy and ability to meet long-term obligations reliably.

Verified Ratings Ensure Your Peace of Mind

Independent rating agencies provide objective assessments of jackson national life insurance financial strength and stability. A.M. Best currently assigns an A+ (Superior) rating to Jackson jackson national life insurance company. This rating indicates excellent financial strength and ability to meet ongoing insurance obligations. Moody’s assigns an A1 rating reflecting strong creditworthiness and stable outlook projections. Standard & Poor’s provides an A+ rating confirming robust financial position. These ratings result from rigorous analysis of capital adequacy, operating performance, and business profiles. Rating agencies examine thousands of data points before issuing opinions about insurer strength. For consumers, these verified ratings provide credible third-party confirmation of jackson national life insurance legitimacy. The company’s consistent high ratings over many years demonstrate sustained financial discipline and risk management effectiveness.

Jackson national life insurance reviews

Customer Complaints Surfacing Online Frequently Now

Like most large financial institutions, jackson national life insurance receives both praise and criticism from customers. Online review platforms display mixed feedback reflecting diverse customer experiences and expectations. Common complaints include difficulty reaching customer service representatives during peak periods. Some policyholders express frustration with complex product features requiring advisor assistance to understand fully. Additionally, surrender charges on early withdrawals generate negative reviews from customers facing unexpected fees. Processing delays for certain transactions occasionally prompt customer dissatisfaction and online complaints. According to the Better Business Bureau, Jackson maintains accreditation but receives periodic complaint submissions. However, complaint volumes must be viewed proportionally given millions of active policyholders nationwide. Many negative reviews stem from misunderstandings about product features rather than actual company failures.

Jackson national life insurance company feedback

Positive reviews of jackson national life insurance Company frequently highlight competitive investment performance and product flexibility. Many contract owners appreciate the variety of investment options available within variable annuity products. Financial advisors often praise jackson national life insurance for responsive wholesaler support and competitive commission structures. The company’s technology platforms receive favorable feedback for ease of use and comprehensive account information. Some policyholders specifically commend claims processing efficiency and accuracy during benefit payment periods. According to consumer feedback aggregators, satisfaction levels correlate strongly with advisor relationship quality. Customers working with knowledgeable financial advisors report significantly higher satisfaction than those lacking ongoing guidance. This pattern suggests Jackson National Life Insurance Company products work best within advised relationships. The company’s business model intentionally relies on advisor-client partnerships rather than direct-to-consumer sales approaches.

Real Experiences Guide Your Decision Confidently

Evaluating jackson national life insurance requires considering both positive and negative customer experiences holistically. Review platforms show common themes that help prospective policyholders set realistic expectations. Firstly, complex annuity products require professional guidance for optimal utilization and understanding. Secondly, customer service accessibility varies depending on inquiry complexity and timing. Thirdly, product performance generally meets or exceeds industry standards when measured objectively. Consulting multiple information sources provides balanced perspective beyond individual anecdotal experiences. Prospective customers should discuss jackson national life insurance company products with licensed financial advisors thoroughly. These professionals can explain product features, costs, and suitability based on individual circumstances. Additionally, state insurance departments provide complaint ratio data comparing insurers within their markets. These official statistics offer more reliable comparisons than unverified online reviews alone.

Jackson National Insurance Product Range

Confusion Over Available Coverage Options Persists

The insurance industry’s product complexity often leaves consumers uncertain about available coverage types and options. Jackson National Insurance offerings focus primarily on retirement solutions rather than traditional life insurance products. This specialization differs from full-service insurers providing comprehensive property, casualty, and life coverage. Many consumers mistakenly assume jackson national life insurance offers term life insurance similar to competitors. However, the company concentrates on annuity products designed for retirement income and asset accumulation. This focused product strategy can disappoint consumers seeking traditional death benefit protection exclusively. Understanding Jackson National Insurance specialization helps align expectations with actual available offerings. The company’s website and advisor networks provide detailed product information for interested consumers.

Jackson National Insurance Offerings Simplified

Jackson National Insurance product portfolio includes several distinct annuity categories serving different retirement planning needs. Variable annuities allow contract owners to invest in professionally managed subaccounts with market exposure. Fixed indexed annuities provide principal protection while crediting interest based on external index performance. Registered index-linked annuities offer market participation with downside protection through structured crediting strategies. Additionally, the company offers institutional products for retirement plan sponsors and pension fund managers. According to industry publications, jackson national life insurance ranks among top variable annuity providers. Each product category features multiple variations with different riders, benefits, and fee structures. Optional living benefit riders provide guaranteed lifetime income regardless of account value fluctuations. Death benefit riders ensure beneficiaries receive minimum amounts protecting against market downturns.

Perfect Protection Matches Your Unique Needs

Selecting appropriate Jackson National Insurance products requires careful analysis of personal financial situations and goals. Retirement planning involves balancing growth potential, income security, and legacy planning considerations. Variable annuities suit investors comfortable with market exposure seeking long-term growth potential. Fixed indexed annuities appeal to conservative savers desiring principal protection with modest growth opportunities. jackson national life insurance products work effectively within diversified retirement strategies alongside other investment accounts. Financial advisors help determine appropriate allocation percentages based on risk tolerance and time horizons. The company’s product flexibility allows customization through rider selections matching specific needs. However, annuity products involve fees including mortality and expense charges, administrative fees, and investment management costs. Understanding total cost structure ensures informed decisions about product suitability and expected performance.

Jackson Life Insurance Company Services

Policy Management Challenges Frustrating Customers Today

Modern policyholders expect seamless digital experiences similar to online banking and retail platforms. Jackson Life Insurance Company has invested significantly in technology improvements addressing customer service expectations. However, legacy systems and regulatory requirements sometimes complicate straightforward digital transactions. Some policyholders report difficulty navigating online portals without advisor assistance initially. Complex annuity contracts involve numerous provisions requiring careful review before executing changes. Additionally, certain transactions require paper forms and manual processing due to regulatory documentation requirements. These operational realities occasionally frustrate customers expecting instant digital gratification. jackson national life insurance Company continues modernizing systems to enhance user experiences. Nevertheless, some inherent complexity remains given the regulated nature of insurance products.

Jackson Life Insurance Company Support Solutions

Jackson Life Insurance Company provides multiple customer service channels addressing various policyholder needs efficiently. Contract owners can access information through secure online portals displaying account values and transaction histories. The company maintains a customer service phone line staffed by representatives trained in policy inquiries. Financial advisors serve as primary contacts for many policyholders, providing personalized guidance and transaction assistance. Additionally, jackson national life insurance offers email support for non-urgent inquiries and documentation requests. The company’s website features extensive educational resources explaining product features and common procedures. Online forms streamline routine transactions like beneficiary changes and address updates. For complex situations, dedicated service teams handle specialized requests requiring additional documentation and processing. These multilayered support options accommodate different customer preferences and inquiry types effectively.

Streamlined Access Saves Time and Stress

Efficient policy management requires understanding available Jackson Life InsuranceCompany resources and utilizing appropriate channels. Policyholders should register for online portal access upon policy issuance to establish digital connectivity. Secure portals allow 24/7 account monitoring without waiting for phone support availability. Routine inquiries about account values and transaction histories resolve quickly through self-service tools. For complex questions, contacting financial advisors often provides faster resolutions than general customer service lines. Advisors understand individual client situations and can navigate jackson national life insurance processes efficiently. Keeping policy documents organized and accessible expedites service requests requiring reference information. Proactive communication about address changes and beneficiary updates prevents future complications. Understanding product features and contractual provisions minimizes misunderstandings and unnecessary service contacts. These practices optimize interactions with Jackson Life Insurance Company support systems significantly.

Jackson Life Insurance Policy Benefits

Uncertainty About Coverage Value Concerns Families

Many families struggle to quantify life insurance and annuity benefits when evaluating coverage adequacy. Jackson Life Insurance products provide multiple benefit types depending on specific contract provisions selected. Variable annuities offer growth potential through investment subaccount appreciation over time. Fixed indexed annuities guarantee principal protection while providing potential interest credits based on index performance. Optional living benefit riders create guaranteed lifetime income streams regardless of account value fluctuations. Death benefit provisions ensure beneficiaries receive specified amounts protecting against premature death losses. However, understanding these complex benefit structures requires careful policy review and professional guidance. jackson national life insurance benefits vary significantly based on product type, rider selections, and individual circumstances. This variability makes general benefit statements difficult without examining specific policy details thoroughly.

Jackson Life Insurance Advantages Revealed Clearly

Jackson Life Insurance products offer several distinct advantages for retirement planning and wealth accumulation strategies. Tax-deferred growth within annuity contracts allows earnings to compound without annual income tax obligations. This tax treatment potentially accelerates asset accumulation compared to taxable investment accounts. jackson national life insurance provides diverse investment options through professional money managers and asset allocation strategies. Downside protection features through living benefit riders guarantee minimum income levels even during market downturns. Death benefit provisions pass assets to beneficiaries efficiently, often avoiding probate complications. According to financial planning research, annuities fill specific roles within comprehensive retirement strategies. Jackson Life Insurance Company products integrate well with Social Security, pensions, and personal savings. The company’s financial strength ensures long-term contractual obligations receive reliable support throughout extended retirement periods.

Financial Security Transforms Your Future Planning

Comprehensive financial security requires multiple protection layers addressing various risks and contingencies. Jackson Life Insurance products specifically address longevity risk, the possibility of outliving accumulated savings. Guaranteed lifetime income riders ensure monthly payments continue regardless of lifespan or market performance. This predictable income foundation allows more confident spending decisions during retirement years. Additionally, death benefit provisions create legacy assets for surviving family members and charitable causes. jackson national life insurance flexibility accommodates changing circumstances through product exchanges and rider adjustments. Market volatility protection through certain product features reduces anxiety during economic downturns. These combined benefits create psychological peace of mind complementing financial security measures. Proper product utilization requires ongoing communication with financial advisors monitoring changing needs. Jackson Life Insurance Company encourages regular policy reviews ensuring continued alignment with evolving goals.

Jackson national life insurance ratings

Financial Strength Questions Worry Policyholders Now

Insurance company financial strength directly impacts their ability to honor long-term policy commitments reliably. Policyholders understandably worry about insurer solvency given the extended time horizons of annuity contracts. Jackson National Life Insurance financial stability becomes particularly important for younger policyholders expecting decades of contract duration. Economic uncertainties and market volatilities heighten concerns about institutional financial health generally. Some consumers question whether any insurance company can maintain stability through unpredictable economic cycles. These worries intensify when considering large premium payments made to insurers like Jackson National Life Insurance Company. However, rigorous regulatory oversight and conservative investment requirements protect policyholders significantly. State insurance departments monitor insurer financial conditions continuously, intervening before problems become critical. Independent rating agencies provide objective assessments helping consumers evaluate insurer financial strength confidently.

Jackson national life insurance stability confirmed

Jackson National Life Insurance maintains strong financial ratings from all major independent rating agencies consistently. A.M. Best assigns an A+ (Superior) rating, the second-highest of 15 possible categories. Moody’s provides an A1 rating indicating excellent financial security and low credit risk. Standard & Poor’s assigns an A+ rating reflecting strong capacity to meet financial commitments. Fitch Ratings confirms these assessments with similar high-quality ratings. These independent evaluations examine capital adequacy, asset quality, operating profitability, and management competence thoroughly. Jackson National Life Insurance Company maintains statutory capital well exceeding regulatory minimum requirements. The company’s risk-based capital ratio provides substantial cushion against unexpected losses. Additionally, conservative investment portfolios emphasize high-quality bonds and diversified holdings. These combined factors demonstrate jackson national life insurance financial stability and capability to honor long-term contractual obligations reliably.

Top-Tier Ratings Guarantee Long-Term Reliability

High financial strength ratings provide credible assurance of jackson national life insurance long-term viability. Rating agencies employ sophisticated analytical methodologies examining thousands of financial and operational data points. They assess insurers’ abilities to withstand various stress scenarios including market crashes and economic recessions. Jackson National Life Insurance Company ratings reflect proven resilience through multiple economic cycles. The 2008 financial crisis tested insurers significantly, yet Jackson maintained strong ratings throughout that period. Similarly, the COVID-19 pandemic’s economic disruptions didn’t materially impair Jjackson national life insurance financial position. This historical performance demonstrates management competence and risk management effectiveness. For policyholders, sustained high ratings reduce concerns about company failure disrupting benefits. While no investment carries zero risk, jackson national life insurance ratings indicate very low probability of default. These third-party assessments provide valuable independent confirmation beyond company marketing materials.

Jackson Annuity Investment Options

Retirement Planning Confusion Overwhelming Investors Today

Americans face daunting retirement planning challenges requiring decades of disciplined saving and investing. Many workers feel overwhelmed by investment option abundance lacking clear guidance about appropriate selections. Jackson Annuity products address these concerns through professionally managed investment portfolios and structured choices. Variable annuities offer diverse subaccount options spanning asset classes, investment styles, and geographic regions. However, this variety sometimes creates analysis paralysis for investors uncertain about proper allocations. Additionally, understanding fees, expenses, and tax implications requires financial literacy many investors lack. Market volatility compounds anxiety as account values fluctuate, testing emotional discipline during downturns. Jackson National Life Insurance provides educational resources helping investors understand options available within their contracts. Nevertheless, professional guidance typically proves necessary for optimal decision-making and ongoing portfolio management.

Jackson Annuity Products Deliver Growth Potential

Jackson Annuity products provide multiple investment pathways matching different risk tolerances and growth objectives. Variable annuities allow market participation through subaccounts managed by prominent investment companies. Available managers include well-known firms like BlackRock, Fidelity, and T. Rowe Price. According to Morningstar ratings, many Jackson subaccount options earn high performance marks. Asset classes include U.S. stocks, international equities, bonds, and specialized sector funds. Investors can construct diversified portfolios allocating across multiple subaccounts matching target risk profiles. Fixed indexed annuities offer principal protection while crediting interest based on external index performance. These products eliminate downside market risk while providing participation in index gains subject to caps. Jackson National Life Insurance Company regularly introduces new investment options responding to evolving market conditions. This ongoing innovation ensures competitive positioning within the dynamic annuity marketplace.

Guaranteed Income Secures Your Golden Years

Beyond growth potential, Jackson Annuity products provide optional guaranteed lifetime income features addressing longevity risk. Living benefit riders create income floors ensuring minimum annual withdrawals regardless of account performance. These guarantees eliminate concerns about outliving savings a primary retirement planning fear. Jackson National Life Insurance guarantees remain valid even if account values decline to zero. This protection allows retirees to spend confidently knowing baseline income continues throughout their lifetimes. Income guarantees typically involve additional fees assessed against account values annually. According to industry studies, these costs average between 0.95% and 1.95% annually depending on specific rider features. Evaluating whether guaranteed income justifies associated costs requires personal risk tolerance assessment. For risk-averse retirees, these guarantees provide invaluable peace of mind. Jackson Annuity riders offer various customization options including inflation adjustments and spousal continuation provisions.

Jackson National Life Customer Service

Support Accessibility Frustrating Members Seeking Help

Customer service quality significantly impacts overall satisfaction with financial services providers like insurers. Jackson National Life customer service receives mixed reviews reflecting varied experiences across different inquiry types. Some policyholders report extended hold times when calling during business hours, particularly during peak periods. Reaching knowledgeable representatives who can address complex annuity questions sometimes requires multiple transfers. Additionally, the company’s advisor-centric distribution model means many service functions flow through financial advisors. This structure works well for customers with engaged advisors but disadvantages those lacking ongoing professional relationships. jackson national life insurance has invested in technology improvements including enhanced online portals. However, certain transactions still require paper forms and manual processing, causing frustration. These service challenges exist across the insurance industry, not exclusively at Jackson.

Jackson national life insurance service channels

Jackson National Life Insurance provides multiple contact methods addressing different customer service needs efficiently. The primary customer service phone number connects policyholders with representatives during extended business hours. Online portals allow secure access to account information, transaction histories, and policy documents. Email support accommodates non-urgent inquiries that don’t require immediate telephone discussions. Financial advisors serve as primary contacts for many customers, handling routine service needs directly. Jackson National Life Insurance Company wholesalers support advisors with technical questions and complex case assistance. The company’s website features comprehensive educational resources, frequently asked questions, and instructional videos. These self-service tools empower customers to find answers independently without contacting representatives. For specialized situations like estate settlements and policy loans, dedicated service teams provide expert assistance. Understanding which channel suits specific needs improves service experience efficiency significantly.

Quick Resolutions Enhance Your Experience Dramatically

Maximizing Jackson National Life customer service efficiency requires strategic approaches to common policyholder needs. Before contacting support, gather relevant information including policy numbers, recent statements, and specific questions. This preparation helps representatives address inquiries more efficiently without lengthy information-gathering delays. Utilizing online portals for routine inquiries like account values and transaction confirmations saves time. Reserve phone contacts for complex issues requiring representative expertise and judgment. When calling jackson national life insurance, note business days and hours to avoid closed-office frustration. Mornings typically experience lower call volumes than afternoons when many customers contact insurers. Maintaining regular communication with financial advisors prevents issues requiring customer service intervention. Advisors often resolve questions quickly through direct company contacts unavailable to general public callers. These practical strategies optimize interactions with Jackson National Life Insurance Company support systems effectively.

When Did Jackson National Stop Selling?

Industry Exit Rumors Spreading Concern Nationwide

In recent years, several major insurers exited retail annuity markets, triggering speculation about industry-wide trends. These corporate decisions raised questions about jackson national life insurance future sales plans. Some consumers heard rumors suggesting Jackson would stop accepting new business entirely. Social media amplified these concerns, spreading unverified information causing unnecessary policyholder anxiety. Market observers noted that some insurers withdrew from certain product lines due to low interest rates. This economic environment compressed profit margins on traditional annuity products significantly. Additionally, increased regulatory requirements raised compliance costs, discouraging some companies from continuing annuity sales. These industry dynamics created uncertainty about various insurers’ long-term commitments. However, rumors don’t always reflect actual corporate strategies or official company announcements.

Jackson National Life Insurance Sales Timeline

Jackson National Life Insurance continues accepting new business for most annuity products as of 2025. The company hasn’t announced complete market withdrawal or cessation of all new policy sales. However, jackson national life insurance company has made strategic adjustments to product offerings recently. In 2020, Jackson stopped accepting new variable annuity applications from certain distribution channels. This decision reflected management’s assessment of profitability and risk in specific market segments. The company continues selling variable annuities through select broker-dealer relationships maintaining existing distribution agreements. Fixed indexed annuities remain available through independent insurance agencies and financial advisory firms nationwide. According to industry reports, Jackson maintains significant market presence despite strategic refinements. The company evaluates product offerings continuously, adjusting strategies based on market conditions and profitability assessments. These ongoing evaluations ensure long-term business sustainability.

Current Availability Meets Your Coverage Demands

Prospective customers can still purchase jackson national life insurance products through appropriate distribution channels. Working with licensed financial advisors provides access to current product offerings and available policy options. jackson national life insurance company maintains relationships with thousands of independent advisors nationwide. These professionals help clients evaluate whether Jackson products align with individual retirement planning needs. Product availability may vary by state due to different regulatory requirements and company licensing decisions. Interested consumers should consult local advisors to confirm specific product availability in their jurisdictions. While some products experienced sales restrictions, Jackson National Life Insurance remains active in annuity markets. The company’s continued operations and new product development demonstrate ongoing market commitment. For existing policyholders, company operations continue normally regardless of new business sales strategies.

Jackson national life insurance lookup

Lost Policy Documents Creating Verification Problems

Americans frequently lose track of life insurance policies and annuity contracts over time. Family relocations, document disorganization, and passing years cause important paperwork to disappear. Beneficiaries sometimes discover deceased relatives owned jackson national life insurance policies only after estate settlements. These situations create challenges verifying coverage existence and determining current policy values. Additionally, policyholders forget about small contracts purchased decades earlier that now hold significant value. The National Association of Insurance Commissioners maintains a Life Insurance Policy Locator Service. This free tool helps consumers search multiple insurers simultaneously for lost policies. However, knowing which companies to search improves efficiency significantly. jackson national life insurance contracts sometimes surface during estate administration requiring beneficiary contact information updates.

Jackson National Life Insurance Policy Search

Several methods help locate lost jackson national life insurance policies efficiently without extensive investigation efforts. The company maintains a customer service department assisting with policy verification inquiries. Calling with personal identifying information like Social Security numbers helps representatives search internal databases. jackson national life insurance company can confirm policy existence and provide current contact information for policyholders. Online portals allow registered users to view all contracts associated with their credentials instantly. For beneficiaries seeking policies after a death, providing deceased’s information helps locate relevant contracts. The NAIC Life Insurance Policy Locator Service includes Jackson National Life Insurance in its national database. This centralized resource searches multiple carriers simultaneously, streamlining the discovery process. State insurance departments also maintain records of licensed insurers operating within their jurisdictions.

Easy Retrieval Reconnects You With Benefits

Once located, Jackson National Life Insurance policies can be reactivated and benefits claimed through established processes. The company provides claim forms and instructions guiding beneficiaries through necessary documentation requirements. Death benefit claims typically require certified death certificates and properly completed beneficiary claim forms. jackson national life insurance company processes valid claims efficiently, usually disbursing benefits within weeks. For living policyholders rediscovering old contracts, updating contact information ensures future communications reach them. Contract values may have grown substantially over decades through investment performance and interest crediting. These discovered assets can significantly improve retirement security or provide unexpected legacy gifts. Professional assistance from financial advisors helps determine optimal strategies for rediscovered Jackson National Life Insurance contracts. Options include maintaining current contracts, exchanging into new products, or liquidating for other purposes.

What Happened To Jackson National Life?

Recent Changes Sparking Widespread Speculation Daily

The insurance industry undergoes constant evolution through mergers, acquisitions, product changes, and strategic repositioning. Jackson National Life experienced significant corporate changes recently, generating considerable industry attention. Prudential plc’s decision to separate from its U.S. operations surprised many market observers. This strategic move prompted questions about underlying motivations and future.

Jackson national life insurance company updates

The most significant recent development involved jackson national life insurance company becoming an independent entity in 2021. Prudential plc completed the demerger process, separating Jackson from its UK-based parent organization. This transaction created Jackson Financial Inc., a publicly traded company holding JacksonNational Life Insurance operations. The separation allowed Prudential to focus on UK and Asian markets while Jackson concentrated exclusively on U.S. retirement solutions. According to SEC filings, the demerger received all necessary regulatory approvals. jackson national life insurance company emerged with strengthened capital positions and focused management attention. The company maintained its Lansing, Michigan headquarters and continued serving existing policyholders without disruption. Post-separation, Jackson introduced new product features and enhanced digital capabilities. These improvements demonstrate continued investment in customer experience and competitive market positioning.

Evolution Strengthens Policyholder Value Significantly

Independence brought jackson national life insurance several strategic advantages benefiting current and future policyholders. Dedicated management teams now focus exclusively on retirement solutions without competing corporate priorities. Capital allocation decisions specifically support annuity operations rather than diversified conglomerate needs. Jackson National Life Insurance Company gained flexibility to pursue partnerships and strategic initiatives aligned with retirement markets. The public company structure increased transparency through regular financial disclosures and investor communications. Rating agencies confirmed strong financial positions following the separation, validating the strategic rationale. For policyholders, these changes mean enhanced attention to product innovation and customer service improvements. The company’s market focus ensures resources target areas directly impacting contract owner experiences. Jackson National Life Insurance continues evolving to meet changing retirement planning needs effectively.

Jackson national life insurance New York

State-Specific Regulations Confusing NY Residents Now

New York maintains some of the nation’s most stringent insurance regulations, creating unique compliance requirements. Jackson national life insurance must meet specialized standards when selling products to New York residents. These regulations affect product features, pricing structures, and available options compared to other states. Many insurance companies avoid New York markets entirely due to regulatory complexity and compliance costs. Consumers in New York sometimes discover fewer product choices than residents of other states. Additionally, policy illustrations and disclosure requirements differ significantly under New York insurance law. These state-specific rules intend to protect consumers but sometimes limit available options. Jackson National Life Insurance Company navigates these requirements to maintain New York market presence. Understanding state-specific regulations helps New York residents set appropriate expectations about available coverage.

Jackson national life insurance Company NY

Jackson National Life Insurance Company maintains licenses and continues operations in New York under state regulatory oversight. The New York State Department of Financial Services supervises all insurance activities within state borders. Jackson National Life Insurance files required financial statements and complies with all state-mandated regulations. Products sold to New York residents undergo additional regulatory review before receiving approval. Consequently, some features available in other states may not appear in New York versions. However, New York policyholders receive strong regulatory protections and oversight unmatched in many jurisdictions. The state’s guarantee fund provides substantial coverage protecting policyholders if insurers experience financial difficulties. According to New York State DFS, rigorous oversight ensures only financially sound companies operate. Jackson National Life Insurance Company meets these high standards, demonstrating commitment to Empire State customers.

Tailored Coverage Meets Empire State Requirements

New York residents can access Jackson National Life Insurance products specifically designed for state regulatory compliance. Variable annuities offered in New York include mandated consumer protections and disclosure enhancements. Fixed indexed annuities comply with state-specific crediting method regulations and illustration requirements. Jackson National Life Insurance Company works with financial advisors licensed in New York who understand state-specific considerations. These professionals help clients navigate differences between New York products and those available elsewhere. While some features differ, core benefits like tax-deferred growth and lifetime income options remain available. New York’s regulatory environment actually provides enhanced consumer protections beyond many other states. For Empire State residents, jackson national life insurance represents a viable option meeting stringent local standards. Working with knowledgeable advisors ensures proper product selection aligned with New York regulations.

Why Did Prudential Sell Jackson?

Corporate Restructuring Raising Policyholder Questions Today

Large financial conglomerates periodically restructure operations to optimize shareholder value and strategic focus. Prudential plc’s decision to separate from jackson national life insurance reflected evolving corporate priorities. Many policyholders wondered whether Prudential’s departure indicated problems with Jackson’s business model or financial health. Technically, Prudential didn’t “sell” Jackson to another company through a traditional acquisition transaction. Instead, the demerger distributed Jackson shares to existing Prudential shareholders creating an independent company. This distinction matters because no external buyer acquired jackson national life insurance company. Nevertheless, the separation raised questions about motivations and implications for policyholders. Understanding the strategic rationale helps address concerns about policy security and company stability. Corporate restructuring doesn’t necessarily indicate operational problems or financial weakness.

Jackson national life insurance Independence Gained

Prudential’s demerger decision stemmed from several strategic considerations benefiting both organizations long-term. Geographic focus represented a primary motivation, Prudential wanted to concentrate on UK and Asian markets. Jackson National Life Insurance operations centered exclusively on U.S. retirement solutions, creating geographic misalignment. Additionally, regulatory capital requirements for variable annuities increased substantially in recent years. These requirements tied up capital that Prudential preferred deploying in other business segments. According to company announcements, the separation allowed both entities to pursue focused strategies. jackson national life insurance company gained operational independence and strategic flexibility as a standalone entity. The demerger structure preserved Jackson’s financial strength while eliminating conglomerate overhead costs. For policyholders, independence meant dedicated management attention rather than competing within a diversified conglomerate.

Strategic Separation Improves Focused Service Delivery

Independence allows Jackson National Life Insurance to optimize operations specifically for retirement solution customers. Management teams no longer balance competing priorities from unrelated insurance and financial service segments. Capital allocation decisions directly support annuity operations and policyholder obligations exclusively. Jackson National Life Insurance Company can pursue strategic partnerships and technology investments aligned with retirement markets. Product development focuses entirely on meeting evolving retirement planning needs without conglomerate constraints. According to industry analysts, focused companies often outperform diversified conglomerates in specialized markets. The separation positioned Jackson National Life Insurance to compete more effectively against specialized retirement solution providers. Enhanced flexibility enables faster market responses and innovation cycles benefiting current and future customers. These strategic advantages ultimately strengthen the company’s long-term competitiveness and policyholder value.

Finding Old Life Insurance Policies

Forgotten Coverage Leaving Money Unclaimed Nationwide

An estimated $7.4 billion in life insurance benefits remains unclaimed across the United States annually. Americans frequently lose track of policies purchased decades earlier as life circumstances change. Families relocate, documents disappear, and policy statements go unread causing coverage to become forgotten. Jackson National Life Insurance contracts sometimes remain undiscovered for years despite holding substantial accumulated values. Beneficiaries often don’t know deceased relatives owned policies, leaving death benefits unclaimed indefinitely. Additionally, small premium policies purchased long ago may have grown significantly through investment performance. According to NAIC data, billions in unclaimed benefits await rightful owners. This unclaimed property represents missed financial security opportunities for families nationwide. Systematic search processes help recover these forgotten assets, providing unexpected financial relief during challenging times.

Jackson national life insurance Policy Recovery

Several practical steps help locate potentially forgotten Jackson National Life Insurance policies efficiently and systematically. First, review deceased relatives’ financial records including bank statements, canceled checks, and tax returns. Premium payments often appear on bank statements revealing insurance company names even without policy documents. Second, contact former employers about group insurance benefits that may have included conversion options. Third, search safe deposit boxes, filing cabinets, and personal papers for policy documents or correspondence. Fourth, use the NAIC Life Insurance Policy Locator Service to search multiple insurers simultaneously. Fifth, contact Jackson National Life Insurance Company directly with the deceased’s personal information. Representatives can search internal databases for policies associated with provided Social Security numbers. State unclaimed property divisions also maintain databases of turned-over insurance benefits awaiting rightful claimants.

Discovered Benefits Provide Unexpected Financial Relief

Located Jackson National Life Insurance policies can deliver substantial financial benefits to surprised beneficiaries and policyholders. Death benefits provide immediate liquidity helping families cover funeral expenses and outstanding debts. Annuity contract values may have grown significantly through decades of tax-deferred investment performance. These discovered assets can fund education expenses, supplement retirement income, or create emergency reserves. Jackson National Life Insurance Company provides claim forms and guidance helping beneficiaries navigate the claims process. Processing typically completes within weeks once proper documentation is submitted and verified. For living policyholders rediscovering old contracts, options include maintaining current coverage or exchanging into new products. Financial advisors help evaluate discovered Jackson National Life Insurance policies determining optimal strategies. These unexpected windfalls can meaningfully improve financial security and provide peace of mind during uncertain times.

Life Insurance Company Closure Concerns

Business Failure Fears Threatening Policy Security

Economic uncertainties and market volatilities naturally raise concerns about financial institution stability including insurers. Policyholders worry whether their insurance companies will survive long enough to honor decades-long contractual commitments. Recent bank failures and corporate bankruptcies heighten anxiety about institutional financial health generally. Jackson National Life Insurance policyholders occasionally express concerns about company longevity given extended annuity time horizons. These worries intensify when considering large premium payments made with expectations of future benefits. However, insurance companies face extensive regulatory oversight specifically designed to prevent catastrophic failures. State insurance departments monitor financial conditions continuously, intervening beore problems become critical. Additionally, statutory accounting requirements force conservative financial management protecting policyholders. Understanding these protective mechanisms reduces unnecessary anxiety about insurer failures.

Jackson National Life Insurance Guarantees Protection

Multiple safeguard layers protect Jackson National Life Insurance policyholders beyond the company’s own financial strength. State guarantee associations provide backup coverage if licensed insurers become insolvent within their jurisdictions. These associations assess surviving insurers to fund benefits for failed company policyholders. Coverage limits vary by state but typically provide substantial protection for most policyholders. According to the National Organization of Life and Health Insurance Guaranty Associations, most states guarantee annuity benefits up to $250,000. This protection activates automatically without requiring policyholder applications or claim filings. Additionally, Jackson National Life Insurance Company maintains financial strength ratings indicating very low default probability. Regulatory capital requirements ensure insurers hold sufficient assets covering all policy obligations. These combined protections make insurance company failures relatively rare compared to other financial institutions.

State Safeguards Ensure Your Benefits Survive

Even if Jackson National Life Insurance experienced financial difficulties, state guarantee associations would protect most policyholders. Every state maintains guarantee funds backing licensed insurers operating within their borders. These associations intervene when regulators determine insurers cannot meet ongoing obligations independently. Guarantee associations either facilitate policy transfers to healthy insurers or directly pay benefits to policyholders. According to state insurance regulations, these protections apply to both death benefits and annuity values. Coverage limits mean most middle-income policyholders receive complete protection while wealthy individuals face partial exposure. However, Jackson National Life Insurance Company strong financial ratings indicate remote failure probability. The regulatory framework and guarantee system have protected millions of policyholders when insurers failed historically. These proven safeguards provide reasonable assurance that benefits will survive even catastrophic company failures.

Jackson National Life Insurance Future

Market Uncertainty Creating Investment Hesitation Today

The retirement solutions industry faces numerous challenges including low interest rates and increased regulatory requirements. Market observers question whether traditional annuity business models remain economically viable long-term. Jackson National Life Insurance must navigate these industry headwinds while maintaining competitive product offerings. Some competitors exited variable annuity markets entirely, raising questions about Jackson’s future commitment. Additionally, changing consumer preferences toward fee-based advisory models challenge commission-based distribution structures. Younger consumers demonstrate less interest in traditional insurance products compared to previous generations. These demographic shifts require product innovation and marketing strategy adjustments. Jackson National Life Insurance Company faces pressure to modernize technology platforms meeting evolving customer expectations. However, the company’s strong financial position and market expertise position it well for adaptation.

Jackson National Life Insurance Company Vision

Jackson National Life Insurance Company leadership articulates a clear vision focusing on retirement income solutions innovation. The company continues investing in technology infrastructure enhancing customer experiences and operational efficiency. Product development teams work on creating solutions addressing evolving retirement planning needs and market conditions. Jackson National Life Insurance emphasizes lifetime income guarantees as differentiators in competitive annuity markets. According to company communications, management sees continued strong demand for retirement security products. An aging U.S. population creates growing markets for products addressing longevity risk. The company plans to leverage its specialized expertise and established distribution relationships. Strategic partnerships with technology providers enhance digital capabilities without massive infrastructure investments. These initiatives position Jackson National Life Insurance Company to compete effectively in evolving retirement solutions markets.

Innovation Positions Growth For Decades Ahead

Despite current challenges, Jackson National Life Insurance possesses strengths supporting long-term success in retirement markets. Decades of experience provide deep understanding of customer needs and effective product design principles. Strong financial ratings enable competitive pricing and attract quality distribution partners seeking reliable product providers. The company’s focused strategy avoids distractions from unrelated business segments competing for management attention. Jackson National Life Insurance Company maintains flexibility to adjust product offerings responding to changing economic conditions. Innovation in living benefit riders and income guarantees addresses growing consumer demand for retirement security. According to demographic projections, retiring baby boomers will drive annuity demand for years. Jackson National Life Insurance established brand recognition and market presence provide competitive advantages. These factors suggest the company remains well-positioned despite short-term industry challenges.

FAQs

Is Jackson National Life Insurance still in business?

Yes, Jackson National Life Insurance continues active operations as an independent company. The 2021 demerger from Prudential created a standalone entity focused exclusively on retirement solutions. The company maintains licenses in all 50 states and actively serves over 4 million contract owners. Jackson National Life Insurance Company continues accepting new business for most annuity products through financial advisor channels.

Are Jackson National Life Insurance policies safe?

Jackson National Life Insurance maintains strong financial strength ratings from all major independent rating agencies. A.M. Best assigns an A+ (Superior) rating while Moody’s and S&P provide A1 and A+ ratings respectively. Additionally, state guarantee associations provide backup protection covering most policyholders if insurers become insolvent. These combined safeguards indicate very low risk to policy benefits.

How do I contact Jackson National Life Insurance customer service?

Contact Jackson National Life Insurance customer service by calling their main phone line during business hours. You can also access account information through secure online portals after registering. Financial advisors serve as primary contacts for many policyholders, handling routine service needs directly. The company’s website provides email support options and comprehensive educational resources for self-service inquiries.

Can I still buy Jackson National Life Insurance products?

Yes, Jackson National Life Insurance products remain available through licensed financial advisors and insurance agents. The company continues selling variable and fixed indexed annuities through select distribution channels. Product availability may vary by state due to regulatory requirements and licensing decisions. Consult with local financial advisors to determine current product offerings in your jurisdiction.

What happened to Jackson National Life Insurance policies after the Prudential separation?

All Jackson National Life Insurance policies remained valid and fully protected following the 2021 Prudential demerger. The separation created an independent company without changing any contractual terms or policyholder obligations. Policy benefits, guarantees, and features continued exactly as written in original contracts. The transaction actually strengthened the company’s financial position through focused capital management.

How do I find a lost Jackson National Life Insurance policy?

Use the NAIC Life Insurance Policy Locator Service to search for lost Jackson National Life Insurance policies. You can also contact the company directly with personal identifying information like Social Security numbers. Review deceased relatives’ financial records including bank statements showing premium payments. State unclaimed property divisions maintain databases of turned-over insurance benefits awaiting rightful claimants.

Does Jackson National Life Insurance offer term life insurance?

Jackson National Life Insurance focuses primarily on annuity products rather than traditional term life insurance. The company specializes in retirement solutions including variable annuities, fixed indexed annuities, and registered index-linked annuities. Consumers seeking term life insurance should explore other insurers specializing in death benefit protection products. Financial advisors can recommend appropriate carriers based on specific coverage needs.

What are Jackson National Life Insurance fees?

Jackson National Life Insurance fees vary by product type and selected optional riders. Variable annuities typically include mortality and expense charges, administrative fees, and investment management costs. Total annual expenses often range from 2% to 3.5% depending on features. Fixed indexed annuities generally have no explicit annual fees but may include surrender charges on early withdrawals. Review specific product prospectuses for detailed fee disclosures.

How long does Jackson National Life Insurance take to process claims?

Jackson National Life Insurance typically processes valid death benefit claims within 2-4 weeks after receiving complete documentation. Processing times depend on documentation completeness and claim complexity. Beneficiaries must submit certified death certificates and properly completed claim forms. The company communicates with claimants throughout the process providing status updates. Complex situations involving estate issues may require additional time.

Can I exchange my Jackson National Life Insurance policy?

Yes, Jackson National Life Insurance allows 1035 exchanges into newer products subject to availability and underwriting. These tax-free exchanges preserve tax-deferred status without triggering immediate income tax obligations. However, surrender charges may apply if exchanging during early contract years. Financial advisors help evaluate whether exchanging makes financial sense based on current contracts and available options.

Conclusion

Jackson National Life Insurance represents a legitimate, financially strong insurance company specializing in retirement solutions. The company maintains excellent financial strength ratings from all major independent agencies. Despite recent ownership changes through the Prudential demerger, all policies remain fully protected and secure. Understanding available products, customer service channels, and state protections helps you make informed insurance decisions. Jackson National LifeInsurance Company continues evolving to meet changing retirement planning needs through product innovation. While challenges exist in the broader insurance industry, Jackson’s focused strategy and strong financial position support long-term success. Always work with licensed financial advisors who can explain complex annuity features and determine product suitability. Finally, remember that state guarantee associations provide backup protection offering peace of mind beyond company financial strength alone.

⚠️ Important Disclaimer: This article is for educational purposes only and should not be construed as legal, tax, or financial advice. Insurance regulations and tax laws are subject to change. Please consult with a licensed insurance agent, CPA, or Tax Attorney regarding your specific situation before making coverage decisions.

References

- LIMRA provides insurance industry research and statistics on market trends and company rankings.

- A.M. Best offers independent financial strength ratings for insurance companies nationwide.

- Moody’s delivers credit ratings and analysis for financial institutions including insurers.

- Standard & Poor’s publishes creditworthiness assessments and financial stability ratings.

- Fitch Ratings provides independent insurance company evaluations and risk assessments.

- Securities and Exchange Commission maintains public company filings including Jackson Financial documents.

- National Association of Insurance Commissioners offers consumer resources and regulatory information.

- Better Business Bureau tracks customer complaints and company accreditation status.

- Morningstar analyzes investment performance of annuity subaccounts and funds.

- ThinkAdvisor covers insurance industry news and market developments.

- New York State Department of Financial Services regulates insurers operating within New York.

- Prudential plc provides corporate announcements about strategic decisions and transactions.

- National Organization of Life & Health Insurance Guaranty Associations explains state protections for policyholders.