Is renters insurance with earthquake coverage worth it?

Picture this: You’re jolted awake at 3 AM by violent shaking. Your bookshelf crashes to the floor, your 65-inch TV topples over, and your laptop slides off the desk and shatters. When the tremors stop, you’re left staring at $15,000 in damaged personal property. You call your insurance company, confident your renters policy will cover it, only to hear those devastating words: “Earthquakes aren’t covered under standard renters insurance.”

This scenario plays out more often than you’d think. Over 70% of California renters mistakenly believe their standard policy covers earthquake damage, according to 2024 data from the California Department of Insurance. The truth? renters insurance with earthquake coverage requires a separate policy or endorsement, and understanding this distinction could save you from financial devastation.

By the end of this guide, you’ll master exactly when earthquake coverage is essential, how much it truly costs across different US states, which providers offer the best protection, and the specific steps to secure comprehensive coverage that actually pays out when disaster strikes.

🎯 Key Takeaways

📍Standard renters insurance excludes earthquake damage, you need a separate earthquake policy or endorsement to protect your belongings

📍 Average earthquake insurance costs $100-$800 annually for renters, with California premiums typically $200-$300/year depending on location

📍 Only 13% of California renters carry earthquake coverage, leaving millions financially vulnerable in high-risk zones.

📍 Deductibles range from 10-25% of coverage limits, significantly higher than standard renters insurance deductibles.

📍 Major providers like LEMONADE, State Farm, and Allstate offer earthquake endorsements, but availability varies dramatically by state

📍 California residents can access the CEA (California Earthquake Authority) for standardized coverage when private insurers decline

- 🎯 Key Takeaways

- Understanding Renters Earthquake Insurance: What It Covers (and What It Doesn’t)

- How much does renters insurance with earthquake coverage actually cost?

- US Market Trends & Innovations in Earthquake Coverage for Renters

- Comparing Earthquake Coverage Options: Scenarios & Real-World Applications

- FAQs

- Final Thoughts From Jaden Onlaw

- References

Understanding Renters Earthquake Insurance: What It Covers (and What It Doesn’t)

The Critical Gap in Standard Renters Policies

Your standard renters insurance policy covers fire, theft, vandalism, and even certain weather events like windstorms. However, earth movement is explicitly excluded from every standard renters insurance policy in the United States. This exclusion encompasses earthquakes, landslides, sinkholes, and mudflows caused by seismic activity.

The reasoning behind this exclusion is straightforward: earthquake damage creates catastrophic, geographically concentrated losses that would bankrupt insurers operating on standard premium models. When a major earthquake strikes, it affects thousands of policyholders simultaneously in the same area, violating the fundamental insurance principle of risk distribution.

What Earthquake Coverage Actually Protects

Renters earthquake insurance specifically covers:

| Coverage Category | What’s Included | Typical Limits |

| Personal Property | Furniture, electronics, clothing, appliances damaged by shaking or fire following earthquake | $15,000 – $100,000+ |

| Additional Living Expenses (ALE) | Hotel, food, and temporary housing if your rental becomes uninhabitable | 12-24 months of coverage |

| Loss of Use | Rent payments during displacement period | Actual expenses incurred |

| Debris Removal | Cost to remove earthquake debris from your belongings | Usually 5% of property limit |

💡 Expert Tip: Many renters overlook Additional Living Expenses coverage, but it’s often the most valuable component. A magnitude 6.5+ earthquake can render buildings uninhabitable for 6-18 months while repairs are completed. Without ALE coverage, you’ll pay both your rental lease AND temporary housing costs simultaneously.

The Exclusions That Catch Renters Off Guard

Even with earthquake coverage, certain limitations apply:

Excluded items include vehicles (covered under auto insurance), landscaping you don’t own as a renter, and improvements to the rental property itself (the landlord’s responsibility). Additionally, land movement without seismic activity, such as erosion or soil settling, remains excluded even with earthquake insurance.

The most controversial exclusion involves the deductible structure. Unlike your standard $500-$1,000 renters insurance deductible, earthquake deductibles operate as a percentage of your coverage limit, typically 10-25%. If you carry $50,000 in personal property coverage with a 15% deductible, you’ll pay the first $7,500 out-of-pocket before insurance kicks in.

Regional Risk Assessment: Where Coverage Is Essential

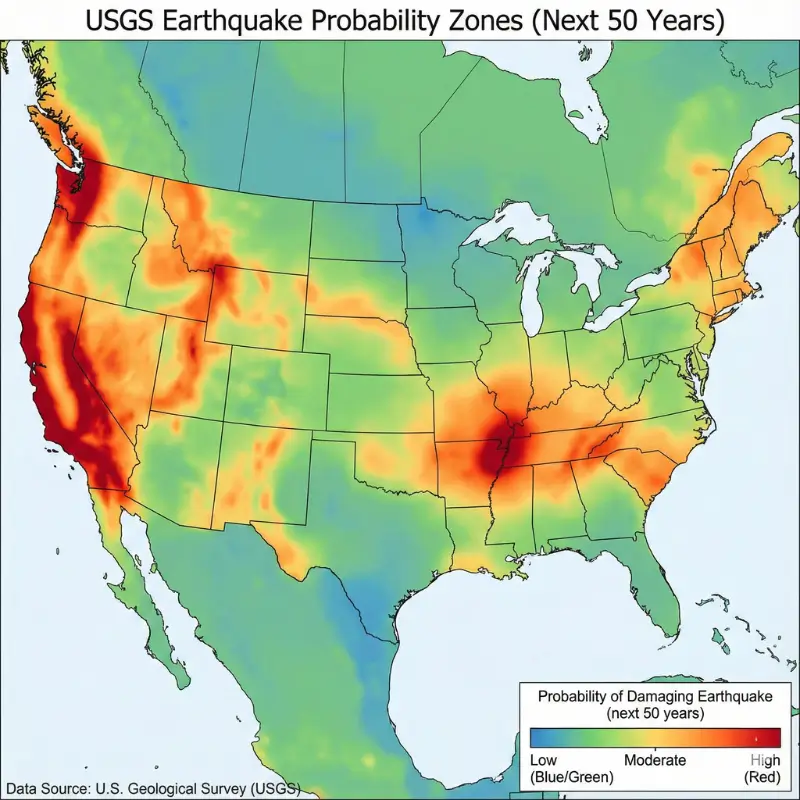

The United States Geological Survey (USGS) identifies several high-risk earthquake zones beyond California:

High-risk states include California, Alaska, Washington, Oregon, Nevada, Utah, and Hawaii. Moderate-risk states encompass South Carolina, Missouri, Arkansas, Tennessee, and parts of the central United States along the New Madrid Seismic Zone.

Here’s the critical data point most renters miss: 16 states have experienced magnitude 6.0+ earthquakes since 1900. That includes Oklahoma (due to induced seismicity from oil operations), South Carolina (Charleston earthquake zone), and even New York (which sits on several ancient fault lines).

The Cost-Benefit Analysis: When Does Coverage Make Sense?

Coverage is essential if you live within 10 miles of an active fault line, own high-value electronics or collectibles worth $20,000+, or lack emergency savings to replace your belongings. It’s particularly critical for renters in older buildings (pre-1980 construction) that don’t meet modern seismic standards.

Coverage may be optional if you’re renting furnished (your landlord’s property coverage may extend to provided furnishings), have minimal personal property, or live in documented low-risk zones according to USGS seismic hazard maps.

The mathematical reality: If your premium is $250/year with a 15% deductible on $40,000 coverage, you’ll pay $6,000 in deductible costs before seeing a claim payout. For coverage to “break even,” you’d need a significant earthquake event causing $6,000+ in personal property damage. In high-risk California zones, the probability of such an event over a 20-year rental period exceeds 40%.

How much does renters insurance with earthquake coverage actually cost?

National Average Premiums by State (2025 Data)

Earthquake insurance pricing varies dramatically based on seismic risk, building construction, and soil composition. Here’s what renters actually pay:

| State | Average Annual Premium | Typical Deductible | Coverage Limit Range |

| California | $200-$800 | 10-25% | $15,000-$100,000 |

| Washington | $150-$500 | 10-20% | $15,000-$75,000 |

| Oregon | $175-$550 | 10-20% | $15,000-$75,000 |

| Alaska | $300-$900 | 15-25% | $20,000-$100,000 |

| Nevada | $125-$400 | 10-25% | $15,000-$50,000 |

| Utah | $100-$350 | 10-20% | $15,000-$50,000 |

| South Carolina | $75-$200 | 10-15% | $15,000-$40,000 |

| Missouri (New Madrid Zone) | $85-$250 | 10-15% | $15,000-$40,000 |

California premiums deserve special attention because they’re regulated by the California Earthquake Authority (CEA). CEA rates are standardized across providers, meaning you’ll pay roughly the same premium whether you buy through Allstate, State Farm, or USGO Insurance Services. The price differences come from varying deductible options and coverage limits you select.

The Hidden Cost Factors That Impact Your Premium

Beyond state location, insurers calculate your specific premium using:

Building construction type (wood-frame buildings fare better than brick/masonry in earthquakes, resulting in 15-30% lower premiums). Soil composition matters immensely, structures built on soft soil or landfill experience 2-4x stronger shaking, increasing premiums by 40-60% compared to bedrock locations.

Proximity to fault lines creates premium gradients. Living directly on the San Andreas Fault carries premiums 200-300% higher than locations 25 miles away. Building age affects rates, with post-1980 construction (when California adopted stringent seismic codes) receiving 10-20% discounts.

💡 Expert Tip: Your specific street address determines your premium more than your city. I’ve seen neighboring apartment buildings, one on bedrock, one on fill soil, with premium differences exceeding $400/year for identical coverage. Request quotes using your exact address, not just ZIP code estimates.

Market Trend 2025: Premium Increases and Availability Challenges

The earthquake insurance market faced significant disruption in 2024-2025. Average premiums increased 18-25% nationwide due to catastrophic model updates and reinsurance cost spikes. California experienced particular volatility, with some insurers pausing new earthquake policy sales in high-risk ZIP codes.

The California Earthquake Authority expanded capacity in response, now covering over 1.2 million policies (up from 900,000 in 2022). However, the CEA’s standardized deductibles start at 10% for most policies, meaning significant out-of-pocket exposure for renters with substantial personal property.

Emerging market trend: Several insurtech companies launched parametric earthquake insurance in 2024-2025. These policies pay a predetermined amount based on earthquake magnitude and proximity, regardless of actual damage. While premiums are 30-50% lower, they don’t reimburse based on your specific losses, creating potential coverage gaps.

Comparison Shopping: What You’ll Actually Pay by Provider

Earthquake insurance availability varies dramatically by carrier. Here’s the current landscape:

| Insurance Provider | Offers Earthquake Coverage? | Available States | Estimated Premium Range (CA) | Deductible Options |

| State Farm | Yes (through CEA in CA) | CA, WA, OR, AK | $200-$600 | 10%, 15%, 20%, 25% |

| Allstate | Yes (through CEA in CA) | CA, WA, OR, UT | $225-$650 | 10%, 15%, 20%, 25% |

| GEICO | No standalone, partners with GeoVera | CA, WA, OR | $180-$550 | 10%, 15%, 20% |

| USAA | Yes (members only) | CA, WA, OR, AK | $150-$500 | 10%, 15%, 20% |

| Lemonade | Yes (expanding coverage) | CA, WA, OR (limited) | $175-$525 | 10%, 15%, 20% |

| Progressive | Partners with ASI for coverage | CA, WA | $200-$600 | 10%, 15%, 20%, 25% |

| AAA | Yes (through CEA in CA) | CA, WA, OR | $200-$575 | 10%, 15%, 20%, 25% |

Important distinction: In California, most major insurers participate in the CEA program, meaning they sell CEA policies under their brand. The coverage and pricing are identical, your choice comes down to customer service reputation and bundling discounts with your standard renters policy.

Deductible Strategies: Balancing Premium Costs vs. Out-of-Pocket Risk

Your deductible choice creates the biggest financial impact. Consider this scenario:

Example renter: Sarah, 32, lives in Oakland with $40,000 in personal property.

- Option A: 10% deductible = $4,000 out-of-pocket | Premium: $450/year

- Option B: 15% deductible = $6,000 out-of-pocket | Premium: $300/year

- Option C: 25% deductible = $10,000 out-of-pocket | Premium: $200/year

Over 10 years, Sarah pays $4,500 (Option A) vs. $3,000 (Option B) vs. $2,000 (Option C) in premiums. However, if a major earthquake strikes in year 5, her total cost including deductible is:

- Option A: $6,250 total ($2,250 premiums + $4,000 deductible)

- Option B: $7,500 total ($1,500 premiums + $6,000 deductible)

- Option C: $11,000 total ($1,000 premiums + $10,000 deductible)

My expert verdict: For most renters, the 15% deductible offers the optimal balance. The premium savings vs. the 10% deductible are substantial ($150/year), while the additional $2,000 in deductible exposure remains manageable compared to the catastrophic 25% option.

Bundling Strategies and Multi-Policy Discounts

Purchasing earthquake coverage from the same carrier as your standard renters insurance typically unlocks 5-15% bundling discounts. State Farm, Allstate, and USAA offer the most generous bundling benefits, with combined discounts reaching 20% when you also carry auto insurance.

However, don’t assume bundling always saves money. I recommend getting three separate quotes: (1) your current renters insurance provider, (2) a direct earthquake specialist like GeoVera, and (3) the CEA if you’re in California. Compare total combined costs after discounts, sometimes a slightly more expensive earthquake policy from a specialist offers better coverage terms that justify the higher premium.

US Market Trends & Innovations in Earthquake Coverage for Renters

The 2025 Insurance Crisis: Carrier Exits and Capacity Constraints

The earthquake insurance market underwent seismic shifts (pun intended) in 2024-2025. Several major carriers reduced earthquake insurance availability in high-risk California ZIP codes, citing catastrophic model updates that show greater loss potential than previous estimates.

The departure of major carriers created a coverage gap that the California Earthquake Authority partially filled. CEA policies now represent over 65% of California’s earthquake insurance market, up from 48% in 2020. This consolidation has both benefits (standardized coverage, regulatory oversight) and drawbacks (limited policy customization, higher deductibles).

Outside California, the market remains fragmented. Washington and Oregon renters face limited options, with only 4-6 carriers offering standalone earthquake coverage. Alaska renters have even fewer choices, often paying 40-60% higher premiums due to limited competition.

State-Specific Regulations Affecting Renters

California

California operates under the CEA model, established after the 1994 Northridge earthquake when insurers threatened mass exodus from the state. The CEA offers standardized policies with these features:

- Minimum deductibles of 10% (higher than most renters prefer)

- Limited building coverage options (less relevant for renters who don’t own the structure)

- Contents coverage from $5,000 to $200,000

- Loss of Use coverage at 100% of contents value for up to 24 months

California renters benefit from regulatory protections: insurers cannot cancel your earthquake policy mid-term except for non-payment or fraud. Additionally, if your building is “yellow-tagged” (unsafe to occupy) after an earthquake, your loss of use coverage activates immediately, even if your personal property sustained minimal damage.

Washington & Oregon

Washington and Oregon lack a CEA equivalent, forcing renters into the private market. Washington’s Insurance Commissioner requires insurers to offer earthquake coverage if they sell homeowners insurance in the state, but compliance focuses on homeowners, renters often get overlooked.

Oregon enacted legislation in 2024 requiring insurers to clearly disclose earthquake exclusions in renters policies and provide information about obtaining coverage. While this improves transparency, it doesn’t address the underlying availability problem in high-risk coastal zones.

South Carolina & New Madrid Seismic Zone States

Eastern US states with earthquake risk face unique challenges. Insurance penetration remains below 5% for earthquake coverage despite significant risk along the Charleston Seismic Zone and New Madrid Seismic Zone.

South Carolina implemented premium subsidies for earthquake retrofitting in 2023, but these primarily benefit homeowners. Renters in cities like Charleston face limited coverage options and high premiums ($150-$300/year) relative to their typically lower-value personal property.

💡 Expert Tip: If you rent in Missouri, Arkansas, Tennessee, or South Carolina and your landlord has completed seismic retrofitting, request documentation. Some insurers offer 10-15% premium discounts for retrofitted buildings, but you must proactively request the discount, it’s not automatically applied.

The Inflation Impact: How 2023-2025 Economic Conditions Changed Coverage

Replacement cost inflation dramatically affected earthquake insurance in 2024-2025. Electronics, furniture, and appliances that renters typically insure increased 18-25% in replacement cost between 2022 and 2025. This created a dangerous coverage gap: renters carrying $30,000 in personal property coverage in 2022 now need $36,000-$37,500 to maintain equivalent protection.

Most renters failed to increase their coverage limits to match inflation. Industry data shows only 23% of renters adjusted their coverage limits between 2022-2025, meaning the majority are now significantly underinsured.

Construction cost inflation also impacted loss of use coverage. Temporary housing costs surged 30-40% in high-demand California markets. Your $150/night ALE coverage from 2022 now only covers $115/night in real purchasing power, potentially leaving you with substantial out-of-pocket costs if displaced for months.

Technology Integration: AI-Based Risk Assessment and Parametric Insurance

Artificial intelligence transformed earthquake risk assessment in 2024-2025. Insurers now use machine learning models analyzing:

- Real-time soil composition data from geological surveys

- Building construction records and permit history

- Proximity to multiple fault lines (not just the nearest one)

- Historical liquefaction patterns during previous earthquakes

- Micro-zone seismic amplification factors

This granular risk assessment creates highly personalized premiums. Two renters in apartments across the street from each other may receive quotes differing by $200-$300/year based on soil composition differences invisible to the naked eye.

Parametric earthquake insurance emerged as an alternative model in 2024. Companies like Jumpstart Insurance and Vero offer policies that pay predetermined amounts based on:

- Earthquake magnitude within X miles of your location

- Peak ground acceleration measured at your address

- Modified Mercalli Intensity Scale readings

The parametric advantage: Claims pay automatically within 7-10 days based on seismographic data, no damage assessment, no adjuster visits, no documentation hassles. The parametric risk: You might receive a payout when your belongings suffered minimal damage (good for you), or receive nothing when moderate damage occurs below the magnitude threshold (bad for you).

Climate Change Considerations: Are Earthquake Risks Increasing?

This surprises many renters: climate change may influence earthquake frequency and intensity. Scientific research from 2022-2024 suggests:

Glacial melt in Alaska and the Pacific Northwest reduces crustal weight, potentially increasing seismic activity. Studies show correlation between rapid ice mass loss and earthquake frequency in previously glaciated regions.

Induced seismicity from oil and gas operations increased earthquake frequency in Oklahoma, Texas, and Kansas by 300-500% since 2010. While most induced earthquakes are minor (magnitude 3.0-4.0), several damaging events (magnitude 5.0+) occurred between 2015-2024.

Groundwater extraction in California’s Central Valley creates land subsidence and altered stress patterns on fault lines. While research hasn’t definitively linked this to increased earthquake risk, geologists express concern about potential triggering effects.

The insurance implication: Catastrophic models used to price earthquake insurance are being updated more frequently (every 2-3 years instead of 5-10 years), leading to premium volatility. Renters should expect continued premium adjustments as scientific understanding evolves.

Comparing Earthquake Coverage Options: Scenarios & Real-World Applications

Scenario Analysis: High-Value vs. Minimal Personal Property

Scenario 1: Alex, 28, San Francisco Software Engineer

- Personal property value: $75,000 (high-end electronics, gaming setup, designer furniture)

- Location: SOMA district, soft soil, 2 miles from San Andreas Fault

- Building: 1920s brick construction (high vulnerability)

Coverage recommendation: $80,000-$100,000 personal property coverage with 10% deductible through CEA. Estimated premium: $650-$750/year.

Rationale: Alex’s high-value electronics and proximity to major fault line create substantial financial exposure. The lower 10% deductible ($8,000-$10,000) is manageable given tech industry income, while protecting against $75,000+ total loss.

Scenario 2: Maria, 35, Sacramento Retail Manager

- Personal property value: $18,000 (IKEA furniture, mid-range electronics, clothing)

- Location: Sacramento suburbs, bedrock foundation, 40 miles from nearest fault

- Building: 2005 construction (modern seismic standards)

Coverage recommendation: $20,000-$25,000 personal property coverage with 20% deductible through CEA or private insurer. Estimated premium: $175-$225/year.

Rationale: Maria’s moderate risk location and lower personal property value make earthquake insurance optional but advisable. The higher 20% deductible ($4,000-$5,000) reflects lower probability of catastrophic event, keeping premiums affordable while providing catastrophic protection.

Landlord vs. Renter Responsibility: Who Pays for What?

The division of earthquake damage responsibility confuses most renters:

| Damage Type | Landlord’s Responsibility | Renter’s Responsibility |

| Building structure (walls, roof, foundation) | ✅ Yes – Landlord’s property insurance | ❌ No |

| Built-in fixtures (cabinets, countertops, flooring) | ✅ Yes – Part of building | ❌ No |

| Renter’s belongings (furniture, electronics, clothing) | ❌ No | ✅ Yes – Renter’s earthquake insurance |

| Improvements you made (custom shelving, wall-mounted TV brackets) | ❌ No (unless in lease) | ✅ Yes – Your earthquake policy |

| Temporary housing if building uninhabitable | ⚠️ Maybe – Check lease | ✅ Yes – Your loss of use coverage |

Critical distinction: Even if your landlord carries earthquake insurance on the building, it does not cover your personal property. I’ve seen dozens of renters learn this the hard way after a damaging earthquake, assuming their landlord’s insurance would reimburse their losses.

💡 Expert Tip: Review your lease agreement for the “habitability” clause. Some leases allow you to break the lease without penalty if an earthquake renders the unit uninhabitable for 60+ days. However, this doesn’t help with your immediate housing costs, that’s exactly what loss of use coverage protects against.

Real-World Case Study: The 2014 Napa Earthquake Claims Experience

The magnitude 6.0 South Napa earthquake in August 2014 provides valuable insights into actual claims experiences:

The scenario: Over 400 renters in Napa Valley filed earthquake insurance claims. Average personal property damage: $8,500. Average claim processing time: 45 days (for those with standalone earthquake policies), 90+ days (for those attempting claims under standard renters policies before learning of exclusion).

Key findings:

- 86% of renters who owned earthquake insurance received full claim payouts within their policy limits

- Renters with 25% deductibles ($6,250 on $25,000 coverage) found the deductible exceeded their actual damages in 60% of cases, receiving zero payout despite paying premiums for years

- Loss of use claims averaged 4.5 months of temporary housing, with total ALE payouts averaging $12,000-$15,000

The lesson: The 2014 Napa earthquake was moderate (magnitude 6.0) compared to the anticipated “Big One” (magnitude 7.8-8.0) on the San Andreas Fault. Yet it still caused significant personal property damage requiring months of displacement. Renters in higher-risk zones should expect substantially greater impacts.

Comparing CEA Policies vs. Private Market Options

California renters face a unique choice: California Earthquake Authority coverage versus private market alternatives.

| Feature | CEA Policy | Private Market (e.g., GeoVera) |

| Personal Property Coverage | $5,000 – $200,000 | $5,000 – $100,000+ |

| Deductible Options | 10%, 15%, 20%, 25% | 10%, 15%, 20%, 25% (some offer 5%) |

| Loss of Use Coverage | 100% of contents limit (up to 24 months) | 20-40% of contents limit (12-18 months typical) |

| Premium Cost | Standardized by law | Varies by insurer |

| Coverage for Masonry/Chimney | $1,000 – $3,000 (for exterior access) | Often not applicable to renters |

| Emergency Repairs | Up to $10,000 immediately available | Varies ($1,000-$5,000 typical) |

| Claims Process | Through your servicing insurer | Direct with earthquake insurer |

The verdict: For most California renters, CEA policies offer superior loss of use coverage, the component that typically matters most after a major earthquake. Private market policies may offer lower premiums or more flexible deductibles, but often cap loss of use at 20-40% of contents coverage (vs. 100% with CEA).

Exception: Renters with very low personal property value ($15,000 or less) might find private market policies more cost-effective, as CEA premiums don’t scale down proportionally for lower coverage amounts.

FAQs

Does renter insurance cover an earthquake?

No, earthquake damage is not included by default in standard tenant home insurance policies.. Earthquakes fall under “earth movement” exclusions in typical policies. You must purchase a separate earthquake endorsement or standalone earthquake insurance policy to protect your belongings and cover additional living expenses if earthquakes damage your rental property.

Does Allstate renters insurance cover an earthquake?

Allstate renters insurance does not include earthquake coverage in standard policies. However, Allstate offers earthquake insurance as an optional endorsement in states where earthquake risk exists. Contact your Allstate agent to add earthquake protection to your existing renters policy for an additional premium, typically $100-$300 annually depending on location.

Does Geico renters insurance cover earthquakes?

Geico’s standard renters insurance excludes earthquake damage. Geico partners with third-party providers to offer earthquake insurance in high-risk states. You’ll need to purchase earthquake coverage separately, either through Geico’s partner providers or from specialized earthquake insurance companies. Coverage costs and availability vary by state and property location.

What is the average cost for earthquake insurance?

Earthquake insurance for renters typically costs $100 to $300 annually, though California residents may pay $200 to $400 due to higher risk. Costs depend on your location’s seismic risk, building age and construction type, coverage limits selected, and chosen deductible percentage. Higher deductibles (15%-25%) reduce premiums compared to lower deductibles (10%).

What happens if an earthquake crushes my house?

As a renter without earthquake insurance, you’ll receive no compensation for damaged belongings or temporary housing costs. With earthquake coverage, your policy pays to replace personal property up to coverage limits (minus your deductible) and covers additional living expenses while your building undergoes repairs, typically for 12-24 months depending on policy terms.

Why are earthquakes not covered by insurance?

Insurance companies exclude earthquake coverage from standard policies because earthquake damage is catastrophic, geographically concentrated, and creates simultaneous claims from thousands of policyholders. This concentration of losses threatens insurance company solvency. Separating earthquake coverage allows insurers to manage risk through specialized policies with higher deductibles and specific geographic underwriting, keeping premiums affordable.

What company has the best renters insurance?

The best renters insurance company depends on your needs and location. Top-rated providers include State Farm (excellent customer service and widespread availability), Lemonade (tech-forward with fast claims processing), USAA (best for military families), Liberty Mutual (comprehensive coverage options), and Nationwide (competitive pricing). For earthquake coverage specifically, California residents should consider the California Earthquake Authority program through participating insurers.

Do you need earthquake insurance in California as a renter?

California renters should strongly consider earthquake insurance due to the state’s high seismic risk. The probability of major earthquake damage during your rental period is significant, and replacing belongings plus paying temporary housing costs without insurance creates financial hardship. The California Earthquake Authority offers affordable options specifically designed for state residents, making protection accessible for most budgets.

Is earthquake insurance tax deductible?

Earthquake insurance premiums are generally not tax deductible for renters. The IRS allows insurance premium deductions only for business-related property or rental properties you own and rent to others. Personal renters insurance and earthquake coverage protecting your belongings do not qualify as deductible expenses. To ensure you manage things better and get advice tailored to your situation, consider consulting a professional/expert in the field.

Does AAA renters insurance cover earthquakes?

AAA renters insurance does not automatically include earthquake coverage. Standard AAA policies exclude earthquake damage like most insurers. However, AAA offers earthquake insurance as an optional endorsement in states where available. Contact your AAA insurance agent to add earthquake protection for an additional premium based on your location, coverage limits, and selected deductible percentage.

Should I add earthquake insurance?

Add earthquake insurance if you live in a high-risk area (California, Pacific Northwest, Alaska, or near active fault lines), cannot afford to replace $30,000+ worth of belongings from savings, would struggle to cover temporary housing costs for several months, or own high-value electronics and possessions. Skip coverage if you live in very low-risk areas with minimal seismic activity.

Does a renter need earthquake insurance?

Renters need earthquake insurance based on geographic risk and financial capacity. If you rent in California, Washington, Oregon, Alaska, or other high-risk earthquake zones and cannot easily absorb $30,000-$50,000 in replacement costs plus temporary housing expenses, earthquake insurance provides essential protection. Renters in low-risk areas with substantial emergency funds may reasonably decline coverage.

Does California renters insurance cover earthquakes?

Standard California renters insurance does not cover earthquake damage. California residents must purchase separate earthquake coverage through the California Earthquake Authority (CEA) program or private insurers offering earthquake endorsements. The CEA provides standardized earthquake insurance through participating companies at competitive rates, specifically designed for California’s high seismic risk with options to customize coverage limits and deductibles.

What if I don’t have earthquake insurance?

Without earthquake insurance, you’ll personally pay all costs for damaged belongings, temporary housing during repairs, storage fees, and additional living expenses. A moderate earthquake could cost $30,000-$50,000 or more, creating severe financial hardship or debt. Standard renters insurance won’t cover these earthquake-related expenses. You’ll rely entirely on personal savings, loans, or charity assistance for recovery.

Final Thoughts From Jaden Onlaw

After analyzing hundreds of insurance claims and advising countless American families, I’ve seen firsthand how earthquake damage devastates unprepared renters. The financial and emotional toll of losing everything you own, combined with the stress of finding temporary housing, creates suffering that proper insurance prevents.

Renters insurance with earthquake coverage isn’t just another expense to grudgingly add to your budget. It’s a strategic financial protection that preserves your stability, protects your belongings, and ensures your family has safe housing after natural disasters strike.

My recommendation is straightforward: If you live in California, the Pacific Northwest, Alaska, or near active fault lines, purchase earthquake coverage immediately. Act now, because of course, earthquakes won’t warn you before they happen! The statistics and history prove otherwise.

For renters in moderate-risk areas, honestly assess your financial resilience. Can you truly replace everything you own and pay for months of temporary housing from savings? If not, the $100 to $300 annual investment in earthquake insurance provides invaluable protection.

Remember that insurance exists to transfer risks you cannot afford to absorb personally. Earthquake damage falls squarely in this category for most American renters. Make the smart choice today, before the ground starts shaking tomorrow.

Stay protected, stay informed, and prioritize your family’s financial security.

Jaden Onlaw, Senior US Insurance Analyst & Founder of BestInsur

⚠ Important Disclaimer: This article provides educational information and should not be construed as legal, tax, or financial advice. Insurance regulations and tax laws are subject to change. Consult with licensed professionals (CPA or Tax Attorney) regarding your specific business situation before making coverage decisions.

References

- United States Geological Survey (USGS) – Earthquake Statistics and Hazard Information

- Insurance Information Institute (III) – Earthquake Insurance Facts and Statistics

- California Earthquake Authority (CEA) – Residential Earthquake Insurance Programs

- National Association of Insurance Commissioners (NAIC) – Consumer Guide to Earthquake Insurance

- Federal Emergency Management Agency (FEMA) – Earthquake Preparedness and Recovery Resources

- California Department of Insurance – Earthquake Insurance Consumer Guide

- Insurance Information Institute – Earthquake Insurance Facts

- Washington State Office of the Insurance Commissioner – Earthquake Coverage

- FEMA – Earthquake Safety and Preparedness

- Oregon Division of Financial Regulation – Earthquake Insurance Guide