Commercial dump truck insurance : Don’t get caught unprotected

What happens when your dump truck causes severe property damage? Commercial dump truck insurance protects your business from catastrophic financial loss. Accidents, liability claims, and regulatory violations threaten dump truck operators daily across America. This comprehensive guide explores coverage essentials that every responsible fleet owner must understand. You’ll discover how proper insurance saves thousands in potential expenses. Learn about liability protection, cost optimization, and compliance requirements. Additionally, we cover emerging trends in the USA dump truck industry. By reading this article, you’ll gain actionable strategies for protecting your operation. Finally, you’ll understand how to choose providers offering reliable support.

🎯 Key Takeaways

Commercial dump truck insurance represents a critical investment protecting your business viability. Proper coverage ensures compliance with state regulations nationwide. Smart insurance planning reduces your overall operational costs significantly.

Your fleet’s success depends on comprehensive protection from liability exposure. Understanding insurance requirements prevents devastating financial consequences. Consequently, informed decisions about coverage directly impact profitability and longevity.

- 🎯 Key Takeaways

- Commercial dump truck insurance

- Dump truck liability insurance guide

- Coverage Costs for Dump Trucks

- Commercial dump truck insurance laws

- Dump truck liability insurance claims

- Essential Coverage Types Explained

- Commercial dump truck insurance rates

- Choosing the Right Insurance Provider

- Dump truck liability insurance requirements

- Risk Management for Dump Trucks

- Commercial dump truck insurance deductibles

- Claims Process Mastery

- Seasonal Coverage Adjustments

- FAQs

- Conclusion

- References

Commercial dump truck insurance

Rising Claims Threaten Your Business

Claims surge dramatically within the dump truck industry across America today. The Federal Motor Carrier Safety Administration reports increasing accident statistics yearly. Operating heavy equipment creates substantial liability exposure for your company. Your business faces mounting expenses from property damage and bodily injury claims. Recent data shows 2024 brought record-high settlement amounts nationwide. Construction sites and waste management operations experience constant accident risks. Without adequate protection, single incidents devastate small and mid-sized operators. Comprehensive commercial dump truck insurance safeguards your financial stability effectively. Your fleet operates in inherently dangerous environments requiring robust coverage. Therefore, addressing claims proactively prevents irreversible business consequences.

Comprehensive Coverage Protects Assets

Comprehensive commercial dump truck insurance covers numerous damage scenarios effectively. Your vehicles, equipment, and business income receive protection from unexpected losses. Physical damage coverage includes collision, comprehensive, and uninsured motorist protection. Liability coverage shields you from lawsuit expenses and settlement obligations. Workers’ compensation addresses employee injury costs on job sites. Commercial dump truck insurance policies protect your company’s most valuable assets. Coverage extends beyond your vehicles to include cargo and equipment. Additionally, specialized policies address unique construction industry risks specifically. Your fleet operates with confidence knowing financial backing exists. Therefore, robust coverage eliminates anxiety about catastrophic loss scenarios.

Secure Operations and Peace of Mind

Operating dump trucks requires constant vigilance regarding safety and compliance. Comprehensive commercial dump truck insurance provides essential business stability. Your team focuses on core operations without insurance-related stress. Protection allows you to negotiate contracts confidently with major clients. Liability coverage demonstrates credibility when securing new business opportunities. Peace of mind enables strategic growth planning for your company. Furthermore, proper insurance reflects professional business practices industry-wide. Employees work more effectively when operations feel secure and stable. Your reputation strengthens as clients recognize responsible risk management practices. Therefore, comprehensive coverage transforms insurance from expense into strategic advantage.

Dump truck liability insurance guide

Accidents Expose You to Costly Lawsuits

Single accidents generate litigation costs exceeding one million dollars frequently. Property damage claims multiply when your truck hits buildings or infrastructure. Bodily injury claims increase exponentially with serious worker injuries involved. Medical expenses, rehabilitation costs, and lost wages accumulate rapidly today.

Third-party liability lawsuits devastate unprepared operators across the United States. Your personal assets face seizure if inadequate coverage exists. Construction site accidents trigger complex litigation requiring expensive legal representation. Settlement negotiations favor well-insured defendants with strong financial backing available. Without dump truck liability insurance, bankruptcy becomes a realistic possibility. Moreover, lawsuits destroy business reputation and future contract opportunities. Therefore, liability protection represents non-negotiable business insurance fundamentally.

Liability Protection Shields Your Finances

Dump truck liability insurance covers legal fees and settlement expenses comprehensively. Your company avoids catastrophic financial consequences from accident-related lawsuits entirely. Coverage limits protect your business within established financial parameters effectively. Defense attorneys and legal experts receive full compensation through insurance. Settlement payments happen without draining operational cash reserves completely. Your creditors remain satisfied knowing insurance protects business continuity effectively. Additionally, liability protection attracts investors and lenders favorably. Banks consider well-insured operations as lower-risk investment opportunities significantly. Your business maintains financial stability despite unexpected accident scenarios. Therefore, liability coverage enables sustained business operations indefinitely.

Operate Confidently Without Fear

Dump truck liability insurance creates psychological confidence for operators nationwide. Your team focuses on work quality rather than accident anxiety. Bidding on lucrative contracts becomes possible with complete coverage evidence. Confidence improves decision-making and operational efficiency substantially throughout operations. Furthermore, worry-free operations reduce employee stress and turnover significantly. Your management team plans business growth strategies proactively and confidently. Coverage demonstrates responsibility to clients, regulators, and business partners alike. Accidents happen despite precautions, yet liability insurance provides security. Your business continues functioning smoothly even during claim investigations. Therefore, psychological benefits complement financial protection meaningfully.

Coverage Costs for Dump Trucks

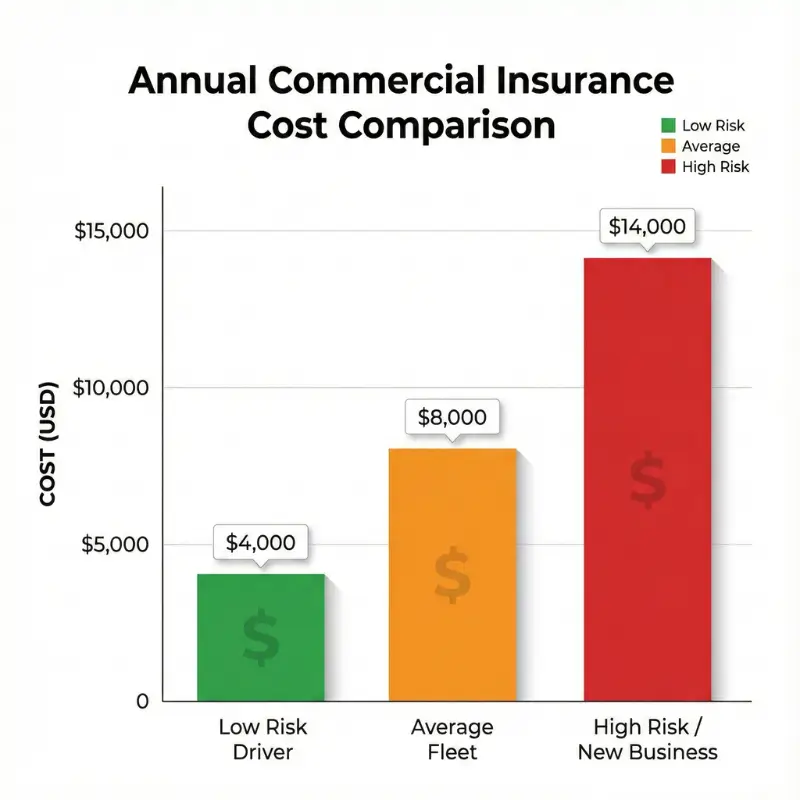

Premium Rates Skyrocket Unexpectedly

Commercial dump truck insurance premiums increase steadily across all USA markets. 2024 data from the National Association of Insurance Commissioners shows 15-25% increases nationally. Driver records, vehicle age, and cargo types influence rates dramatically. Accident history generates premiums increasing 50-100% over baseline rates. Market competition decreases as fewer insurers serve dump truck operations. Fuel surcharges and inflation directly impact insurance pricing calculations.

Furthermore, regulatory changes increase minimum coverage requirements increasingly nationwide. Weather-related claims spike during winter months across northern states. Your operating location determines premium rates based on regional statistics. Therefore, understanding rate drivers enables strategic cost management effectively.

Smart Shopping Saves Thousands Yearly

Competitive insurance shopping reduces premiums by 30-40% regularly nationwide. Obtaining multiple quotes takes minimal time yet yields substantial savings. Bundling commercial policies combines coverage for better rates considerably. Safety improvements, training programs, and maintenance lower your annual costs. Some insurers offer telematics discounts tracking driver behavior objectively. Equipment manufacturers provide insurance discounts for newer, safer vehicles. Professional associations often negotiate group rates for member companies. Additionally, increased deductibles reduce premiums when cash reserves permit. Annual policy reviews identify better options as circumstances change. Therefore, proactive shopping maintains competitive insurance costs sustainably.

Maximize Profits with Lower Costs

Reducing insurance expenses directly improves your bottom line immediately. A single truck operation saving 25% annually generates significant returns. Fleet operators managing 50 vehicles save substantial amounts yearly. Negotiated rates with insurers reward loyalty and safety improvements. Premium savings fund maintenance improvements and equipment upgrades effectively. Additional capital supports expansion and growth initiatives throughout operations. Furthermore, cost reduction improves competitiveness in bidding processes considerably. Your pricing becomes more attractive to clients without sacrificing quality. Profits increase as operational efficiency combines with reduced expenses. Therefore, insurance cost management directly strengthens business profitability.

Commercial dump truck insurance laws

State Regulations Confuse Truck Owners

Each USA state maintains distinct commercial truck insurance requirements mandatorily. Federal regulations establish minimum standards outlined by FMCSA guidelines. State-specific requirements exceed federal minimums in many jurisdictions. Liability limits vary from $750,000 to over $2,000,000 depending on location. Some states require additional coverage types beyond federal standards. Local municipalities impose supplemental regulations and permit requirements independently. Furthermore, requirements change periodically as legislatures update regulations. Staying informed requires continuous monitoring of regulatory changes nationwide. Non-compliance triggers fines, license suspension, and business closure penalties. Therefore, understanding applicable regulations prevents devastating legal consequences.

Expert Guidance Ensures Compliance

Insurance brokers specializing in commercial trucking provide essential guidance effectively. Legal consultants familiar with state regulations clarify compliance requirements thoroughly. Professional associations distribute updated information regarding regulatory changes continuously. Your insurance agent verifies compliance with current state requirements. Documentation systems track coverage status and policy renewals systematically. Furthermore, compliance programs prevent regulatory violations and associated penalties. Brokers familiar with your specific operation offer customized guidance. State insurance departments provide compliance information through official websites. Industry conferences share best practices for regulatory compliance efforts. Therefore, expert guidance ensures your business remains fully compliant.

Avoid Devastating Fines and Penalties

Regulatory violations generate fines ranging from $5,000 to $50,000 frequently. Operating without required insurance carries criminal penalties in many states. License suspension destroys business operations indefinitely when discovered. Court appearances consume management time and resources substantially. Reputation damage from legal violations affects future business opportunities. Customers avoid companies with compliance histories or legal troubles. Furthermore, employees question business stability when regulatory issues emerge. Insurance companies may exclude coverage for non-compliant operations. Investment opportunities disappear when regulatory violations appear in records. Therefore, compliance prevents cascading negative consequences for operations.

Dump truck liability insurance claims

Claim Denials Destroy Your Revenue

Insurance claim denials eliminate expected financial recovery when accidents occur. Unexpected expenses strain cash reserves and operational capability significantly. Your business may face bankruptcy following major accidents without recovery. Denied claims force you to pay damages from personal funds. Revenue loss accelerates when operations cannot continue normally afterward. Employee payroll continues despite reduced income from operational disruptions. Additionally, contractor obligations continue regardless of financial difficulties. Customers may pursue breach of contract claims simultaneously. Business reputation suffers when you cannot fulfill contractual obligations. Therefore, claim denials represent catastrophic business disruptions.

Proper Documentation Guarantees Payouts

Comprehensive accident documentation supports successful claim resolution significantly. Photographs, witness statements, and police reports establish clear liability. Medical records document injuries and associated treatment expenses thoroughly. Repair estimates verify actual damage and replacement costs accurately. Detailed incident reports explain circumstances surrounding accidents completely. Furthermore, maintaining organized documentation systems expedites claim processing. Policy holders who document thoroughly rarely face denial challenges. Insurance adjusters process well-documented claims more rapidly and favorably. Records demonstrate transparency and cooperation throughout investigation processes. Therefore, meticulous documentation ensures successful claim resolution.

Recover Losses and Rebuild Faster

Approved claims provide timely financial recovery enabling business continuity. Your operations resume quickly when insurance covers accident-related damages. Employee income continues without interruption following covered incidents. Customers receive consistent service despite temporary operational disruptions. Furthermore, quick recovery prevents financial penalties from contract violations. Your business reputation strengthens when you manage crises professionally. Cash flow stabilization allows continued investment in fleet maintenance. Growth initiatives resume after financial recovery from accidents. Your competitive position remains strong during recovery periods. Therefore, efficient claims processing enables rapid business recovery.

Essential Coverage Types Explained

Gaps in Policies Create Vulnerabilities

Incomplete insurance coverage exposes your business to substantial risks. Overlooked liability scenarios leave financial exposure uncovered adequately. Coverage gaps emerge when policies use narrow definitions. Your business operates in multiple risk scenarios regularly nationwide. Standard policies often exclude construction-specific hazards intentionally. Environmental liability from spilled materials requires specialized coverage. Furthermore, cargo-related damages need specific protection mechanisms. Employee-related incidents require workers’ compensation coverage separately. Property damage beyond covered scenarios creates financial exposure. Therefore, comprehensive policies eliminate dangerous coverage gaps.

| Coverage Type | Primary Protection | Typical Limits |

| General Liability | Third-party injuries/property damage | $1M-$2M |

| Commercial Auto Liability | Vehicle-caused accidents | $1M+ |

| Workers’ Compensation | Employee injuries | Statutory |

| Physical Damage | Vehicle/equipment damage | Actual value |

| Cargo Liability | Cargo-related damages | $50K-$500K |

Comprehensive Plans Eliminate Blind Spots

Comprehensive policies cover diverse scenarios your operation encounters regularly. Bundled coverage addresses multiple risk categories within single plans. Extended protection includes emergency services and roadside assistance. Your vehicles receive protection from theft, vandalism, and weather damage. Moreover, specialized endorsements address unique industry-specific risks effectively. Equipment breakdown coverage protects expensive machinery from mechanical failure. Contingent liability protects you when subcontractors cause accidents. Environmental liability covers accidental spill cleanup and contamination. Policy limits match your actual operational exposure comprehensively. Therefore, comprehensive plans provide complete business protection.

Protect Every Aspect of Operations

Complete coverage protects your entire business operation effectively. Vehicles, equipment, facilities, and personnel all receive protection. Revenue interruption insurance maintains income during forced operational shutdowns. Product liability protects you from material-related damages or defects. Completed operations coverage extends protection after project completion. Your business reputation receives protection through crisis management services. Additionally, legal defense coverage provides representation without personal cost. Cyber liability protects digital information and business systems. Directors and officers liability protects your management team. Therefore, comprehensive coverage protects your entire business ecosystem.

Commercial dump truck insurance rates

Hidden Factors Inflate Your Premiums

Complex rating factors drive insurance costs beyond obvious variables. Vehicle weight and configuration significantly impact rate calculations. Driver age and experience directly influence premium determination. Driving records reveal accident and violation history transparently. Operating radius affects claims frequency based on regional data. Cargo type determines risk levels associated with specific loads. Additionally, equipment modifications increase or decrease risk profiles. Safety equipment installation qualifies for premium discounts frequently. Maintenance records demonstrate responsible vehicle care practices. GPS tracking and monitoring technology qualifies for rate reductions. Therefore, understanding hidden factors enables strategic rate management.

Strategic Choices Reduce Insurance Costs

Selecting appropriate coverage limits balances protection with affordability. Choosing higher deductibles reduces premiums when cash permits. Professional driver training qualifies for substantial premium discounts. Fleet modernization with newer vehicles reduces accident rates. Installing advanced safety systems qualifies for insurance discounts. Maintaining excellent driving records preserves favorable rates indefinitely. Furthermore, bundling coverages with single insurers provides rate advantages. Loyalty discounts reward long-term relationships with insurance providers. Claims-free records qualify drivers for premium reductions periodically. Strategic partnerships with safety equipment manufacturers yield benefits. Therefore, intentional choices optimize insurance cost structures.

Boost Bottom Line with Savings

Insurance cost reduction directly improves profit margins meaningfully. Fleet operations realize significant savings across multiple vehicles. A ten-truck operation saving $500 monthly saves $60,000 yearly. Larger operations achieve proportionally greater savings through economies. Cost reductions improve competitive bidding capabilities substantially. Lower operational costs enable expanded service areas profitably. Furthermore, savings fund fleet expansion and modernization investments. Technology improvements reduce future claims and accident rates. Your business achieves financial goals faster with cost savings. Therefore, insurance optimization directly strengthens profitability.

Choosing the Right Insurance Provider

Wrong Insurers Delay Critical Payments

Poor insurer selection results in slow claim processing. Inadequate support staff delays communication during critical periods. Complex claims procedures frustrate frustrated policyholders extensively. Limited coverage options force you into inflexible arrangements. Underfunded companies struggle processing large claims effectively. Furthermore, inexperienced adjusters mishandle specialized construction claims. Regional insurers lack national support infrastructure and resources. Online-only providers offer minimal personal assistance when needed. Claims denial rates indicate poor policyholder relationship practices. Therefore, insurer selection dramatically impacts claim satisfaction outcomes.

Trusted Carriers Deliver Prompt Service

Established insurers maintain robust claims processing infrastructure nationwide. Professional adjusters familiar with construction industries handle claims expertly. 24/7 support services address urgent issues immediately and effectively. Dedicated account managers provide personalized service throughout relationships. Rapid response teams deploy quickly to accident sites. Furthermore, transparent communication keeps policyholders informed continuously. Technology platforms enable online claims tracking and documentation. Mobile applications simplify policy management and renewal processes. Customer service representatives resolve issues knowledgeably and professionally. Therefore, trusted carriers provide superior policyholder experiences.

Maintain Cash Flow During Crises

Prompt payment maintains operational continuity during emergencies. Quick settlements enable rapid vehicle repairs and replacements. Revenue flow continues despite accident-related operational disruptions significantly. Employee compensation proceeds without interruption or complications. Supplier relationships remain strong when payments continue normally. Your business maintains creditworthiness through consistent financial performance.

Furthermore, avoided cash flow interruptions prevent expensive borrowing needs. Working capital requirements decrease when claims pay promptly. Operational momentum continues despite temporary incident disruptions. Therefore, reliable insurers maintain business financial stability effectively.

Dump truck liability insurance requirements

Missing Coverage Triggers Legal Troubles

Operating without required insurance violates federal transportation regulations. Criminal charges result from willful regulatory non-compliance. License suspension prevents any legal commercial operations indefinitely. Vehicle impoundment creates immediate operational disruptions completely. Fines accumulate quickly, reaching thousands of dollars daily. Furthermore, civil lawsuits proceed without insurance protection available. Personal asset seizure becomes possible through judgment collection. Bankruptcy emerges as realistic outcome following major incidents. Criminal records damage professional reputation irreparably. Future business opportunities disappear following regulatory violations. Therefore, maintaining required coverage prevents legal catastrophes.

Complete Protection Meets All Standards

Comprehensive policies satisfy all federal and state requirements completely. Minimum liability limits comply with DOT regulations nationally. Additional state-mandated coverage provisions receive full inclusion. Policy language reflects current regulatory requirements explicitly. Endorsements address jurisdiction-specific compliance needs thoroughly. Furthermore, coverage updates automatically reflect regulatory changes. Compliance documentation provides evidence during routine inspections. Certificate of insurance verifies compliance conveniently and instantly. Policy reviews ensure ongoing compliance as regulations evolve. Therefore, complete coverage ensures full legal compliance.

Secure Contracts and Partnerships

Major clients require proof of adequate insurance coverage. Bonding requirements mandate comprehensive insurance backing. Government contracts demand minimum coverage levels strictly. Corporate clients verify insurance status before engaging services. Your credibility improves demonstrating complete regulatory compliance. Moreover, partnerships strengthen through transparent insurance practices. Joint ventures require participating companies maintain adequate coverage. Subcontracting relationships depend upon verified insurance evidence. Bid requirements specify minimum coverage levels explicitly. Therefore, complete coverage enables lucrative business relationships.

Risk Management for Dump Trucks

Preventable Incidents Drain Your Profits

Accidents generate substantial financial losses beyond insurance considerations. Operational downtime prevents revenue generation during repairs. Employee injuries reduce workforce availability and productivity. Customer dissatisfaction follows service interruptions and delays. Reputation damage affects future business opportunities significantly. Furthermore, safety violations attract regulatory scrutiny and penalties. Increased premiums follow accidents regardless of insurance coverage. Legal expenses accumulate through injury litigation processes. Workers’ compensation claims increase long-term premium costs. Therefore, accident prevention protects profitability directly.

Safety Programs Lower Insurance Costs

Comprehensive safety training qualifies for insurance premium discounts. Driver certification programs demonstrate commitment to risk reduction. Equipment maintenance schedules prove responsible asset management practices. Furthermore, safety equipment installation qualifies for rate reductions. Accident prevention records warrant favorable renewal pricing terms. Driver monitoring systems document safe operating practices effectively. Safety compliance audits verify program effectiveness objectively. Regular inspections identify potential hazards before incidents occur. Employee wellness programs reduce workplace injury frequency significantly. Therefore, safety investments generate attractive insurance savings.

Build Reputation as Reliable Operator

Safety records attract premium clients seeking reliable contractors. Insurance compliance demonstrates professional business practices clearly. Safety certifications distinguish your company from competitors. Customer testimonials highlight reliable and professional service delivery. Insurance ratings influence contract awards and project selection. Moreover, reputation for safety enables competitive bidding advantages. Clients prefer contractors with proven safety track records. Safety-first operations command premium pricing power legitimately. Long-term client relationships develop through consistent safety practices. Therefore, reputation investment yields sustained business benefits.

Commercial dump truck insurance deductibles

High Deductibles Strain Emergency Funds

Large deductibles create immediate cash flow challenges during claims. Emergency funds deplete rapidly when large deductibles apply. Working capital becomes tied up in deductible payments. Short-term financing needs emerge unexpectedly following accidents. Interest expenses increase borrowing costs substantially during crises. Furthermore, high deductibles reduce accessibility to insurance benefits. Small businesses struggle meeting substantial deductible payment obligations. Cash reserves designated for operations deplete through deductible payments. Growth investments postpone indefinitely due to emergency fund depletion. Therefore, high deductibles create financial hardship during emergencies.

Balanced Options Protect Your Budget

Moderate deductibles balance affordability with manageable financial obligations. Strategic deductible selection prevents excessive premium payments. Your cash position determines appropriate deductible level selection. Emergency reserves remain adequate for business continuity. Deductible amounts align with realistic financial capacity. Furthermore, balanced deductibles maintain reasonable monthly premium payments. Flexible options accommodate varying business financial situations. Claims become accessible without devastating personal financial impact. Operational stability continues despite accident-related financial obligations. Therefore, balanced deductibles provide practical financial protection.

Weather Unexpected Financial Storms

Adequate reserves enable deductible payment during financial emergencies. Emergency funds provide essential financial stability during crises. Deductible payments proceed without disrupting normal operations. Employee compensation continues through financial challenges. Supplier relationships remain strong through consistent payments. Your business reputation reflects financial stability and reliability. Moreover, financial stress reduces during crisis periods substantially. Management focuses on recovery rather than financial panic. Business continuity proceeds smoothly despite temporary disruptions. Therefore, adequate financial reserves ensure business resilience.

Claims Process Mastery

Confusing Procedures Delay Your Payments

Complex claim processes frustrate policyholders and delay resolutions. Unclear requirements result in incomplete documentation submissions. Back-and-forth communication extends processing timelines unnecessarily. Misunderstandings regarding policy provisions cause payment delays. Inadequate guidance leaves policyholders confused about procedures. Furthermore, documentation mistakes require resubmission consuming time. Multiple insurance adjusters create communication inconsistencies and confusion. Unclear timelines leave policyholders uncertain about payment schedules. Frustration mounts during extended claim investigation processes. Therefore, understanding procedures prevents unnecessary delays.

Step-by-Step Knowledge Speeds Resolution

Documented procedures outline specific claim submission requirements clearly. Understanding policy language facilitates faster claim processing success. Proper documentation compilation eliminates request-response delays. Preemptive communication clarifies requirements before misunderstandings emerge. Following procedures precisely accelerates approval processes significantly. Furthermore, organized records enable rapid adjuster reviews. Clear communication prevents interpretation disputes about incidents. Proactive follow-up keeps claims progressing toward resolution. Digital submission options expedite processing considerably versus mailing. Therefore, procedural knowledge enables rapid claim resolution.

Return to Work Without Interruption

Prompt settlements restore operational capability quickly. Rapid vehicle repairs enable speedy return to work. Revenue generation continues minimizing financial disruption impact. Employee morale improves following financial crisis resolution. Customer obligations continue fulfillment without extended delays. Your business maintains competitive position through continuity. Moreover, momentum continues despite temporary incident disruptions. Operational efficiency resumes following rapid claim resolution. Growth initiatives restart following financial stabilization. Therefore, efficient claims processing enables business continuity.

Seasonal Coverage Adjustments

Winter Hazards Multiply Accident Risks

Cold weather conditions increase accident frequency substantially nationwide. Ice and snow create hazardous driving conditions regularly. Winter precipitation reduces visibility and vehicle control significantly. Equipment freezes causing operational breakdowns and delays. Road salt damage accelerates vehicle corrosion and degradation. Furthermore, winter accidents generate increased claim frequency patterns. Northern states experience elevated accident risks seasonally. Specialized equipment becomes necessary for winter operations. Coverage adjustments address elevated winter risk exposure. Therefore, seasonal considerations require coverage modifications.

| Season | Primary Risk | Recommended Coverage Adjustment |

| Winter | Ice/snow, visibility, equipment failure | Increase liability limits, add emergency coverage |

| Spring | Flooding, washouts, debris | Add environmental liability endorsement |

| Summer | Heat damage, overload capacity | Verify physical damage coverage levels |

| Fall | Reduced visibility, leaf debris | Confirm comprehensive coverage applicability |

Flexible Policies Adapt to Conditions

Seasonal policy adjustments modify coverage matching operational changes. Coverage increases during high-risk seasons protect adequately. Temporary endorsements address specialized seasonal equipment needs. Flexibility enables cost-effective coverage throughout operational year. Reduced coverage during lower-risk periods lowers costs. Furthermore, adjustments align with actual operational patterns. Storage adjustments apply during seasonal operational shutdowns. Equipment additions require coverage modifications immediately. Staffing changes necessitate workers’ compensation adjustments. Therefore, flexible policies optimize coverage and costs.

Stay Protected Year-Round Profitably

Annual coverage optimization balances protection with affordability. Comprehensive planning addresses diverse seasonal operational requirements. Strategic adjustments prevent coverage gaps during transitions. Your operations remain protected regardless of seasonal variations. Cost management strategies reduce overall annual insurance expenses. Moreover, coverage remains complete throughout operational year. Financial planning incorporates seasonal adjustment costs. Profitability improves through optimized coverage strategies. Business stability continues through seasonal variations. Therefore, year-round planning ensures sustained protection.

FAQs

What is the minimum commercial dump truck insurance required?

Federal law mandates $750,000 minimum liability coverage. State requirements often exceed this baseline amount. Your specific operation may require additional coverage types.

How much does commercial dump truck insurance cost?

Premium costs range from $1,500 to $8,000 yearly. Factors including vehicle age, driver record, and location determine costs. Obtaining multiple quotes identifies competitive pricing options.

Can I reduce my insurance premiums?

Yes. Safety training, vehicle maintenance, and claims-free records qualify for discounts. Bundling policies and increasing deductibles also reduce costs significantly.

What does dump truck liability insurance cover?

Coverage addresses third-party bodily injuries and property damage. Legal defense costs and settlement payments receive inclusion. Coverage extends to accidents occurring during commercial operations.

How long does a commercial truck insurance claim take?

Claims typically resolve within 30-90 days nationwide. Straightforward accidents settle faster than complex incidents. Prompt documentation submission accelerates processing significantly.

Do I need coverage during seasonal shutdowns?

Yes. Covered vehicles require continuous protection legally. Storage-specific coverage reduces rates during non-operational periods.

Conclusion

Commercial dump truck insurance represents essential business protection fundamentally. Comprehensive coverage protects assets, ensures legal compliance, and enables growth. Understanding liability insurance requirements prevents devastating financial consequences. Strategic shopping identifies cost-effective options without sacrificing protection. Proper risk management combines insurance with safety initiatives effectively. Balanced deductibles protect financial stability during emergencies. Expert guidance from brokers ensures complete regulatory compliance. Your business thrives when comprehensive protection enables confident operations. Investing in quality insurance builds sustainable, profitable dump truck operations. Therefore, prioritize insurance planning as cornerstone of business strategy.

⚠️ Important Disclaimer: This article is for educational purposes only and should not be construed as legal, tax, or financial advice. Insurance regulations and tax laws are subject to change. Please consult with a licensed insurance agent, CPA, or Tax Attorney regarding your specific situation before making coverage decisions.

References

- Federal Motor Carrier Safety Administration provides official commercial truck safety standards and compliance requirements nationally.

- National Association of Insurance Commissioners offers comprehensive insurance data and state regulatory requirements information.

- American Trucking Associations delivers industry-specific insurance guidance and best practices.

- Department of Transportation establishes federal regulations governing commercial vehicle