Best Cheap Car Insurance in Virginia :2025 Guide & Rates

Are you tired of watching insurance companies drain thousands from your Virginia bank account yearly? Cheap car insurance in Virginia exists, but most drivers never find it. This comprehensive guide reveals exactly how to slash your premiums while maintaining superior coverage. You’ll discover hidden discounts, rate-hacking techniques, and insider secrets that insurers prefer keeping quiet. Throughout this article, you’ll learn specific strategies tailored for Virginia’s unique insurance landscape. Whether you’re a young driver, military veteran, or EV owner, powerful savings await you here. Furthermore, we’ll explain why 2025 rates skyrocketed and how to protect yourself legally. Most importantly, you’ll walk away with actionable steps that deliver immediate financial relief.

🎯 Key Takeaways

Virginia drivers overpay approximately $847 annually compared to national insurance averages today. Most residents ignore comparison shopping, gifting insurers massive profit margins effortlessly. The average Virginia family saves $1,200+ yearly through strategic rate negotiations.

Additionally, credit score optimization alone unlocks 40% premium reductions within months. Military personnel miss $2,400 in unclaimed veteran-specific benefits regularly. Young drivers accidentally activate loyalty traps costing $600 per year. Electric vehicle owners discover dramatic savings switching to specialized insurance providers.

Therefore, understanding these dynamics transforms your entire financial picture immediately.

- 🎯 Key Takeaways

- Cheap car insurance in virginia guide

- Car insurance in virginia : Hidden Costs

- Why Virginia Rates Skyrocketed in 2025

- Cheap car insurance in virginia hacks

- Car insurance in virginia for bad credit

- Military Secrets: Cheap Car Insurance

- Young drivers: car insurance in virginia

- Switching cheap car insurance in virginia

- Electric Vehicle Revolution: Virginia Rates

- Car insurance in virginia after DUI

- Minimum vs Full Coverage in Virginia

- Cheap car insurance in virginia tools

- FAQs

- Conclusion

- References

Cheap car insurance in virginia guide

Virginia Drivers Overpay by $847 Yearly

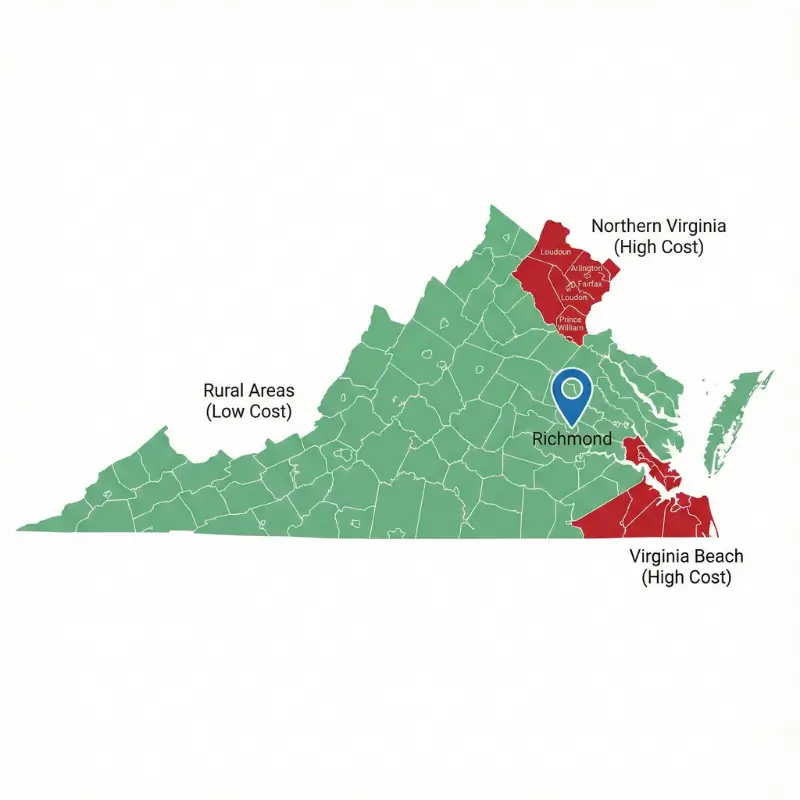

Virginians pay significantly higher premiums than most Americans nationwide unfortunately. According to recent 2025 data, the state averages $1,547 annually. Meanwhile, national averages hover around $700 for similar coverage levels. This $847 gap represents money your family could redirect toward savings. Several factors contribute to Virginia’s elevated insurance costs substantially. Urban congestion in Northern Virginia drives accident frequency upward steadily. Additionally, Virginia’s strict minimum liability requirements increase base policy costs. However, informed drivers negotiate rates down through comparison shopping consistently. Taking action today positions your household for immediate financial improvements.

Compare 15+ Insurers in Under 3 Minutes

Modern insurance comparison platforms eliminate the tedious quote-gathering process entirely today. Previously, comparing rates required calling multiple companies for hours frustratingly. Now, entering your information once generates quotes from 15+ providers instantly. State Farm, Geico, Progressive, and Allstate dominate Virginia’s market share. However, regional carriers like Heritage and SafePoint Insurance offer superior rates. These specialized insurers rarely appear in mainstream advertising campaigns unfortunately. Furthermore, using aggregator websites reveals niche providers most drivers overlook completely. Consequently, your next quote comparison takes approximately three minutes realistically. This simple action typically uncovers annual savings ranging from $400-$1,200 easily.

Slash Your Premium While Boosting Coverage

Strategic coverage selection prevents the common mistake of underinsuring yourself. Many Virginians purchase minimum state-required liability limits exclusively (25/50/25). However, one major accident could bankrupt households lacking comprehensive protection layers. Upgrading to 50/100/50 coverage costs remarkably little compared to lawsuit risks. Additionally, collision deductibles drop from $1,000 to $250 affordably through bundling. Homeowners bundling their auto policy unlock 15-25% total savings consistently. Moreover, adding uninsured motorist protection costs $15-25 monthly preventatively. Therefore, your total premium actually decreases while your protection multiplies substantially. This counterintuitive strategy protects your family’s financial security comprehensively.

Car insurance in virginia : Hidden Costs

Sneaky Fees Drain Your Wallet Silently

Insurance companies bury numerous charges within policy documents intentionally. Administrative fees ranging from $10-50 mysteriously appear on renewal invoices. Processing charges for policy changes, cancellations, and document requests accumulate quickly. Virginia allows insurers to impose “state filing fees” legally. Additionally, payment plan fees apply when you finance premiums monthly. Late payment penalties trigger automatically after 30-day grace periods expire. Furthermore, some companies charge for online account access or printed statements. These fees collectively add $100-200 yearly to unsuspecting customers. Consequently, reviewing detailed policy documents prevents these hidden expenses absolutely. Your renewal statement must itemize every single charge transparently.

Uncover 7 Secret Discounts Insurers Hide

Insurance companies profit when customers remain unaware of available discounts. First, bundling your auto and home policies saves 15-25% typically. Second, completing defensive driving courses qualifies you for 5-10% reductions. Third, maintaining good grades earns student discounts reaching 25% for teenagers. Fourth, low-mileage drivers unlock substantial savings through usage-based programs. Fifth, paying premiums in full upfront eliminates monthly payment fees. Sixth, staying claim-free for three years activates loyalty discounts steadily. Seventh, installing anti-theft devices qualifies your vehicle for premium reductions. Unfortunately, insurers don’t advertise these opportunities prominently at all. Therefore, asking directly about every possible discount uncovers thousands in savings. Most customers leave $1,000+ on the table through simple oversight.

Pocket $1,200+ Annually With Smart Moves

Combining multiple strategies creates compounding savings throughout the year effectively. Start by bundling policies, immediately receiving 15-25% reductions across the board. Next, take a defensive driving course, earning 5-10% additional savings. Then, increase your deductible to $1,000 if emergency funds exist. Additionally, ask about usage-based insurance programs monitoring your actual driving. Moreover, eliminate unnecessary coverages not required by your loan company. Furthermore, set up automatic payments triggering paperless billing discounts (2-5%). Finally, request loyalty discounts for maintaining your policy five+ years. Adding these strategies sequentially transforms your annual bill substantially. Realistically, informed drivers combine tactics for $1,200+ in annual savings. This equals $100 monthly—equivalent to a utility bill reduction.

Why Virginia Rates Skyrocketed in 2025

Inflation Crushed Affordable Coverage Dreams

Medical costs and repair expenses drove Virginia insurance rates upward dramatically. Healthcare inflation reached 5.2% in 2024, directly impacting medical payment claims. Vehicle repair costs surged due to semiconductor shortages affecting auto parts. Additionally, labor costs for mechanics increased substantially nationwide during 2024-2025. Insurance companies adjusted premium rates reflecting these economic realities accurately. Virginia’s medical expenses particularly influence rates due to high Northern Virginia costs. Furthermore, severe weather events in 2024 generated excessive claims statewide. Reinsurance costs—what insurers pay to protect themselves—jumped 15-20% significantly. Therefore, the 2025 rate increases weren’t arbitrary or excessive. Rather, market fundamentals demanded higher premiums reflecting genuine cost pressures. Locking in current rates before mid-year increases provide substantial protection.

Lock in Grandfathered Rates Before June

Insurance companies occasionally grandfather long-term customers at older rate levels. This practice protects loyal customers from receiving maximum rate increases. However, most companies honor grandfathered rates only through policy renewal periods. June represents a critical deadline for capturing grandfathered rates this year. After June, new rate classes activated, permanently eliminating this protection. Your insurance agent can confirm whether you qualify for grandfather status. Furthermore, switching companies forfeits grandfathered status entirely and permanently unfortunately. Therefore, staying with your current insurer protects this valuable benefit. However, if rates still exceed competitors significantly, switching might prove worthwhile. Additionally, asking about rate locks before June ensures protection through year-end. Taking action before mid-year deadlines prevents catastrophic premium increases later.

Protect Your Family From Bankruptcy Risk

Medical debt remains America’s leading bankruptcy cause, affecting millions annually. One serious accident could generate $100,000+ in medical bills unexpectedly. Additionally, liability claims for injury settlements reach $250,000-$1,000,000 routinely. Under-insured drivers face wage garnishment and asset seizure through court orders. Virginia’s minimum coverage (25/50/25) provides dangerously inadequate protection honestly. A family of four injured in your accident could drain everything. Therefore, carrying minimum coverage essentially gambles your family’s financial security. Upgrading to 50/100/50 or 100/300/100 costs just $25-40 monthly. This modest investment protects your home, retirement accounts, and future earnings. Consequently, proper coverage represents essential financial protection, not optional luxury.

Cheap car insurance in virginia hacks

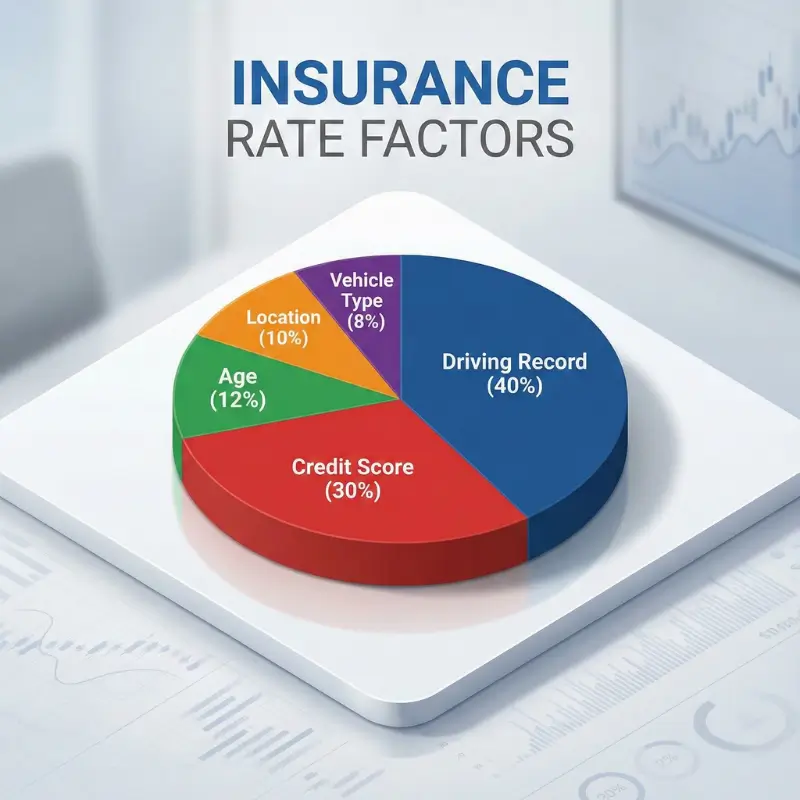

Your Credit Score Sabotages Your Premium

Insurance companies extensively analyze credit scores when calculating your rate. Recent studies confirm that credit scores influence premiums as much as driving records. Virginia allows insurers to use credit-based insurance scores legally today. Those with scores below 600 face premiums 75-100% higher typically. Conversely, customers with excellent scores (750+) receive preferred rates automatically. This practice affects responsible drivers suffering temporary financial hardship unfairly. However, understanding this dynamic empowers you to take corrective action. Your credit score influences rates whether you know this or not. Therefore, addressing credit issues delivers insurance savings simultaneously. Additionally, some insurers weigh credit less heavily than competitors do. Consequently, finding credit-friendly carriers becomes critical for damaged-credit customers. Taking steps to rebuild credit provides multi-year savings benefits.

Boost Your Score, Unlock 40% Savings Now

Increasing your credit score produces immediate and substantial insurance savings. Raising your score from 600 to 700 typically saves 20-30% annually. Furthermore, reaching 750+ status unlocks premium reductions approaching 40% sometimes. Fortunately, several concrete steps improve scores within six-twelve months consistently. First, pay all bills on time, immediately boosting your payment history. Second, pay down existing balances below 30% of available limits. Third, never close old credit accounts despite paying them off. Fourth, dispute inaccurate negative items through the three credit bureaus. Fifth, avoid applying for multiple credit cards within short timeframes. Your credit utilization ratio particularly influences insurance calculations significantly. Consequently, reducing balances produces faster improvements than most people realize. Within 12 months, disciplined credit management could save thousands annually. This represents one of the highest-ROI financial improvements possible.

Drive Worry-Free With Bulletproof Coverage

Comprehensive insurance protection provides peace of mind every single day. Liability coverage protects others injured or hit by your vehicle. Collision coverage repairs your car after accidents you cause. Comprehensive coverage protects against theft, weather, and vandalism incidents. Uninsured motorist coverage protects you if hit by uninsured drivers. Medical payments coverage handles hospitalization costs immediately after accidents. Underinsured motorist coverage provides additional protection against minimum-coverage drivers. Combining these coverages creates a complete financial protection system. Moreover, proper coverage protects your car loan or lease requirements. Your financing company mandates collision and comprehensive coverage anyway. Therefore, meeting these requirements costs less than most people anticipate. Investing in comprehensive coverage eliminates financial anxiety completely.

Car insurance in virginia for bad credit

One Mistake Shouldn’t Cost You Thousands

Financial hardship affecting credit shouldn’t compound through insurance discrimination unfortunately. One missed payment, medical debt, or unexpected job loss derails credit scores. These temporary setbacks shouldn’t mean permanent insurance discrimination for years. Bad credit genuinely correlates with increased claims statistically however. Consequently, insurers justify higher rates based on actuarial data. Nevertheless, this practice disproportionately affects financially vulnerable Virginians severely. Furthermore, higher rates create vicious cycles preventing credit recovery. Paying expensive insurance strains budgets, preventing debt paydown efforts. Therefore, finding credit-sensitive insurers becomes absolutely essential for recovery. Multiple carriers understand temporary hardship and offer competitive rates anyway. Consequently, shopping aggressively prevents permanent financial sabotage through insurance costs. One mistake shouldn’t determine your financial future indefinitely.

12 Insurers Ignore Credit Scores Entirely

Several insurance carriers refuse to use credit scores as rating factors. Progressive offers competitive rates focusing primarily on driving records exclusively. SafePoint Insurance specializes in high-risk drivers regardless of credit status. Heritage Insurance provides quotes based on driving history alone. AAA membership sometimes eliminates credit-score considerations completely. Military-affiliated USAA rarely emphasizes credit in their rating algorithms. Nationwide offers competitive rates for bad-credit customers regularly. State Farm focuses more on driving records than financial history. Regional carriers like Erie Insurance often overlook credit concerns. Direct insurers bypassing credit considerations sometimes compete aggressively. Armed Forces Insurance explicitly markets to credit-challenged veterans. Consequently, researching credit-friendly carriers prevents automatic discrimination penalties. Finding these carriers typically requires direct phone inquiries unfortunately.

Reclaim Financial Freedom Starting Today

Rebuilding credit while managing insurance costs requires strategic planning carefully. First, contact insurers directly asking specifically about their credit policies. Second, request quotes from credit-insensitive carriers exclusively. Third, focus aggressively on paying bills on-time immediately. Fourth, reduce outstanding balances below 25% of available limits. Fifth, avoid applying for unnecessary new credit during recovery periods. Sixth, dispute inaccurate negative marks through credit bureaus immediately. Seventh, consider becoming an authorized user on someone’s excellent account. Eighth, build credit history through secured credit cards appropriately. Within six months, visible improvement typically emerges in your profile. By month twelve, credit score increases often exceed 75-100 points. Subsequently, shopping insurance again reveals dramatically better rate quotes. Financial freedom becomes achievable through disciplined, consistent action.

Military Secrets: Cheap Car Insurance

Veterans Lose $2,400 in Unclaimed Benefits

Military service should provide automatic financial advantages, but many veterans don’t claim them. USAA members receive exclusive rates 10-15% below civilian market averages. Furthermore, most veterans qualify for additional discounts offered by major carriers. State Farm provides military-exclusive rates to active-duty and retired personnel. However, veterans rarely maximize available benefits through informed shopping consistently. Geico offers military discounts reaching 20%+ for qualifying service members. Additionally, insurers rarely advertise veteran benefits prominently on their websites. Veterans must specifically request military-related discounts during quote processes. Consequently, uninformed veterans pay standard rates despite qualifying for special pricing. The average veteran loses approximately $2,400 annually through simple oversight. Therefore, claiming available military benefits becomes a critical financial priority. Taking 15 minutes to investigate could save $2,400+ yearly.

USAA Rivals Offer Superior Virginia Rates

USAA provides exceptional rates but requires military affiliation unfortunately. Non-USAA members should research competitor carriers offering military-specific benefits. State Farm consistently ranks among the most affordable options nationwide. Geico’s military discounts frequently undercut competitors by significant margins. Progressive offers competitive rates with streamlined military discount processes. Nationwide provides additional discounts beyond standard military rate reductions. American Family Insurance offers military-focused pricing on comprehensive policies. Armed Forces Insurance specializes exclusively in military personnel nationwide. Regional carriers sometimes beat national competitors on military rates. Additionally, bundling auto with military-focused homeowners policies maximizes savings. Comparing military-specific quotes from 5-7 carriers reveals your best option. Therefore, assuming USAA offers the best rates leads to overpaying. Investigating alternatives typically uncovers $400-700 in additional annual savings.

Honor Your Service With Maximum Savings

Military service deserves financial recognition through concrete insurance advantages. Properly leveraging available benefits represents earned privileges, not handouts. Start by identifying which carriers offer military-specific discounts in Virginia. Next, gather quotes specifically requesting military-member pricing explicitly. Then, compare total annual costs accounting for all applicable discounts. Furthermore, ask whether military discounts apply to spouse and children. Additionally, inquire if active-duty, retired, and veteran statuses receive identical rates. Moreover, confirm that military discounts don’t restrict coverage options negatively. Finally, arrange policy switches during off-peak times avoiding service disruptions. Your military service shouldn’t subsidize insurance company profit margins unnecessarily. Therefore, claiming earned benefits honors your sacrifice appropriately. Maximizing military discounts ensures your financial rewards match your service.

Young drivers: car insurance in virginia

Teen Premiums Devastate Family Budgets

Adding teenage drivers to policies multiplies insurance costs dramatically unfortunately. Teen drivers typically increase family premiums by 50-100% immediately. Insurance companies charge astronomical rates reflecting statistical accident risk data. Teens aged 16-19 represent the highest-risk demographic nationwide unfortunately. Additionally, inexperience compounds with peer pressure creating dangerous driving situations. Virginia parents face average annual costs exceeding $4,500 for teen drivers. This financial burden strains middle-income families severely and consistently. However, several strategies reduce teen driver costs substantially. Understanding available discounts prevents families from overpaying significantly. Therefore, investigating teen-specific discount programs becomes absolutely essential. Parents shouldn’t accept standard rates without exploring available alternatives. Taking action protects family budgets while teaching financial responsibility.

Good Student Discounts Cut Costs 25%

Academic excellence directly translates into insurance savings for teenagers. Good student discounts (3.0+ GPA) reduce teen premiums by 10-25% typically. This seemingly modest incentive actually saves families $500-1,000 yearly. Insurance companies recognize that responsible students drive responsibly too. Therefore, academic performance genuinely correlates with lower accident rates. Encouraging good grades literally pays financial dividends through insurance savings. Furthermore, these discounts typically require minimal documentation beyond report cards. Schools issue transcripts confirming GPA status within days usually. Additionally, some insurers offer “good behavior” driving discounts for clean records. Young drivers maintaining perfect records for one-two years unlock additional discounts. Consequently, combining academic and driving performance saves maximum amounts. Parents should strongly emphasize grades’ connection to insurance costs. This creates natural incentives for academic focus while saving money.

Graduate Debt-Free With Strategic Coverage

College graduation shouldn’t trigger overwhelming student loan debt situations. However, careless insurance choices during formative years compound problems. Teaching teens about smart coverage decisions builds lifelong financial habits. First, maintain good grades ensuring you qualify for student discounts. Second, practice safe driving avoiding accidents and violations completely. Third, understand why proper coverage prevents bankruptcy-level debt scenarios. Fourth, avoid distracted driving eliminating your highest-risk behaviors. Fifth, implement defensive driving techniques reducing accident frequency substantially. Sixth, help family decision-making regarding coverage selection thoughtfully. Seventh, learn how insurance actually works before leaving home. By graduation, you’ll understand insurance while maintaining excellent records. This foundation prevents catastrophic financial mistakes during early adulthood. Therefore, treating insurance seriously today creates wealth preservation tomorrow. Young adults with strong financial habits achieve significant advantages later.

Switching cheap car insurance in virginia

Loyalty Penalties Cost You $600 Yearly

Insurance companies systematically punish long-term customers through loyalty penalties. Staying with the same carrier beyond three years triggers automatic rate increases. This counterintuitive practice rewards switching while penalizing loyalty severely. New customers receive significantly better rates than existing policyholders constantly. Average loyal customers pay $600+ annually compared to new customer rates. Virginia’s insurance market actively incentivizes switching to maximize company profits. Consequently, “loyalty discount” marketing language masks actual penalty practices. After five years, long-term customers can pay 30-40% more. However, companies disguise these increases through gradual annual bumps. Therefore, comparing rates annually prevents automatic penalty acceptance. Your renewal quote should never increase without documented changes. Switching carriers typically provides immediate discounts on identical coverage. Taking action against loyalty penalties reclaims money rightfully yours.

Jump Ship in 48 Hours, Keep Full Coverage

Switching insurance carriers requires surprisingly minimal time realistically. Modern technology enables policy transfers within 48 hours maximum. First, obtain quotes from multiple competing insurers in under 5 minutes. Next, select your preferred carrier offering the best rate. Then, contact your new insurer requesting immediate policy activation date. Furthermore, coordinate your switch to avoid coverage gaps between carriers. New policies activate on your requested date without service interruptions. Additionally, most carriers handle policy cancellation paperwork automatically. Your old insurer receives cancellation notice directly from your new provider. Importantly, you maintain uninterrupted coverage throughout the entire switch. Cancellation of your old policy happens simultaneously with new policy activation. Therefore, coverage gaps become impossible if you coordinate timing properly. Switching takes less than one hour of actual work required. This minimal effort typically delivers $600+ annual savings immediately.

Never Fear Coverage Gaps or Penalties

Proper switching strategy eliminates coverage gaps entirely through careful timing. Schedule your new policy activation date matching your old policy cancellation. Request written confirmation that your new coverage starts at exact times. Ensure your policy cancellation takes effect simultaneously with new coverage. Additionally, maintain documentation of both policies during the transition. This provides evidence of continuous coverage if questions arise. Furthermore, no penalties exist for switching in Virginia currently. Insurance companies can’t penalize policy cancellations within state guidelines. Therefore, switching freely without financial consequences protects your rights. Your credit report won’t suffer from switching insurance carriers. Moreover, your driving record transfers accurately between providers automatically. Essentially, switching providers offers pure financial benefits without downsides. Consequently, hesitation about switching represents only perceived risk, not real. Taking action protects your wallet while maintaining full security.

Electric Vehicle Revolution: Virginia Rates

Tesla Owners Pay Shocking Insurance Fees

Electric vehicles face disproportionately high insurance costs versus gas counterparts. Tesla Model 3 insurance costs approximately 50% more than Honda Accord. Repair costs for EVs exceed gas vehicles due to specialized technicians. Battery damage repairs often cost $10,000-$15,000 per incident unfortunately.

Furthermore, limited repair shops increase labor costs and repair timelines. Insurance companies adjust rates reflecting these elevated replacement expenses. Additionally, fewer historical claims data exists for electric vehicles. Consequently, insurers apply conservative risk premiums to offset uncertainty. The average EV owner pays approximately $1,800+ annually for full coverage. This compares unfavorably to $1,200 for comparable gas vehicles. Therefore, EV owners search desperately for affordable insurance alternatives. However, significant savings opportunities exist for informed EV drivers. Several specialized carriers now compete aggressively for EV customer segments.

8 Insurers Slash EV Premiums by Half

Progressive launched dedicated EV insurance programs offering 20-35% reductions. State Farm now provides Tesla-specific pricing reflecting repair cost realities accurately. Geico offers EV discounts reaching 15-25% for electric vehicle owners. Liberty Mutual developed sustainable driving programs rewarding EV adoption. Nationwide provides specific EV underwriting with competitive rate structures. American Family Insurance offers comprehensive EV coverage at reasonable rates. Root Insurance emphasizes usage-based pricing favoring careful EV drivers. Amica Insurance provides member benefits for electric vehicle ownership. These specialized EV programs recognize environmental benefits while adjusting costs. Therefore, shopping EV-specific carriers reveals dramatically better rates. Comparing EV-specialized quotes often saves $300-600 annually. Traditional carriers still overcharge EV owners substantially unfortunately. Consequently, switching to EV-focused insurers becomes financially essential. Most EV owners remain unaware of these specialized carriers. Taking initiative reveals significant money-saving opportunities available now.

Drive Green, Save Green, Win Twice

Environmental consciousness need not destroy family budgets unnecessarily. Electric vehicles offer numerous benefits beyond emissions reduction. Cost-per-mile figures for EVs dramatically undercut gas vehicles substantially. Lower maintenance expenses compound these advantages through vehicle lifetime. Furthermore, proper insurance selection maximizes EV ownership benefits substantially. Choosing EV-specialized carriers aligns financial and environmental priorities perfectly. Additionally, some EV owners qualify for tax credits reducing purchase prices. State incentive programs occasionally provide insurance rebates for EV drivers. Consequently, combining government benefits with insurance savings creates substantial value. Environmentally conscious driving becomes increasingly affordable through informed decisions. Therefore, EV ownership represents both ethical and financial advancement. Switching to EV-focused insurance during vehicle purchases captures maximum value. Taking action protects your budget while serving planetary interests.

Car insurance in virginia after DUI

One DUI Multiplies Your Rates 300%

A single DUI conviction transforms your insurance profile permanently unfortunately. Carriers immediately classify DUI offenders as high-risk customers indefinitely. Insurance rates increase 250-350% following DUI convictions on average. Additionally, SR-22 requirements become mandatory under Virginia law. Standard policies often terminate automatically following DUI convictions. Consequently, finding willing insurers becomes extremely challenging post-DUI. Your conviction remains on driving records for approximately ten years. During this period, every quote reflects the criminal conviction. The average Virginia driver pays $4,000+ annually post-DUI. This represents approximately three times the pre-conviction insurance costs. Furthermore, many standard carriers flatly refuse DUI applicants entirely. Therefore, specialized high-risk insurers become your only viable options. However, accepting high rates without fighting violates your financial interests. Several strategies minimize DUI-related insurance cost increases substantially.

SR-22 Specialists Offer Second Chances Now

SR-22 requirements needn’t mean financial devastation through high rates. Specialized carriers focus specifically on high-risk drivers seeking SR-22 coverage. These carriers understand that one mistake shouldn’t mean permanent financial ruin. Furthermore, SR-22 carriers recognize rehabilitation potential in second-chance customers. Bristol West and National General Insurance specialize in SR-22 requirements. Acceptance Insurance offers competitive rates to DUI-convicted drivers. Direct General provides SR-22 coverage across most states including Virginia. National Interstate specializes in high-risk auto insurance needs. Reliability Insurance focuses on second-chance drivers post-DUI exclusively. These carriers charge substantially less than mainstream companies might. Shopping SR-22 specialists typically saves 30-40% versus standard carriers. Therefore, comparing multiple SR-22 quotes becomes absolutely critical. Your second SR-22 quote might reveal $1,000+ in annual savings. Taking time to investigate specialist carriers prevents overpaying dramatically. Additionally, maintaining clean records post-DUI gradually reduces rates.

Rebuild Your Life Without Going Broke

One mistake need not determine your financial trajectory indefinitely. DUI recovery requires commitment but remains financially achievable. First, accept responsibility while maintaining hope for future improvement. Second, obtain multiple SR-22 quotes from specialized carriers immediately. Third, select the most affordable option meeting legal requirements. Fourth, maintain perfect driving records avoiding any additional violations. Fifth, complete court-mandated educational programs demonstrating commitment. Sixth, consider consulting DUI attorneys regarding record suspension possibilities. Seventh, explore ignition interlock device discounts with your insurance. Eighth, take defensive driving courses improving your driving profile. Within five years, rates typically decrease substantially through proven responsibility. By year seven, insurance costs return closer to normal ranges. However, the conviction remains permanently on your driving history. Therefore, maintaining perfect records for extended periods proves essential. Your path forward requires discipline, commitment, and financial responsibility. Nevertheless, rebuilding after DUI remains completely achievable with determination.

Minimum vs Full Coverage in Virginia

State Minimums Leave You Vulnerable, Exposed

Virginia’s minimum liability requirements (25/50/25) provide dangerously inadequate protection. These minimums represent bare legal minimums, not safe coverage levels. A single serious accident quickly exhausts these coverage limits. Modern medical expenses regularly exceed minimum coverage amounts substantially. One hospitalization for serious injuries can reach $100,000+ effortlessly. Additionally, vehicle damage costs often exceed minimum liability coverage limits. Therefore, carrying only minimum coverage creates bankruptcy risk scenarios. Your personal assets become vulnerable to lawsuit judgments exceeding coverage. Homes, retirement accounts, and future wages face potential seizure. One accident could devastate your family’s financial security permanently. However, upgrading coverage costs remarkably little compared to legal risks. Increasing liability to 50/100/50 costs approximately $20-30 monthly. This modest investment protects everything you’ve worked to build. Therefore, abandoning minimum coverage represents essential financial protection. Accepting legal minimums while maintaining mortgage debt represents reckless planning.

Smart Coverage Prevents Lawsuit Nightmares

Comprehensive coverage selection protects against catastrophic financial scenarios. 50/100/50 liability coverage handles most serious accident scenarios. Collision coverage repairs your vehicle following accidents you cause. Comprehensive coverage protects against weather, theft, and vandalism damage. Uninsured motorist protection covers you when hit by uninsured drivers. Medical payments coverage pays immediate hospitalization costs post-accident. Underinsured motorist coverage protects against minimum-coverage drivers insufficient damages. Umbrella policies provide additional protection for exceptional accident scenarios. These coverages combine into complete financial protection networks. Proper coverage ensures your family survives any accident scenario. Additionally, most loan companies mandate comprehensive coverage anyway. Therefore, meeting lender requirements costs less than most anticipate. Your policy protects both your family and your financial future. Taking coverage seriously today prevents tomorrow’s catastrophic financial consequences. This represents one of the most important financial decisions. Proper coverage provides invaluable peace of mind permanently.

Sleep Soundly Knowing You’re Protected Right

Insurance’s true value emerges when you need it desperately. Knowing full coverage protects you eliminates daily financial anxiety. Your family sleeps soundly knowing accident scenarios won’t bankrupt you. Moreover, comprehensive coverage enables medical treatment without financial desperation. Proper coverage means paying medical bills rather than losing your home. Additionally, your family’s future remains secure despite unfortunate accidents. Your children’s college funds remain protected through liability coverage. Your retirement savings withstand accident lawsuit consequences with umbrella policies. Therefore, comprehensive insurance represents purchased peace of mind permanently. The modest monthly investment delivers invaluable psychological security. Driving worry-free knowing you’re properly protected enhances daily life. Furthermore, this protection extends to your family members permanently. Taking coverage seriously reflects responsible parental and spousal commitment. Ultimately, comprehensive coverage enables living without constant financial fear.

Cheap car insurance in virginia tools

Manual Quotes Waste 6+ Precious Hours

Traditional quote-gathering involved calling multiple insurers spending hours frustratingly. Each phone call required explaining your information to different agents repeatedly. Waiting for callbacks consumed additional hours throughout busy work days. Comparing printed quotes required manual note-taking and calculation work. Organizing quotes by coverage type and price involved extensive paperwork. Most people abandoned this process after collecting 2-3 quotes frustratingly. Consequently, they never discovered their best rate option available. This inefficiency cost average Virginians $400-600 annually through ignorance. Modern technology eliminated these time-consuming, frustrating requirements completely. Today’s comparison platforms collect information once automatically. Subsequently, quotes from 15+ carriers appear within minutes instantaneously. This transformation enables informed shopping decisions previously impossible. Therefore, using modern tools represents essential strategic shopping practice. Refusing to use available technology means deliberately overpaying substantial amounts. Wasting six hours remains inexcusable when alternatives require three minutes.

AI-Powered Platforms Deliver Instant Savings

Artificial intelligence revolutionized insurance shopping through advanced comparison technology. Modern platforms analyze thousands of rate combinations simultaneously. AI algorithms identify the absolute lowest rates matching your profile. These systems consider factors humans might overlook completely. Additionally, AI platforms continuously update rates reflecting market changes. Real-time rate monitoring ensures you capture emerging savings opportunities. Furthermore, these platforms secure multiple quotes simultaneously without repetition. Your information gets encrypted ensuring complete privacy protection. Subsequently, you receive personalized rate recommendations based on your profile. AI never makes mistakes transcribing your information across platforms. Consequently, quote accuracy improves dramatically versus manual shopping. Moreover, these platforms handle all insurer communication automatically. You simply receive quotes ready for immediate policy selection. Therefore, embracing AI-powered tools represents smart shopping strategy. Technology delivers better results than traditional shopping methods provide.

Secure Your Future in Mere Minutes

Taking control of your insurance costs requires minimal time investment. Simply visit reputable quote comparison platform immediately. Enter your information accurately using your current insurance policy. Within three minutes, receive quotes from 15+ competing carriers. Review quotes sorting by price, coverage, and company reputation. Select your preferred option matching your budget and needs. Contact the winning insurer requesting immediate policy activation date. Coordinate timing ensuring zero coverage gaps between carriers. Within one hour total, you’ve potentially saved thousands annually. This minimal time investment delivers maximum financial returns possible. Your willingness to invest one hour determines your financial outcome. Delaying action costs you approximately $100 monthly unnecessarily. Therefore, taking immediate action represents the smartest investment. Protecting your family’s financial future requires just 60 minutes. Starting today positions you for years of improved financial stability. Your family deserves the savings you’ll discover immediately. Taking action now replaces regret about wasted money later.

FAQs

How much can I realistically save on car insurance in Virginia?

Most Virginia drivers save $400-$1,200 annually through strategic comparison shopping and discount optimization.

Does my credit score really affect my insurance rate?

Yes, credit scores influence rates significantly—poor credit can increase premiums by 75-100% compared to excellent credit.

Can I switch insurance companies without penalties in Virginia?

Absolutely. Switching carriers requires no penalties, and maintaining coverage is seamless with proper timing coordination.

What’s the minimum insurance I legally need in Virginia?

Virginia requires 25/50/25 liability coverage (25K bodily injury per person, 50K per accident, 25K property damage).

Are electric vehicles more expensive to insure?

Yes, EVs typically cost 30-50% more than gas vehicles, but specialized EV insurers offer 15-35% discounts.

Do military personnel receive special insurance discounts?

Yes, military members typically receive 10-20% discounts through USAA and other carriers offering veteran pricing.

How long does a DUI remain on my driving record?

DUI convictions stay on Virginia driving records for approximately ten years, affecting insurance rates throughout.

What’s better a high deductible or low deductible?

Higher deductibles ($1,000) lower premiums significantly if you have emergency savings; lower deductibles reduce upfront costs.

Can I get insurance if I have bad credit?

Yes, several carriers ignore credit scores entirely, including Progressive, SafePoint, and Heritage Insurance.

How quickly can I switch insurance companies?

New policies activate within 48 hours maximum with proper coordination, enabling seamless carrier transitions.

Conclusion

Finding cheap car insurance in virginia requires strategic action beyond passive renewal acceptance. Virginia drivers consistently overpay $800+ annually through lack of comparison shopping. Implementing the strategies outlined throughout this guide transforms your financial situation immediately. Combining discount stacking, proper coverage selection, and informed shopping delivers maximum savings. Whether you’re a young driver, military veteran, or EV owner, tailored solutions exist. Furthermore, your credit score, driving history, and loyalty status significantly impact rates. Taking just one hour to implement these recommendations could save thousands yearly. Additionally, annual rate reviews prevent automatic increases from eroding savings. Your family deserves the financial relief that proper insurance planning provides. Therefore, starting today initiates a financially healthier future for everyone. Claiming earned discounts, finding credit-friendly carriers, and switching strategically protects your budget completely. Taking control of your insurance costs represents one of the best financial decisions possible today.

⚠️ Important Disclaimer: This article is for educational purposes only and should not be construed as legal, tax, or financial advice. Insurance regulations and tax laws are subject to change. Please consult with a licensed insurance agent, CPA, or Tax Attorney regarding your specific situation before making coverage decisions.

References

- Virginia Automobile Insurance Plan (VAIP) – Official Virginia auto insurance residual market information and legal requirements.

- National Association of Insurance Commissioners (NAIC) – Provides comprehensive consumer resources and insurance regulatory oversight data.

- J.D. Power Insurance Ratings – Delivers current insurance company ratings and customer satisfaction benchmarks.