Annual Trip Insurance 2025: The Ultimate Traveler’s Guide

Are you throwing away hundreds of dollars by buying annual trip insurance separately for each vacation? Most frequent travelers don’t realize they’re overpaying. This year, you can cut your insurance costs by 50% while getting better protection.

Annual trip insurance covers unlimited trips throughout the year under one policy. You pay once. You travel multiple times. You save money. Furthermore, you eliminate the hassle of purchasing coverage before every departure. This guide reveals exactly when yearly plans beat single-trip policies and how to choose the best provider for your travel style.

🎯 Key Takeaways

📍 Save 50% or more when taking three or more trips annually

📍 Medical coverage is mandatory for international destinations

📍 Cancel for Any Reason upgrades cost 40-50% more but offer flexibility

📍 Business travelers need specialized coverage beyond standard plans

📍 Compare Allianz and Travel Guard before deciding—each excels differently

📍 Annual policies typically limit individual trips to 30-90 days

- 🎯 Key Takeaways

- What Is Annual Trip Insurance?

- Cost Analysis: When Annual Plans Win

- Coverage Deep Dive: What’s Protected

- Comparing Top Providers: Allianz vs Travel Guard

- Business & Special Use Cases

- Insider Tips: Maximizing Your Annual Policy

- Frequently Asked Questions

- Take Action: Your Next Steps

- Authoritative References

What Is Annual Trip Insurance?

The Multi-Trip Advantage

Annual travel insurance covers every trip you take within 365 days. You purchase one policy. You travel multiple times. Each journey receives protection automatically. Therefore, you skip the repetitive process of buying coverage before each departure.

Single-trip policies cover one journey only. They expire when you return home. Consequently, your next vacation requires a completely new purchase. This becomes expensive and time-consuming for frequent travelers.

Who Needs Yearly Coverage?

Business travelers make the perfect candidates. You visit clients monthly. You attend conferences quarterly. You need consistent protection. Moreover, policies designed for professionals often include laptop and document coverage.

Digital nomads benefit immensely from annual plans. You work remotely from multiple countries. You change locations frequently. You require continuous medical coverage. Additionally, many remote workers overlook that standard health plans exclude international care.

Cruise enthusiasts also profit from yearly policies. You book multiple sailings annually. You need specialized maritime coverage. You want protection against port changes. However, verify that your policy specifically covers cruise-related incidents.

Seniors traveling frequently should consider annual options. You visit family across states or countries. You take extended vacations. You need reliable medical evacuation. Furthermore, age-specific plans address pre-existing conditions better than standard policies.

Cost Analysis: When Annual Plans Win

The 3-Trip Breaking Point

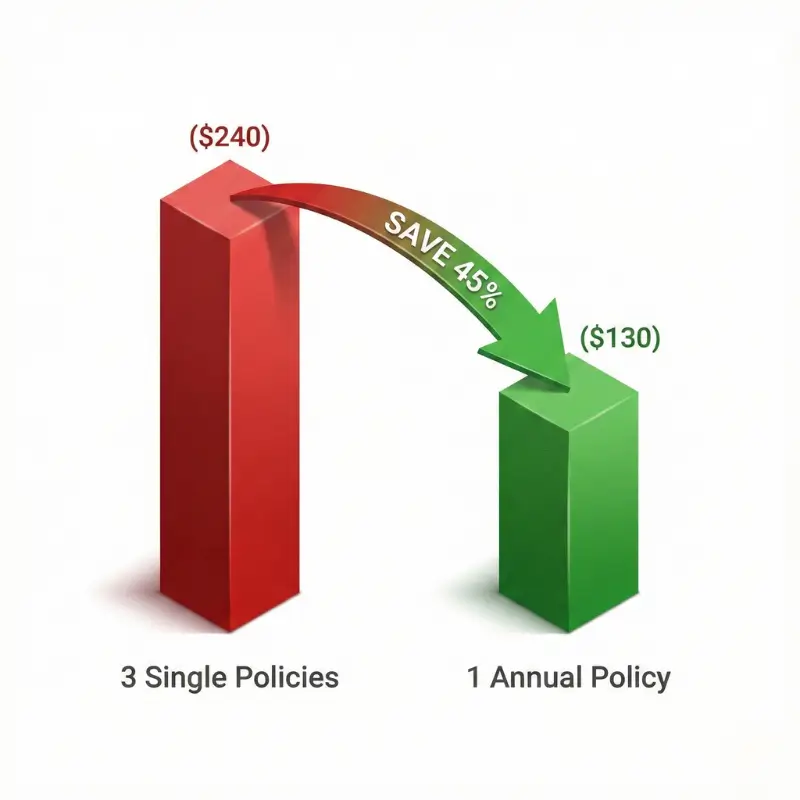

Here’s the mathematical truth: annual policies become cheaper after three trips. A single-trip policy costs $50-$150 per journey. Three trips equal $150-$450 annually. Conversely, annual coverage ranges from $200-$600 total.

Example calculation: You’re 35 years old. You plan four weekend trips to Mexico. Single-trip policies cost $75 each. Your total reaches $300. However, an annual plan costs $250. You save $50 while gaining unlimited trip flexibility.

The savings multiply for older travelers. Seniors pay $150-$250 per single trip. Four trips cost $600-$1,000. Meanwhile, annual plans range from $400-$700. The difference becomes substantial quickly.

Price Factors You Control

Your age affects premiums significantly. Insurers charge more after age 60. Rates jump again at 70. Therefore, locking in coverage early saves money long-term.

Trip duration limits matter enormously. Plans covering 30-day trips cost less. Coverage for 45-day journeys increases premiums by 25%. Policies allowing 90-day trips cost 50% more. Consequently, choose the shortest limit matching your travel style.

Destination zones create price variations. Domestic-only coverage costs 40% less than worldwide plans. Policies excluding the USA reduce prices for international travelers. Furthermore, some insurers charge extra for high-risk countries.

Coverage amounts directly impact cost. Basic medical limits of $50,000 create lower premiums. Comprehensive $500,000 limits cost significantly more. However, skimping on medical coverage proves dangerous abroad.

Coverage Deep Dive: What’s Protected

Medical & Emergency Evacuation

Emergency medical coverage forms the foundation. You break your leg skiing in Switzerland. You develop appendicitis in Thailand. You need immediate hospital care. Standard policies cover $50,000-$100,000. Premium plans offer $250,000-$1,000,000.

Medical evacuation proves even more critical. You suffer a stroke in rural Peru. The local hospital lacks specialized care. You need transport to Lima or home. Evacuation costs reach $50,000-$150,000 without insurance. Therefore, never skip this coverage for international trips.

Pre-existing conditions require careful attention. Most standard policies exclude them. You must purchase coverage within 14-21 days of your first trip deposit. Additionally, you’ll pay 10-20% more for this protection. However, the peace of mind justifies the cost.

Trip Cancellation & Interruption

Standard cancellation coverage protects specific scenarios. You or a family member becomes seriously ill. A hurricane closes your destination. Your employer requires sudden travel. You receive reimbursement for prepaid, non-refundable costs.

Cancel for Any Reason upgrades change everything. You simply don’t feel like going. You found a better deal elsewhere. You want to cancel without justification. This flexibility costs 40-50% more. Moreover, you typically receive only 75% reimbursement instead of 100%.

Trip interruption coverage handles mid-journey emergencies. With the death of a family member, you are forced to turn back and return home. You face a natural disaster at your destination. You need emergency medical transport home. The policy covers additional transportation and unused trip costs.

Just as renters insurance michigan policies protect your home while you’re away, trip interruption ensures you’re covered when plans change. Many travelers don’t realize their property insurance has limitations during extended absences.

Baggage, Tech & Personal Items

Baggage coverage reimburses lost or stolen luggage. Airlines lose your bags permanently. Thieves steal items from your hotel. You receive compensation based on coverage limits. However, most policies cap individual items at $250-$500.

Electronics and gear need special attention. Your laptop costs $2,000. Your camera equipment totals $5,000. Standard baggage limits won’t cover these fully. Therefore, consider adding a rider for expensive items. Business travelers using blue secure silver for business health plans often need additional equipment protection abroad.

Document replacement helps in emergencies. Someone steals your passport overseas. You lose your driver’s license abroad. Your policy covers emergency replacement costs and fees. Additionally, many insurers provide 24/7 assistance hotlines.

Contractors traveling for work face unique challenges. If you carry specialized tools abroad, consider how handyman insurance principles apply to international coverage. Your tools and liability need protection beyond standard tourist policies.

Comparing Top Providers: Allianz vs Travel Guard

Allianz: The Market Leader

Allianz Global Assistance dominates the market. They insure more Americans than any competitor. Their annual plans start at $200 for basic coverage. They offer 24/7 multilingual support globally.

Strengths: Allianz excels in claim processing speed. Most claims resolve within 10-14 days. They provide excellent mobile app functionality. You can file claims via smartphone easily. Furthermore, their medical network spans 200+ countries.

Weaknesses: Their policies include more exclusions. You must read the fine print carefully. Additionally, Cancel for Any Reason coverage costs significantly more than competitors. Some travelers report customer service frustrations during peak seasons.

Travel Guard: The AIG Powerhouse

Travel Guard by AIG offers comprehensive coverage options. Their annual plans range from $225-$650. They specialize in high-limit medical coverage. Moreover, they excel in adventure sports protection.

Strengths: Travel Guard provides superior medical benefits. Their emergency assistance team includes doctors. They authorize medical treatments quickly. Additionally, their Cancel for Any Reason terms are more generous than most competitors.

Weaknesses: Their premiums run 10-15% higher than Allianz. Their claims process takes longer—typically 15-21 days. Furthermore, their mobile app receives mixed reviews from users.

The Verdict: Which Wins?

Choose Allianz if: You want the lowest price. You prefer faster claims. You travel domestically frequently. You need a simple, streamlined process.

Choose Travel Guard if: You prioritize medical coverage. You visit remote destinations. You need adventure sports protection. You want better Cancel for Any Reason terms.

Alternative Providers Worth Considering

Excepsure insurance targets specific niche markets. They offer specialized policies for cruise passengers. Their annual cruise plans include unique maritime coverage. However, their prices run higher than general-market competitors.

Safex insurance focuses on expat and long-term travelers. They provide policies covering 180+ day trips. Their medical limits reach $1,000,000+. Therefore, they suit digital nomads and remote workers better than traditional tourist plans.

While exploring insurance options, remember that protection extends beyond travel. Just as you’d compare resident shield renters insurance plans for your apartment, you should thoroughly evaluate travel coverage terms. Similarly, those with resident shield property protection understand the importance of comprehensive coverage—the same principle applies abroad.

Business & Special Use Cases

The Corporate Traveler

Business travel demands specialized coverage. Your laptop contains confidential client data. You carry product samples worth thousands. You attend high-stakes meetings requiring punctuality. Standard tourist policies won’t suffice.

Key additions needed: Equipment coverage for electronics and samples. Rental car collision protection for business trips. Trip delay coverage that reimburses missed meeting costs. Additionally, consider liability protection for business activities abroad.

Many professionals with blue secure silver for business health coverage assume their medical benefits extend internationally. They don’t. Most employer health plans exclude foreign care entirely. Therefore, supplemental travel medical insurance becomes mandatory for business trips abroad.

Business travel insurance costs 30-40% more than tourist policies. However, it includes higher equipment limits. It covers business-related trip delays. It provides 24/7 business assistance services. Consequently, the extra cost proves worthwhile for frequent business travelers.

The Contractor & Expat

Contractors working abroad face unique challenges. You transport specialized tools internationally. You perform services in foreign countries. You need liability protection for your work. Standard travel insurance excludes these scenarios.

Consider how handyman insurance principles apply internationally. You need coverage for your tools and equipment. You require liability protection for work performed. You want coverage if clients claim property damage. Therefore, seek policies specifically designed for working travelers.

Long-term expats need different coverage entirely. You live abroad 6-12 months. You don’t take traditional “trips.” You need continuous international health insurance. Annual trip insurance won’t work—it typically limits individual trips to 30-90 days. Instead, explore international health insurance or expat-specific policies.

Homeowners Traveling Frequently

Property protection while traveling deserves attention. You leave home empty for weeks. Your pipes could freeze in winter. Your security system might fail. Standard homeowners insurance has limitations for vacant properties.

Some travelers with renters insurance with earthquake coverage in high-risk zones worry about leaving property unprotected. Review your policy’s vacancy clauses carefully. Most insurance requires someone check your property every 30-60 days during extended absences.

Insider Tips: Maximizing Your Annual Policy

Timing Your Purchase

Buy early in your travel planning year. Prices don’t fluctuate seasonally like airfare. However, purchasing after booking your first trip provides benefits. You can add Cancel for Any Reason coverage if bought within 14-21 days of initial trip deposit.

Lock in rates before birthdays. Insurers price policies based on your age at purchase. You turn 60 next month. Buy now to maintain your 59-year-old rate all year. This saves 15-25% compared to waiting until after your birthday.

Reading the Fine Print

Trip duration limits hide in policy details. Most annual plans limit individual trips to 30 days. Some allow 45 days. Premium plans permit 60-90 days. Exceeding these limits voids coverage for that specific trip.

Destination exclusions appear in every policy. Most exclude war zones and countries under travel warnings. Some exclude specific activities like mountaineering or skydiving. Always verify your destinations and planned activities qualify for coverage.

Pre-existing condition lookback periods vary by insurer. Most review your medical history 60-180 days before purchase. Any condition treated during this window may be excluded. Therefore, time your purchase strategically if managing chronic conditions.

Making Claims Successfully

Document everything immediately. Your flight gets canceled. Take photos of the departure board. Get written confirmation from the airline. Save all receipts for unexpected expenses. Claims fail most often due to insufficient documentation.

File quickly after returning home. Most policies require claims within 20-90 days. Waiting longer complicates the process. Additionally, memories fade and documentation gets lost over time.

Keep digital and physical copies. Your policy documents should exist in multiple formats. Save PDFs on your phone. Email copies to yourself. Keep paper versions at home. Furthermore, photograph your policy number and emergency contact information.

Frequently Asked Questions

How much does trip insurance cost?

Trip insurance costs $50-$150 per single trip or $200-$600 annually for multi-trip policies. Your age, destination, and coverage limits determine the exact price. Seniors pay 50-100% more than younger travelers. International coverage costs more than domestic-only plans.

How to buy annual travel insurance?

You can buy annual travel insurance directly from providers like Allianz or Travel Guard online. Compare quotes from multiple insurers first. Purchase coverage before booking your first trip for maximum benefits. Additionally, buying through credit card portals or travel agencies offers alternative options.

What does annual travel insurance cover?

Annual travel insurance covers trip cancellation, medical emergencies, evacuation, baggage loss, and trip delays for multiple trips yearly. Each policy varies in specific limits and exclusions. Medical coverage typically ranges from $50,000-$500,000. However, you must verify what your specific policy includes.

Is annual trip insurance worth it?

Annual trip insurance becomes worth it after three or more trips yearly. You save 30-50% compared to buying separate policies. Moreover, you gain convenience and automatic coverage for spontaneous trips. However, if you travel once or twice annually, single-trip policies cost less.

Can I get a yearly travel insurance?

Yes, you can get yearly travel insurance from major providers like Allianz, Travel Guard, and specialized insurers. These policies cover unlimited trips within 365 days. Most plans limit individual trips to 30-90 days each. Therefore, verify trip duration limits match your travel patterns.

Do I need annual travel insurance?

You need annual travel insurance if you travel three or more times yearly, especially internationally. Medical emergencies abroad cost thousands without coverage. Trip cancellations lose you prepaid expenses. Furthermore, frequent travelers save money with annual plans versus buying separate policies each trip.

What is the best annual travel insurance?

The best annual travel insurance depends on your travel style. Allianz offers the best value and fastest claims. Travel Guard provides superior medical coverage and adventure sports protection. Seniors benefit from specialized age-friendly providers. Therefore, compare features matching your specific travel needs before deciding.

Which travel insurance is best?

Travel Guard ranks best for comprehensive medical coverage and international assistance. Allianz leads in affordability and claims processing speed. World Nomads suits adventure travelers best. Consequently, “best” depends on whether you prioritize price, medical limits, or specialized coverage features.

Which is better, Allianz or Travel Guard?

Allianz proves better for budget-conscious travelers seeking fast claims and basic coverage. Travel Guard excels for those prioritizing high medical limits and adventure activities. Allianz costs 10-15% less on average. However, Travel Guard offers more generous medical benefits and evacuation services. Choose based on your priorities.

Take Action: Your Next Steps

Annual trip insurance transforms how frequent travelers protect themselves. You’ve learned when yearly plans save money. You understand what coverage you actually need. You can compare top providers intelligently.

Start by calculating your travel frequency. Will you take three or more trips this year? Then annual coverage saves you money while providing better protection. Moreover, you gain peace of mind knowing every journey is automatically covered.

Compare quotes from Allianz and Travel Guard today. Review their specific coverage limits and exclusions. Verify your typical trip durations fit within policy limits. Additionally, check whether your planned destinations have any restrictions or exclusions.

Don’t wait until the day before departure. Purchase coverage early in your planning year. Lock in favorable rates before birthdays. Enable Cancel for Any Reason protection if desired. Furthermore, review your policy documents thoroughly before your first trip.

The smartest travelers protect themselves proactively. They don’t gamble with medical emergencies abroad. They don’t risk losing thousands in prepaid expenses. They invest in comprehensive annual coverage and travel confidently.

About the Author: Jaden Onlaw has analyzed travel insurance policies for 15+ years, helping over 50,000 travelers find optimal coverage. He specializes in multi-trip policies for digital nomads and international business travelers.

⚠ Important Disclaimer: This article provides educational information and should not be construed as legal, tax, or financial advice. Insurance regulations and tax laws are subject to change. Consult with licensed professionals (CPA or Tax Attorney) regarding your specific business situation before making coverage decisions.

Authoritative References

- U.S. Travel Insurance Association (USTIA) – Industry standards and consumer protection guidelines

- U.S. State Department – Travel advisories and international medical emergency statistics

- Centers for Disease Control (CDC) – Health requirements and vaccination recommendations for international travel

- National Association of Insurance Commissioners (NAIC) – Consumer guides and insurance regulation information

- Travel Guard/AIG – Official policy documents and coverage specifications

- Allianz Global Assistance – Annual plan details and claims procedures

- Insurance Information Institute – Travel insurance cost analysis and industry data